This content is for subscribers. (Login or Subscribe)

ChartTrader – VIX Spike – NDX Breadth Deteriorates – Short-term Breadth Not Yet Oversold – SPY Downside Target (Premium)

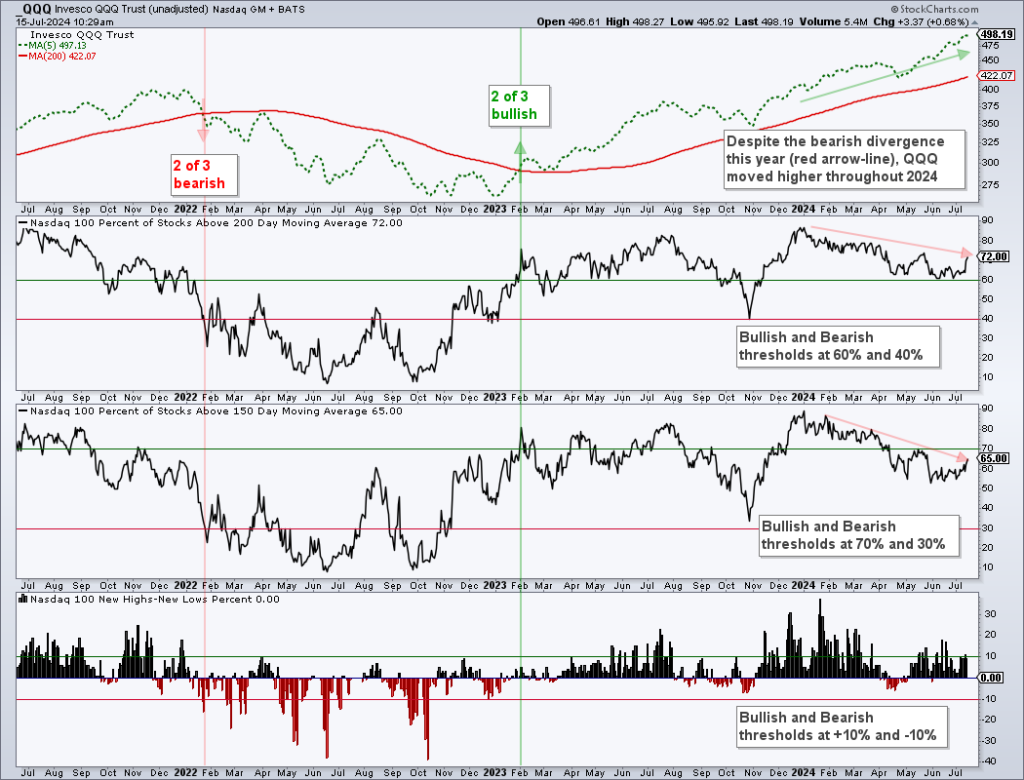

Selling pressure broadened over the last three days with the broader market (S&P 500 stocks) joining tech-related stocks (Nasdaq 100 stocks) in the sell off. The long-term trends are still up for SPY and QQQ. In addition, the Composite Breadth Model and the SPX-NDX Breadth model remain