Watch out for rising correlation in the stock market. Selling pressure was concentrated in large-caps on Wednesday as S&P 500 Advance-Decline Percent (-78.2%) plunged to its lowest level since June 18th. I view the plus and minus 80% levels as significant because they represent 90% up/down days. Plus/Minus 80% means 450 or more of S&P 500 stocks advanced/declined (450/500 = 90%). Advance-Decline Percent is advances less declines divided by total issues (450 – 50 = 400 and 400/500 = 80%).

Notice that AD% for the S&P 500 was positive on Friday and Monday, but it was negative for the S&P MidCap 400 and S&P SmallCap 600 (red bars). This shows mid-caps and small-caps lagging when large-caps were holding up. Now notice that S&P 500 AD% was more negative (-78.2%) than $MID AD% (64.25%) and $SML AD% (53.17%) on Wednesday.

I would not read this as a healthy sign for mid-caps and small-caps. Instead, it shows that selling pressure expanded in large-caps. Even though SPX AD% did not exceed -80%, Wednesday’s broadening of downside participation shows how correlations rise during broad market declines. This means that relatively few stocks and stock-related ETFs would be immune to a broad market correction.

You can learn more about my chart strategy in this article covering the different timeframes, chart settings, StochClose, RSI and StochRSI.

40% of Stock-Related ETFs in StochClose Downtrends

On the ETF Ranking, Trends and Setups table, some 45 stock-related ETFs are in downtrends, as per their StochClose signals. 67 are in uptrends. This means around 40% of the stock-related ETFs are in downtrends and this is a pretty sizable chunk of the stock market. The S&P 500 SPDR (SPY) and S&P 500 EW ETF (RSP) are still in uptrends, but the Russell 2000 ETF (IWM) and Russell Microcap ETF (IWC) turned bearish in mid July.

Prior leaders and high flyers continue to lag. The downtrend signals in the ARK ETFs are between 46 and 100 days old (PRNT, ARKF, ARKG, ARKQ, ARKK, IZRL, ARKW). The down trend signals for the clean energy ETFs are between 73 and 103 days (ICLN, PBW, QCLN, FAN, TAN). The downtrends in the China-related ETFs are between 101 and 103 days (ASHR, FXI, KWEB, CQQQ). These are trading days so 100 days is around 4.5 months.

The ARK, Clean Energy and Cannabis ETFs represent the high flyers that were leading the market in February. They came down hard from mid February to May and never fully recovered. These are the high beta ETFs that represent the quintessential risk-on trade. Their continued underperformance shows that the most speculative end of the stock market is not the place to be.

In a separate, but related, comment on the ARK ETFs. Their strategy is the polar opposite of trend and momentum because Cathie Wood is adding to positions in downtrends in many cases. This is a classic averaging down strategy, which may work in the long run (5 years), but the drawdowns are going to be big. Perhaps Dr. Michael Burry, who is short ARKK, knows something about trend, momentum and valuation.

Most recently, the Natural Gas ETF (FCG), Energy SPDR (XLE) and Robotic Automation ETF (ROBO) triggered downtrend signals over the last four days. The Oil & Gas Equipment & Services ETF (XES) and Oil & Gas Exploration & Production ETF (XOP) triggered bearish around two weeks ago.

Even though I thought the surge in the 20+ Yr Treasury Bond ETF (TLT) was a counter-trend bounce, the StochClose signal has been bullish since July 8th (30 days) and bonds are leading the market over the last few months. StochClose signals are purely systematic in nature, while visual chart analysis has a clear discretionary element. The chart below shows TLT forming a bull flag just above the 200-day SMA. A breakout at 150 would be bullish. The indicator windows show TLT with a 9.18% gain the last 65 days and the S&P 500 EW ETF (RSP) with a 1.65% gain. FWIW, the 65-day Rate-of-Change for SPY is 5.69%.

Check out this video for more on TLT, the 10-yr Yield and

Seasonal patterns for the 10-yr yield.

MDY Fails as IWM and IWC Break

The charts above showed the short-term breakdowns in IWM and IWC, small-caps and micro-caps. We are also seeing a failed breakout in the S&P MidCap 400 SPDR (MDY). The smaller we get in market cap, the weaker the price action. The chart shows MDY breaking out, holding the breakout zone for two weeks and then falling below the August 3rd low. Also notice that RSI failed in the 50-60 zone, which acts as momentum resistance in a downtrend. Technically, MDY is still in a long-term uptrend because StochClose is bullish. However, the failed breakout and RSI failure at 50 suggests that we could see a deeper pullback, perhaps to the rising 200-day.

The next chart shows SPY with a sharp two day decline (1.74%), which is shown in the bottom window. Overall, SPY remains in a clear uptrend with a new high just three days ago. The two day decline and failed flag suggest that we could see another pullback to the rising 50-day SMA, which provided great mean-reversion setups since January. One of these will fail and we will get a deeper correction at some point. A 33% retracement of the advance from late October to mid August would extend to the low 400s. This would be a decline of around 9% and a return to the rising 200-day. Take correction targets with a grain of salt.

Is this pullback different? SPY has bounced off the rising 50-day SMA at least six times since January. Jonathan Krinsky of Bay Crest Partners, says “don’t buy this dip” and I respect his assessments. See Youtube video here.

Extended and Ripe for a Correction QQQ, XLK, IGV, IBB Et Al

ETFs in this next group are basically tied to the Technology sector, except perhaps IBB. These ETFs led the market from mid May to mid August with big moves and they are quite extended. The trends are up, but these are ripe for a corrective period (rest) and I do not see any setups. This group includes the tech-related ETFs because they are highlight correlated (XLK, QQQ, SMH, SOXX, IGV, SKYY, CIBR, FDN).

The next chart shows the Nasdaq 100 ETF (QQQ) with a 17% surge from mid May to mid August. The long-term trend is clearly up, but QQQ is also extended and ripe for a correction. A 50% retracement of the May-August advance would extend to the 343 area, which also marks possible support from the prior resistance level. The chart below QQQ shows IGV with similar characteristics.

Note that there are several ETFs in strong uptrends, but these too are quite extended after big advances the last few months. Even though I do not see anything bearish on these charts and they are in clear uptrends, they are ripe for a correction and there are no active setups at the moment. These include XLRE, IYR, REZ, PHO, XLV, IHI and XLC

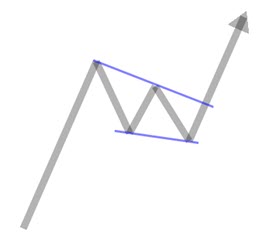

ETFs in this group hit new highs in May, corrected into July with falling wedges and broke out in late July or early August. A falling wedge/channel after a new high is deemed a bullish continuation pattern and a breakout signals a continuation of the bigger uptrend. The breakouts are holding for now with the breakout zones turning into the first support levels to watch going forward. First, a strong breakout should hold. Second, broken resistance typically turns into support. A move below the early August lows would negate the breakouts. This would not be enough to reverse the long-term uptrends, but it would argue for more correction.

The first chart shows XLF breaking out and hitting a new high as the 10yr yield surged and TLT fell in early August. This correlation suggests that a flag breakout in TLT would be negative for the finance sector and banks. The breakout zone and early August lows mark a support zone to watch on a pullback. A close below 36 would negate the breakout and be negative.

The red line on the chart above shows the ATR Trailing Stop, which is two ATR(22) values below the highest close since the breakout. This is a tight stop that would trigger with a close below 37.68. This is when traders need to plan their trade and then trade according to that plan. Short-term traders may opt for a tight trailing stop after the breakout. Other traders may want to allow more wiggle room and use the early August lows as a stop. Trend-followers using bullish continuation patterns to build a position can exit when StochClose triggers bearish, which would involve a higher drawdown if triggered.

The next charts show the Industrials SPDR (XLI) and Infrastructure ETF (IFRA) with wedge breakouts and pullbacks the last few days. The ATR Trailing Stops are holding, but are very close to triggering. The early August low (green line) is also quite close and further weakness below these levels would negate the breakouts.

You can learn more about falling wedge patterns in this video.

ETFs in this next group formed falling channels into mid July and broke out in late July. These breakouts are largely holding and we are seeing a test of the breakout zones with pullbacks the last few days. The first chart shows the Regional Bank ETF (KRE) gapping up on August 6th and breaking out of its falling channel. The ETF fell back into the gap zone this week and further weakness below the August 5th close would fill the gap and negate the breakout. Banks also surged as the 10-yr yield surged in early August and TLT fell. As such, a flag breakout in TLT would be negative for KRE and KBE.

ETFs related to the finance, industrials and materials sectors were part of a rotation we saw in late July and early August as money moved into banks, infrastructure, steel and such. The Steel ETF (SLX) is part of this group with a channel breakout in late July and a second throwback to the breakout zone here in August. The breakout zone turns into support and this is the moment of truth. The ATR Trailing Stop already triggered and further weakness below the early August lows would negate the breakout.

The next chart shows the Home Construction ETF (ITB) with another twist on the ATR Trailing Stop. First, the chart characteristics for ITB and XHB are similar to those above: new high in May, correction into July, wedge breakout. Now let’s look at a prior breakout and the ATR Trailing Stop setting. ITB formed a large triangle from October to December and broke out in January. Traders employing an ATR Trailing Stop that was two ATR(22) values below the highest close since the breakout would have been stopped out on the January or February throwbacks to the breakout zone. The alternative is to set the initial stop just below the pattern low, which usually requires a larger ATR multiplier. A 5 x ATR(22) trailing stop was needed for the January breakout. Using a 4 x ATR(22) stop on the current wedge breakout places the initial stop just below the pattern low (mid July low). This stop also trails higher when prices advance, but is wider because it is 4 ATR(22) values below the highest close since the breakout.

You can learn more about ATR Trailing stops in this post,

which includes a video and charting option for everyone.

Now we get to the failed breakouts. ETFs in this first group corrected in June-July, broke out later in July and failed to hold these breakouts. They all moved below their early August lows and triggered their ATR Trailing Stops. The first chart shows the Networking ETF (IGN) with a channel breakout in late July and then a sharp decline the last two weeks. I highlighted the falling wedge on the candlestick chart last week, but there was no breakout and this pattern did not bear fruit.

Failed Wedge Breakout or Failed Triangle COPX, CPER, DBB

The Copper Miners ETF (COPX) was holding its breakout at the start of the week, but fell sharply the last three days to negate the breakout. COPX also triggered the ATR Trailing Stop and closed just below the 200-day SMA. Note that StochClose triggered bearish on July 20th.

The next chart shows the Copper ETF (CPER) forming a triangle consolidation from May to August and then plunging below the lower line. I was watching the falling wedge on the candlestick chart, but CPER did not manage to hold the breakout. With this week’s decline, StochClose triggered bearish and this reverses the bullish signal from 9-June-2020.