Market Regime – Weighing the Evidence using Trends, Breadth and Yield Spreads

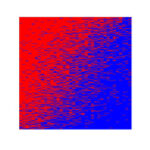

After hitting oversold extremes in early April, breadth indicators bounced the last few weeks with the percentage of S&P 500 stocks above their 200-day SMA hitting 36%. This also means that 66% are below their 200-day SMAs and in long-term downtrends. You cannot have a bull market with