Chart Trader – Education

Indicators

Trend Composite – Understanding the Indicators, Aggregating Signals, Reducing Whipsaws, Catching Trends

This is the first article in a new strategy series that will extend over the next several weeks. We will start by defining the Trend Composite indicator and then work our way towards a systematic trading strategy. The strategy is based on signals from the Trend Composite.

StochClose – Introduction to Indicator, Methodology, Charts and Ranking

StochClose is an indicator that quantifies trend direction and trend strength. It also removes volatility from the equation and levels the playing field for stocks and ETFs. As such, it offers a balanced approach to trend identification and relative chart strength. TrendInvestorPro uses this indicator on charts and in the ETF ranking tables. This article will explain the methodology, show chart examples and provide an example of the ranking table.

Exit Indicators – Trend Reversal, Chandelier, Parabolic SAR and ATR Trailing Stop – Resources

Chartists trading oversold bounces and short-term bullish continuation patterns have two basic choices when it comes to an exit: trailing stop or trend reversal. Trailing stops are used initially as stop-losses and then trail price if/when it moves higher. Trend reversal exits are used to accumulate during an uptrend and exit when the longer-term trend reverses. This article will cover the trend reversal exit and three trailing stop alternatives.

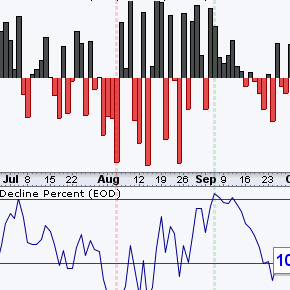

Breadth Charts and ChartList – Get an Edge with Inside Information

Breadth indicators are also referred to as market internals. As the “vital signs” for an index or sector, breadth indicators reflect aggregate performance for the individual components. As such, breadth indicators can provide leading signals by strengthening before a bottom or weakening ahead of a top. After all, the whole is only as good as the sum of the parts

Chart Analysis, Strategies, Setups and Signals

Sectors with Lowest Correlation, Good and Bad Trades with Oversold Setups (Premium)

Today’s report will show two more examples using the Momentum Composite and StochRSI. The Momentum Composite identifies oversold conditions and StochRSI signals a subsequent

Chart Strategy – Timeframes, Trend Composite, Momentum Composite, StochRSI, Setups and Signals (Premium)

A charting strategy is essential because it increases objectivity and improves the odds of success. A basic chart strategy is similar to basic black jack strategy. In his classic book, Beat the Dealer, Edward Thorp, lays out a basic black jack strategy with a set of rules to improve the odds. Once players master basic strategy, they can move on to card counting and such to further improve performance.

Separating the Consistent from the Inconsistent (Premium)

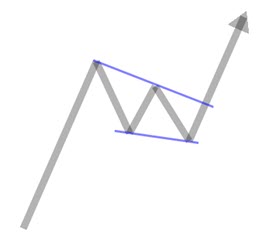

In an ideal world, trends would be consistent and persist for months. An ideal uptrend would march higher by consistently recording higher highs and higher lows. Once reversed, a downtrend would take over and work its way lower with lower lows and lower highs. There are plenty of chart examples for these consistence and persistent trends.

Identifying and Trading the Falling Wedge (Video) – Successes, Failures and Two Current Setups (Premium)

The falling wedge is a bullish continuation pattern that chartists can use to trade or invest in the direction of the underlying trend. I realized that some books show falling wedges as bullish reversal patterns, but I am only interested in bullish continuation patterns and I choose to ignore names that are hitting new lows. This video will show

Trading the Swing within a Bigger Pattern (Video) – A Success, A Failure and a Current Setup (Premium)

Chartists can get a jump on a bigger breakout by trading the swings within a developing pattern. In this example, I will outline the steps to identify these setups and the triggers for the trade. We will start with the overall

Identifying Trend Changes and Tradable Pullbacks within Uptrends (w/ Video)

2021 is just around the corner and chartists without a strategy should think long and hard about getting one. Trading in the direction of the trend is pretty much my bread and butter strategy. I do not fish for bottoms or attempt to pick tops. Tempting as it often is, I try to refrain from such endeavors as much as possible. More often than not, we are better off using trend-following indicators to identify bullish and bearish trend reversals