Big Tech Still Leading – SOXX Forms Flag – CIBR Oversold – XLF, KRE, XLY, XLP

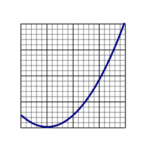

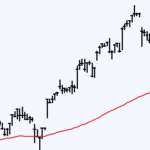

Big tech continues to lead the market with the Technology SPDR, Mag7 ETF and Semiconductor ETF powering higher. These three have one thing in common (NVDA). It is not just Nvidia power semis because we are also seeing a flag breakout in SOXX. Elsewhere, the Finance sector is maintaining its uptrend as the Regional Bank ETF turned up after