This content is for subscribers. (Login or Subscribe)

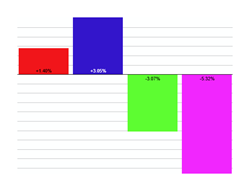

Broad Breadth Model – Current Signal

Updated at the end of every week (usually Saturday mornings), this page shows charts and current signals for the Broad Breadth Model (BBM). The model uses an array of breadth indicators from various indexes for a weight of the evidence approach to assess conditions for the broader stock market (large-caps, mid-caps, small-caps). Stock market conditions are favorable when this model is bullish (positive) and unfavorable when the model is bearish (negative).

Broad Breadth Model – Current Signal Read More »