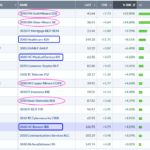

Trend Composite Signals for S&P 500 Stocks

This page shows Trend Composite signals for stocks in the S&P 500. The Trend Composite aggregate trend signals in five trend-following indicators. Recent signals appear at the top of the table. Users can also sort by different columns and single out specific sectors using the search function. Stocks in uptrends are color coded green for quick identification. This table includes the signal date, gain/loss since the signal and a chart link.