Timing a correction in the S&P 500 has been a fool’s errand since the November surge and breakout. The index brushed off negative seasonality in February and August. Techs and high flyers declined from mid February to mid May, but the S&P 500 kept right on trucking as money rotated elsewhere. Despite new highs in early September, I continue to see evidence that weakness is spreading within the index and there are plenty of stocks/ETFs in correction or downtrend mode right now. Bonds are also perking up and a breakout in TLT could show money moving into a safe-haven asset.

On a closing basis, SPY has not experienced a 5% drawdown since late October. On an intraday basis, high to low, there was a 5% drawdown from February 16th to March 4th, around six months ago. SPY was back at a new high in mid March and is up around 20% since the early March low. On the chart below the solid blue line shows the level for a 5% drawdown from the high. This line was last touched on March 4th.

By comparison, the Russell 2000 ETF (IWM) has experienced 9 downswings of at least 5% (high to low) since mid February. IWM is above its early March low, but still below its March high and its June high. The trading range since mid February is either a big topping formation or a big bullish consolidation. Flip a coin.

There are lots a groups in correction or downtrend mode since early March (125 days or six months). The Oil & Gas Equipment & Services ETF (XES) and Clean Energy ETF (PBW) are down more than 20%. The Airline ETF (JETS) and the Online Retail ETF (IBUY) are down more than 10%. The Regional Bank ETF (KRE) and Biotech SPDR (XBI) are down around 8%. The Aerospace & Defense ETF (XAR) is down around 6% and Russell 2000 ETF (IWM) is down around 4%.

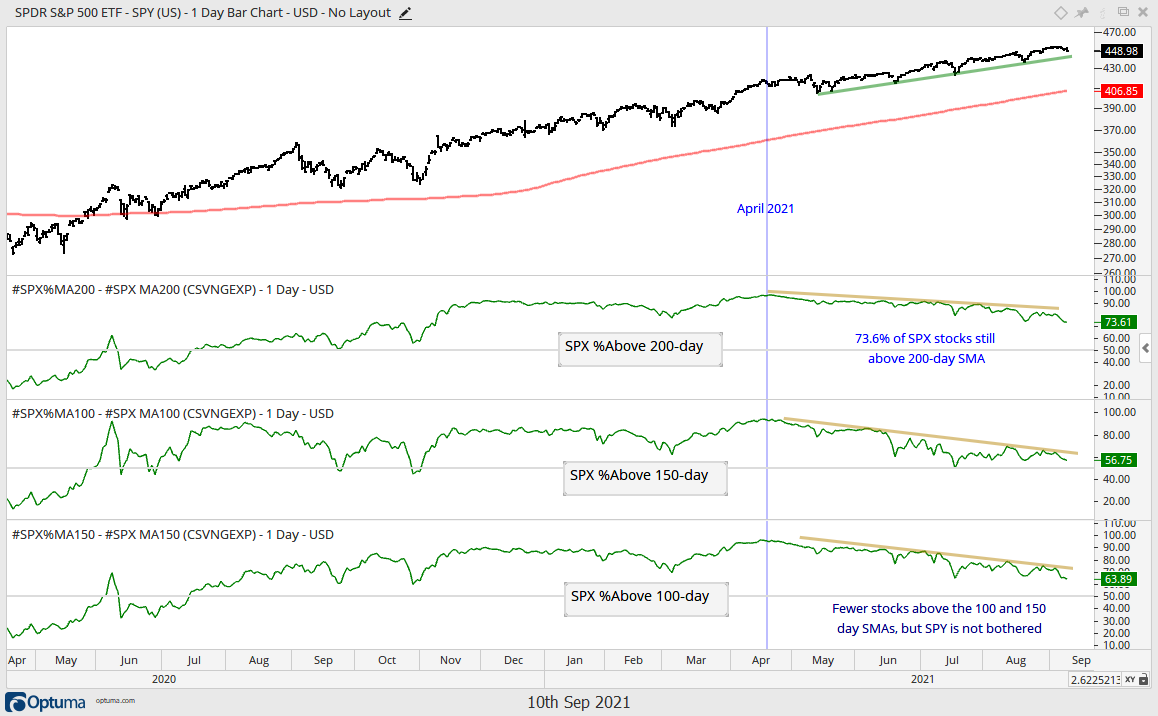

Breadth indicators confirm the existence of downtrends and/or corrections, but have yet to reach a tipping point that would be outright negative (<50%). 73.6% of S&P 500 stocks are above their 200-day SMAs. Still plenty for a bull market, but this is the lowest reading since early November 2020. 63.9% of S&P 500 stocks are above their 100-day SMAs and this is the lowest reading since October 30th.

Large-caps continue to lead with SPY, QQQ and the S&P 500 EW ETF (RSP) hitting new highs again this week. Small-caps (IWM) and micro-caps (IWC) bounced off support zones, but remain stuck in trading ranges that extend back to March. SPY, QQQ, RSP, MDY, IJR and IWM have bullish StochClose signals, while the Russell Microcap ETF (IWC) remains with a bearish StochClose signal.

Seasonally, September is the weakest month of the year for the S&P 500, but price action remains strong for large-caps (click here for full report on seasonal patterns).

The Composite Breadth Model (CBM) remains bullish and has been bullish since May 2020 (see Market Regime page for charts covering the CBM, yield spreads and Fed balance sheet).

Investment grade and junk grade corporate bond spreads narrowed from late September 2020 to late June 2021 and then flattened out at low levels the last two months. There are no signs of stress in the credit markets.

The Fed balance sheet edged higher this week and recorded another all time high. It has been in a steady uptrend (expansion) since mid July 2020.

The 20+ Yr Treasury Bond ETF (TLT) is going for a flag breakout.

The Dollar backed off resistance, but the cup remains half full.

Gold failed to break resistance and is at its moment of truth.

Oil remains in corrective mode with a falling channel since July.

There will be another commentary later today covering some recent StochClose signals. I will show ways to identify pullbacks after a bullish trend signal. Sometimes the trend pauses, and sometimes it doesn’t.

TLT Goes for Flag Breakout

The 20+ Yr Treasury Bond ETF (TLT) surged on Thursday and completely recouped the losses from Friday-Monday, which were in reaction to the employment report. Overall TLT remains in a long-term uptrend: StochClose is bullish, price is above the 200-day and the 50-day is above the 200-day. The decline from late July to early September is deemed a correction within a bigger uptrend. TLT was mildly oversold this week as RSI dipped into the 40-50 zone and Thursday’s surged triggered a StochRSI pop. Thus, the flag remains in play and a breakout is in the making. A close below 145 would call for a re-evaluation.

Gold Falters at Resistance

Gold is getting whipped around, but the overall trend and pattern are the same. Technically, GLD remains in a downtrend because StochClose triggered bearish on June 22nd. However, it would not take much to reverse this signal because StochClose is currently at 52.3. On the bar chart, GLD surged from March to early June and then corrected with a falling wedge. A higher low formed from March to August and this shows buying pressure at higher prices (positive). The falling wedge is also typical for a correction after a big advance. GLD broke the wedge trendline, but was turned back at resistance this week. Support from the mini-flag (candlestick chart) and late August lows is at hand, which makes this a moment of truth. A bounce from here and break above the July-August highs would be bullish.

Dollar Hits Short-term Support

The Dollar fell sharply into early September, became oversold and got an oversold bounce. StochClose has been bullish since June 23rd, which is a day after StochClose turned bearish for GLD. On the price chart, UUP is range bound since January and just above the mid point of this range (50% line). This is also a good exercise in understanding StochClose (125,5) as an indicator. StochClose measures the location of the close relative to the closing high-low range over a 125-day period (blue lines). This value is then smoothed with a 5-day SMA. A move below the 40% line would put the close firmly in the lower half of the 125-day range and push StochClose toward 40, possibly leading to a bearish signal. For now, the trend is up and UUP is at a moment of truth short-term, just like GLD. Support from the August low is at hand and a break would reverse the upswing within the trading range. A support break in UUP would be positive for gold, while a bounce off support would keep the upswing alive and would be negative for gold.

Oil Stalls at Channel Line

Oil remains in a long-term uptrend and a medium-term downtrend. Long-term, spot crude hit a new high in early July and remains above the rising 200-day SMA. Medium-term, the ETF fell in July-August and formed a falling channel. A breakout at 71 would be bullish for oil and argue for a continuation of the bigger uptrend. Short-term, the swing within this channel is up, but oil is hitting resistance in the 70 area. A break below 47 in USO would reverse the upswing (see candlestick chart).