Market-ETF Report – Gold, Silver and Miners Consolidate – Copper and Palladium Extend

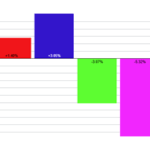

Even though some equity groups are performing well year-to-date, commodity and crypto related ETFs feature prominently on the leaderboard. The pink shading on the image below highlights these leaders. The top five ETFs are related to platinum, gold, silver, uranium and blockchain. Further down, we have ETFs related to copper, palladium, mining and BitCoin. SPY and QQQ may be trading at new highs, but they are not