This content is for subscribers. (Login or Subscribe)

QQQ Overtakes QQEW – GOOGL Near High – Groups with Most Highs – Verizon Gaps

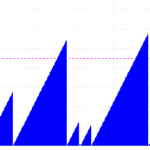

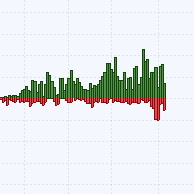

Welcome to your Friday Chart Fix. Today’s report starts with year-to-date performance for QQQ and its equal-weight brother (QQEW). We then look at the leaders within QQQ and single out Alphabet because it is close to a new high. Attention then turns to small and mid caps because they led the market this week. New highs are still sparse within the space. We then show a ranking table to find the groups with the most new highs. And finally,

QQQ Overtakes QQEW – GOOGL Near High – Groups with Most Highs – Verizon Gaps Read More »