This content is for subscribers. (Login or Subscribe)

ChartTrader – Using Two Timeframes to Increase the Odds – Strategic and Tactical – NOC – Parts 1 & 2 (Premium)

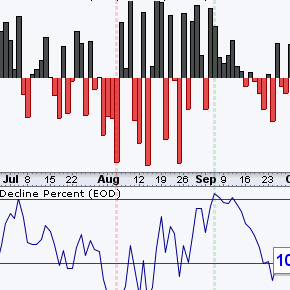

Chartists looking to increase their odds should consider two timeframes for their analysis. The longer timeframe sets the strategic tone, while the shorter timeframe defines the trading tactics. Strategically, I am interested in stocks with long-term uptrends.