A Key Momentum Indicator Shifts from Bullish to Bearish for QQQ – with video (Free)

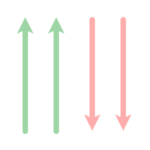

QQQ remains well above the rising 200-day SMA, but clearly shifted from bullish to bearish over the last two months. Today’s report/video will show this momentum shift and analyze the short-term continuation pattern taking shape.