TrendInvestorPro - Premium Services

TrendInvestorPro provides two complementary services for investing and trading. First, we offer objective chart analysis to identify leading uptrends and find bullish setups within these trends. Second, we offer rules-based systematic strategies to trade stocks and ETFs with the strongest momentum. These strategies are complementary because the first trades pullbacks and the second trades names with the strongest momentum. This balanced approach means there is always a horse in the race.

Objective Chart Analysis and Bullish Setups

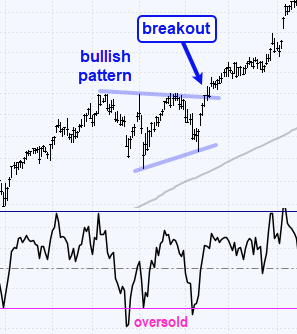

Current Analysis/Videos – These reports and videos focus on ETFs with leading uptrends. Within these uptrends, we look for bullish continuation patterns and oversold conditions to trade with the trend. Our annotated charts cover two years to identify long-term uptrends and short-term setups within the uptrend.

Market Regime Charts – Using 12 breadth indicators and 3 trend indicators, these charts and signals provide an objective manner to weigh the evidence (bull or bear market). This page includes yield spreads to analyze stress levels in the credit markets and Treasury yields to gauge Fed policy.

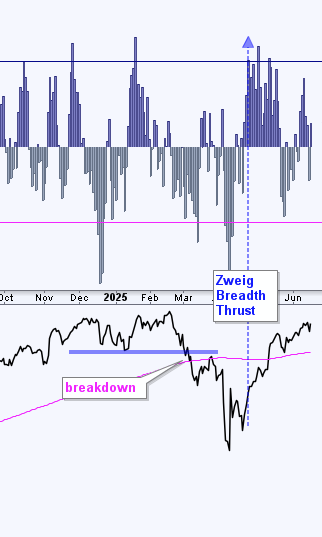

Research & Education – Our research reports explain indicators and trading strategies with real-world examples. When possible, we test these signals and provide performance metrics, such as the win rate, gain/loss ratio and Profit Factor. Recent reports covered the Zweig Breadth Thrust, a twist on the 200-day SMA cross and tradable setups within uptrends.

Systematic Strategies, Signals and Ranking Tables

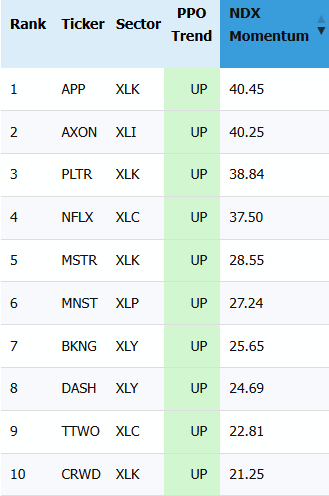

Systematic Strategies – To complement our chart analysis and discretionary trading, we also offer fully automated rules-based strategies. These strategies use trend and momentum to rotate into the strongest names within the Nasdaq 100, S&P 500 and our all-weather ETF universe.

Signals & Ranking Tables – The systematic strategies trade weekly with signal updates every Saturday. These updates include ranking tables based on volatility-adjusted momentum, which ensures that risk is being adequately rewarded. We rank performance for stocks in the Nasdaq 100 and S&P 500, as well as our ETF universe.

Broad Breadth Model (BBM) – The BBM quantifies stock market conditions for our systematic strategies. This rules-based model uses 25 indicators to distinguish between bull markets (risk-on) and bear markets (risk-off). The systematic strategies trade stocks and equity ETFs only in bull markets.

Bonus reports included with every subscription!

Bonus 1: Improving Performance for 200-day SMA Signals

SPY and QQQ crossed above their 200-day SMAs in May. These signals are bullish, but prone to whipsaws. We published a report showing how to reduce whipsaws and improve returns. We also offer a performance enhancing twist for QQQ.

Bonus 2: V Reversals – Capitulation, Surge and Broadening

SPY forged a massive V-Reversal in April. Does this reversal have legs? What separates a bear market bounce from a bull market signal? We answer these questions and more with a comprehensive report and video.

Bonus 3: Three Breadth Thrust Indicators (including Zweig)

A Zweig Breadth Thrust triggered on April 24th. This signal was widely reported, but without an exit strategy. We published a research report showing past signals and detailing an exit strategy.

Bonus 4: ETF ChartList

There are 1000s of ETFs, but many are redundant and/or thinly traded. We narrowed the universe down to 74 core ETFs that cover all areas (equities, bonds, commodities and crypto).

These alone are worth the price of admission!

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.