This content is for subscribers. (Login or Subscribe)

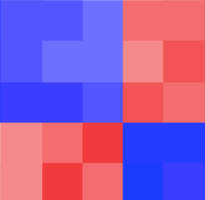

Market Regime – Weighing the Evidence using Trends, Breadth and Yield Spreads

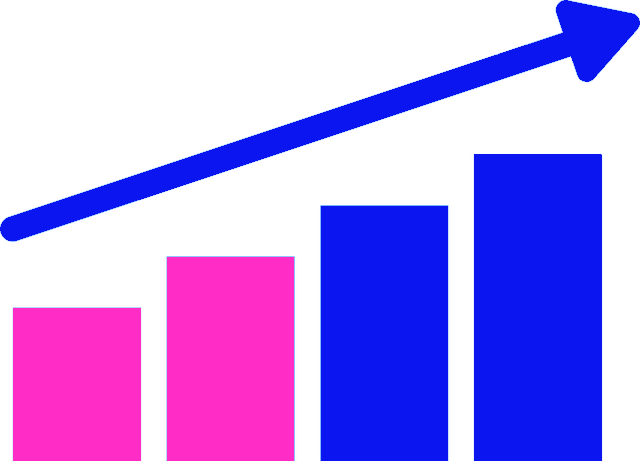

This market regime report weighs the evidence to determine the state of the stock market. Are we in a bull market or bear market? We start with the long-term trends for three major index ETFs (SPY,QQQ,RSP). Attention then turns to breadth indicators to measure the percentage of stocks in uptrends/downtrends and the percentage hitting

Market Regime – Weighing the Evidence using Trends, Breadth and Yield Spreads Read More »