This content is for subscribers. (Login or Subscribe)

ETF Report – SPY/QQQ Lead – AI ETFs Surge – XLI/PAVE Trigger – Bank ETFs Hold Breakouts

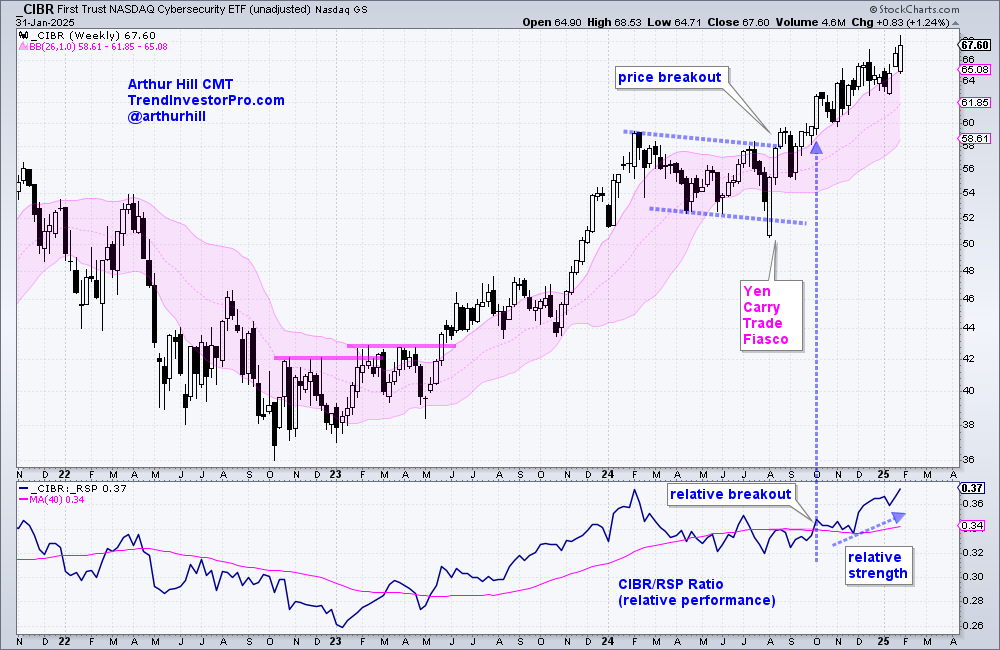

The weight of the evidence remains bullish for stocks, but small-caps and mid-caps continue to lag. We are watching a bullish pattern in SPY and a breakout QQQ. Several tech-related ETFs extended on their mid January breakouts and hit new highs. Elsewhere, short-term bullish patterns formed for ETFs related to industrials, infrastructure and defense.

The Finance SPDR (XLF) and Communication Services SPDR (XLC) are leading the sectors with new highs here in February. The Technology SPDR (XLK) is holding up as it surged off support

ETF Report – SPY/QQQ Lead – AI ETFs Surge – XLI/PAVE Trigger – Bank ETFs Hold Breakouts Read More »