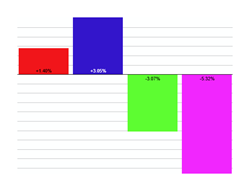

SPY/QQQ Lead, Small/Mids Lag and Leading Sectors (w/ video)

SPY and QQQ are in leading uptrends with fresh new highs in late July. The first chart shows SPY with the big trend-reversing breakout on May 12th. This is when it broke the late March high, negated the Double Top