All Reports and Signal Pages

(most recent at top)

ChartTrader – Tech-ETFs Lead the Pullback, Energy-Healthcare Hold Up, Symbols: XLE, XES, XLV, HAL, PXD, EOG, DIS, PKG (Premium)

Stocks are starting 2024 a bit different than the last two months of 2023. After big advances into yearend, stocks fell the first three days of the year. High-beta stocks and ETFs led the way lower with some falling more than 9% (MDB, AMD, ARKK, ARKF). These sharp three day declines

ChartTrader – Bull Market Recap, Seasonal Patterns, RSI Ranges, Symbols: IGV, SMH, XLE, XES, NVDA, LMT, NOC, LLY (Premium)

Let’s first recap the broad market environment. The most recent bull run started with an S&P 1500 Zweig Breadth Thrust on November 3rd. This initial surge extended throughout November

ChartTrader – Identifying Support-Reversal Zones Symbols: XLK, XLC, SOXX, IGV, CIBR, ITB, FINX, ARKK, XLE, XES, GLD (Premium)

Even though the market advance broadened over the last few weeks, most ETFs are still well below their 2021 highs. In other words, they have yet to fully recover from January to October in 2022. Stocks and ETFs that exceeded their

ChartTrader – A Complete Cycle for SPY, Beware of Small-caps, Symbols: IWM, TLT, DRIV, HERO, MSFT, GOOGL, BNGT, BNTX (Premium)

There is no change in the broad market environment: bullish and short-term overbought (strong). We saw a parade of bullish signals in November starting with the Zweig Breadth Thrust on the 3rd. SPY then continued higher and broke above the upper Bollinger Band (125,1) and the upper line of the

ChartTrader – RSI Exceeds 75, the Surge on top of the Surge, Symbols: CSCO, DRIV, TLY, MRK, GILD, PFE (Premium)

For the third time in seven months, RSI(14) moved above 75, which suggests that SPY is short-term overbought. Once again, SPY is overbought and remaining overbought. The red arrows on the

ChartTrader – Overbought and Staying Overbought, Symbols: XME, HERO, DRIV, AMZN, LYV, CSCO, TXT, LLY (Premium)

The weight of the evidence is bullish for stocks. It all started with a Zweig Breadth Thrust on November 3rd and the broad advance extended into early December. The 5-day SMA for the Composite Breadth Model (CBM) hit +1 on December 7th. The CBM is a trend-following

ETF-Strategy: Trend Momentum Profit Target Strategy for Stock-Based ETFs – UPDATES (Premium)

This report updates the Trend and Momentum Strategy that trades 74 stock-based ETFs. This strategy went through a rough patch from January 2022 to May 2023, but rebounded the last two months

ChartTrader – Long-term Uptrends and Short-term Overbought, QQQ Starts to Lag, Symbols: TSLA, VRTX, NOC, LMT (Premium)

SPY and QQQ are in long-term uptrends as both recorded 52-week highs over the last few weeks. Small-caps are in long-term trading ranges, but short-term uptrends as IWM and IJR surged the last six weeks. Overall, stocks are short-term

ChartTrader – Large-caps Get Extended, Small-caps Surge, QQQ Lags, Symbols: CSCO, QCOM, HOLX, UHS (Premium)

making big gains (11-15%). Almost all stock-based ETFs are up over this five week period with many up more than 10%. Energy-related ETFs are down, as are ETFs related to some commodities

ChartTrader – QQQ/SPY Slow after Being Overbought, Small-caps Consolidate, Symbols: USO, XLE, XES, FANG, PKG, AMGN, REGN (Premium)

There is no change in the broad market situation. QQQ is leading because it recorded a 52-week high in November. SPY is not far behind, but it has yet to exceed its July highs. Both are short-term overbought after sharp advances from late October to late November.

ChartTrader – Thrust vs Trend, QQQ Gets Extended, Symbols:XLK, HACK, SMH, IGV, URI, VRTX, GPN, PANW (Premium)

The broader market remains mixed. The S&P 500 SPDR (SPY) is performing well because it is weighted by market cap and Nasdaq 100 stocks account for a third of the ETF. The Nasdaq 100 ETF (QQQ) is performing well because tech stocks are leading the market and the tech sector

SystemTrader – Testing the Zweig Breadth Thrust using other Indexes – Adding Beta and Diversification to the Strategy (Premium)

Today’s report will put the Zweig Breadth Thrust indicators for the various indexes to the test. My default breadth index is the S&P 1500 because it covers all bases and represents a broad swath of the US stock market. We can also generate ZBT signals using

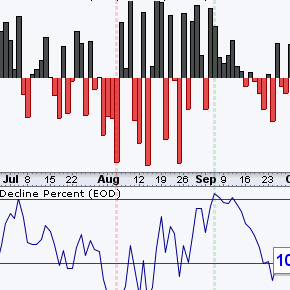

Charting the S&P 1500 Zweig Breadth Thrust using Advance-Decline Percent (Free)

StockCharts users can chart the Zweig Breadth Thrust for the S&P 1500 or any other index that has Advance-Decline Percent data. All we have to do its convert the Zweig Breadth Thrust levels to their equivalents using Advance-Decline Percent.

Getting Started with TrendInvestorPro!

This page shows users how to navigate the website and explains the offerings. We cover the publishing schedule for Chart Trader and signal updates for System Trader. Attention then turns to my trading and analysis style and the tools of the trade.

Breadth Charts and ChartList – Get an Edge with Inside Information

Breadth indicators are also referred to as market internals. As the “vital signs” for an index or sector, breadth indicators reflect aggregate performance for the individual components. As such, breadth indicators can provide leading signals by strengthening before a bottom or weakening ahead of a top. After all, the whole is only as good as the sum of the parts