For over 20 years, trader and investors have relied on Arthur Hill CMT for objective chart analysis and systematic strategies.

Our Premium Services keep traders on the right side of the market and in the right places.

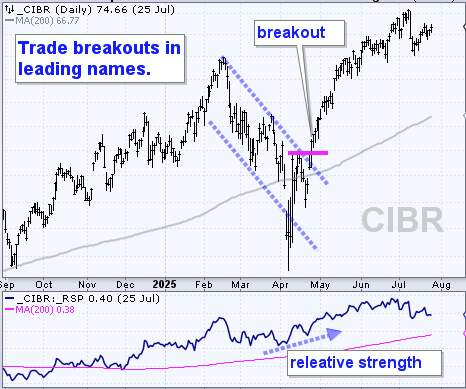

Current Analysis/Videos – These reports focus on stocks and ETFs with strong uptrends, relative strength and tradable setups. We focus on bullish continuation patterns, breakouts and oversold conditions to trade with the trend.

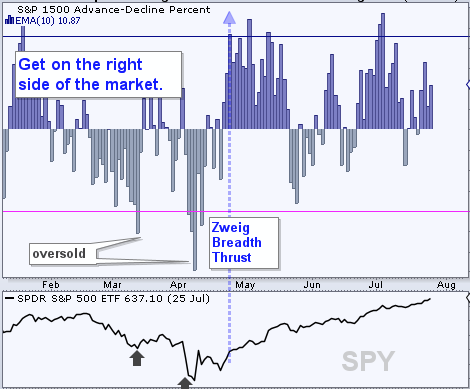

Market Regime Charts – These reports keep you on the right side of the market. Our charts define the broad market environment using long-term breadth indicators. We also cover an array of thrust and sentiment indicators to time market movements.

Research & Education – Our research reports explain indicators and trading strategies with real-world examples. When possible, we test these signals and provide performance metrics. Recent reports covered the Zweig Breadth Thrust, a twist on the 200-day SMA cross and tradable setups within uptrends.

Stay on the right side and trade leading names!

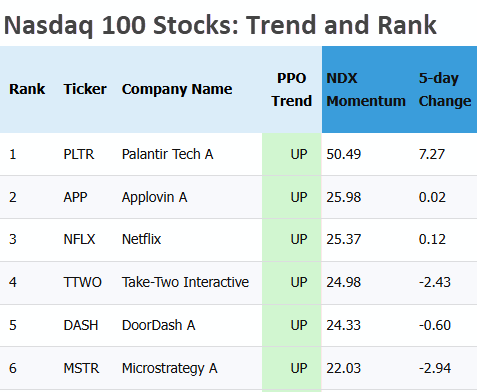

Our Premium Services also include Systematic strategies, signals and ranking tables.

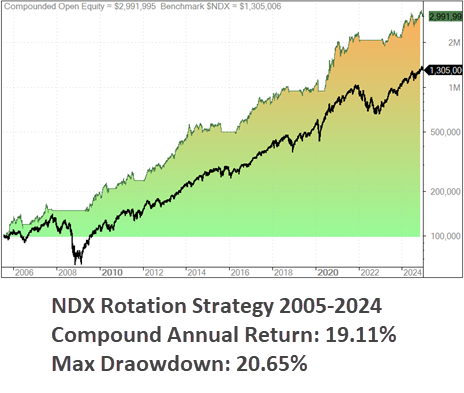

Systematic Strategies – To complement our chart analysis, we also offer fully automated rules-based strategies. These strategies use trend and momentum to rotate into the strongest names within the Nasdaq 100, S&P 500 and our all-weather ETF universe.

Signals & Ranking Tables – The systematic strategies trade weekly with signal updates every Saturday. These updates include ranking tables based on volatility-adjusted momentum, which ensures that risk is being adequately rewarded. Universes covers the Nasdaq 100, S&P 500 and ETFs.

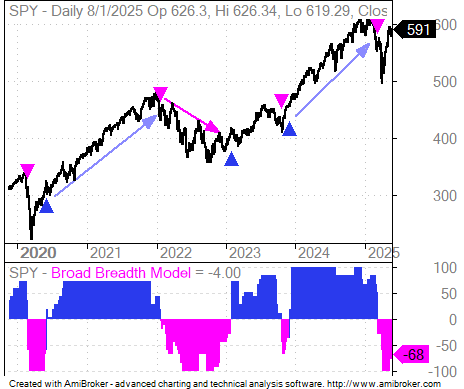

Broad Breadth Model (BBM) – The BBM quantifies stock market conditions for our systematic strategies. This rules-based model uses 25 indicators to distinguish between bull markets (risk-on) and bear markets (risk-off). The systematic strategies trade stocks and equity ETFs only in bull markets.

Remove the guesswork with proven strategies.

Bonus reports included with every subscription!

Bonus 1: Improving Performance for 200-day SMA – This invaluable report shows how to reduce whipsaws and improve returns using SPY and the 200-day SMA. We also offer a performance enhancing twist for QQQ.

Bonus 2: V Reversals – Capitulation, Surge and Broadening – This report explains the market sequence that starts with capitulation to exhaust selling pressure, a breadth thrust to forge a bottom and broadening participation to signal a bull market.

Bonus 3: Three Breadth Thrust Indicators (including Zweig) – A Zweig Breadth Thrust triggered on April 24th. This signal was widely reported, but without an exit strategy. We published a research report showing past signals and detailing an exit strategy.

Bonus 4: ETF ChartList – There are 1000s of ETFs, but many are redundant and/or thinly traded. We narrowed the universe down to 74 core ETFs that cover all areas (equities, bonds, commodities and crypto).

$9 for a 30 day trail

$29 per month thereafter

Cancel Anytime

These alone are worth the price of admission!

Arthur developed and refined his trading processes with over three decades of experience. His strategies are designed to survive bear markets by preserving capital and outperform during bull markets by focusing on leaders. To this end, TrendInvestorPro provides data-driven trading strategies and actionable chart analysis to help you take your trading success to the next level.

Arthur holds the Chartered Market Technician (CMT) designation from the CMT Association.

His research appears in the Journal of Technical Analysis: Finding Consistent Trends with Strong Momentum.

He wrote a book that teaches new traders how to trade in the direction of the bigger trend: Define the Trend and Trade the Trend.

Arthur’s work can also be seen on StockCharts.com, Financial Sense, Traders.com and Stocks & Commodities Magazine.

Stay on the right side and trade leading names!

Testimonials

Frequently asked questions

There are two separate subscriptions: ChartTrader and SystemTrader. ChartTrader is for chart analysis and trading setups. SystemTrader is for quantified strategies and signals.

We publish the Chart Trader report and video every Friday morning (by 7AM ET)

Our time horizon is anywhere from a few weeks to several months. We focus on bullish setups with high reward potential and low risk.

We post weekly signals at the end of the trading week (usually Saturday mornings).

Our market timing is updated at the end of every week. We will issue an alert should the model change between signals.

Yes! We want to be involved in names that show persistent and consistent uptrends, and that have strong relative momentum. The momentum-rotation strategies capture the leaders with the S&P 500 and Nasdaq 100.

System Trader tracks the performance for the quantified strategies and the Composite Breadth Model. Chart Trader does not publish a track record because I do not trade all ideas presented. Self-directed traders should assess the ideas for themselves and decide which fit their criteria. See our Disclaimer and Terms of Use for more details.

Yes, you can cancel at any time. We do not offer prorated refunds and your subscription will end with the billing cycle. Cancel using the Support link at the upper right of each page.

This information is issued solely for informational and educational purposes and does not constitute a recommendation to buy or sell securities. Past performance does not guarantee future performance. Users should consult their own financial or investment adviser before trading or acting upon any information provided. You, and only you, are responsible for your investment and trading decisions. For more details, please review our Disclaimer.

TrendInvestorPro respects your privacy and strives for transparency on our data collection practices. We only use your information to customize the site for you and contact you about your membership. We will never sell you information or send you promotions for other services. For more details, please review our Privacy Policy.