New Highs vs Lows, XLC Goes Beast Mode – Risk is On – Dissecting Gold – A Cyber Setup

- Arthur Hill, CMT

Welcome to the Friday Chart Fix! Today’s report starts with a bullish breadth indicator and the level to watch going forward. We then turn to the strongest sector: Communication Services. It has been on fire since May and continues to lead. Overall, stocks are in good shape because the EW Technology sector is trading above resistance and Consumer Discretionary is outperforming the Consumer Staples. And finally, we focus on Zscaler as it corrects within a long-term uptrend.

A speech from Fed Chairman Powell juiced the markets two weeks ago. Today, the employment report will provide the fireworks. This report was written well before the eternally revised employment report. Jobs and interest rates matter, but price is the ultimate arbiter, which is why charts matter the most. Whatever the reaction to the employment report, focus on the charts and maintain perspective.

Recent Reports and Videos for Premium Members

- SPY, QQQ and XLK Hold the Line (Key Levels to Watch)

- Fastenal Turns Leader and GE Becomes Oversold

- A Bullish Setup for the 7-10Yr TBond ETF

- Bitcoin ETF Forms Bearish Continuation Pattern

- Click here to take a trial and gain full access.

New Highs Consistently Outpacing New Lows

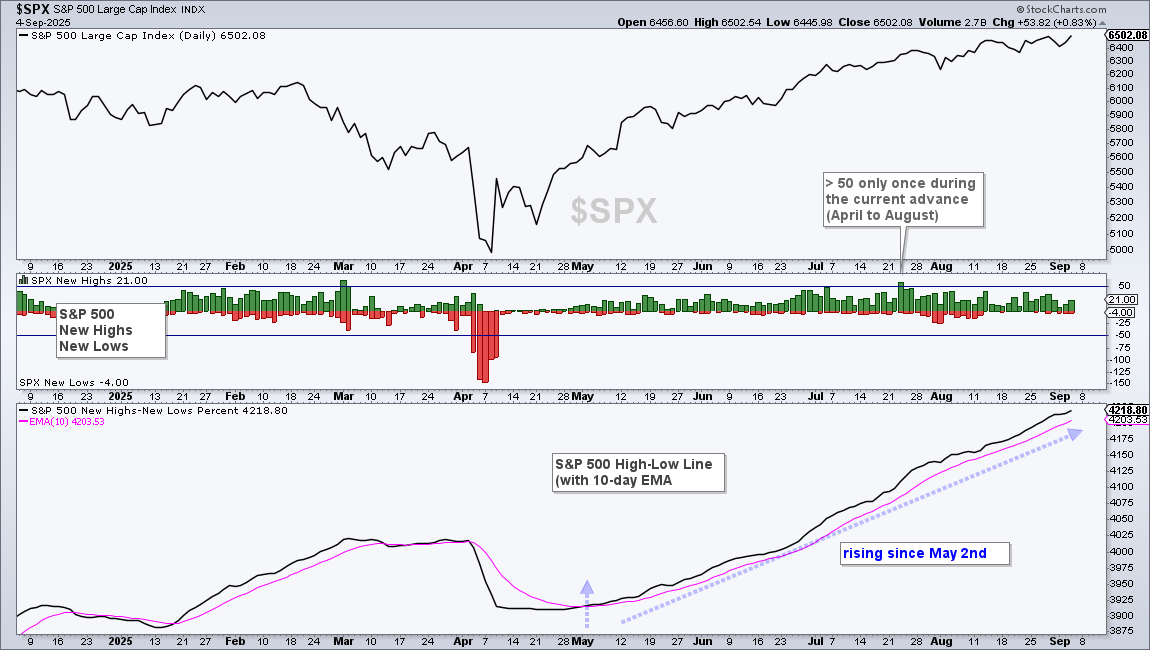

The chart below shows the S&P 500, New Highs/Lows and the High-Low Line. Even though new highs exceeded 50 only once since the current advance began (April), the High-Low Line continues to rise as new highs outnumber new lows. Notice that the High-Low Line first crossed its 10-day EMA (pink line) on May 2nd. The bulls have the edge as long as this EMA holds.

The High-Low Line is a running total of the difference between 52-week highs and 52-week lows. This line rises when new highs outnumber new lows and falls when new lows outpace new highs. A rising High-Low Line means new highs are consistently outpacing new lows.

Communication Services SPDR Leads with New High

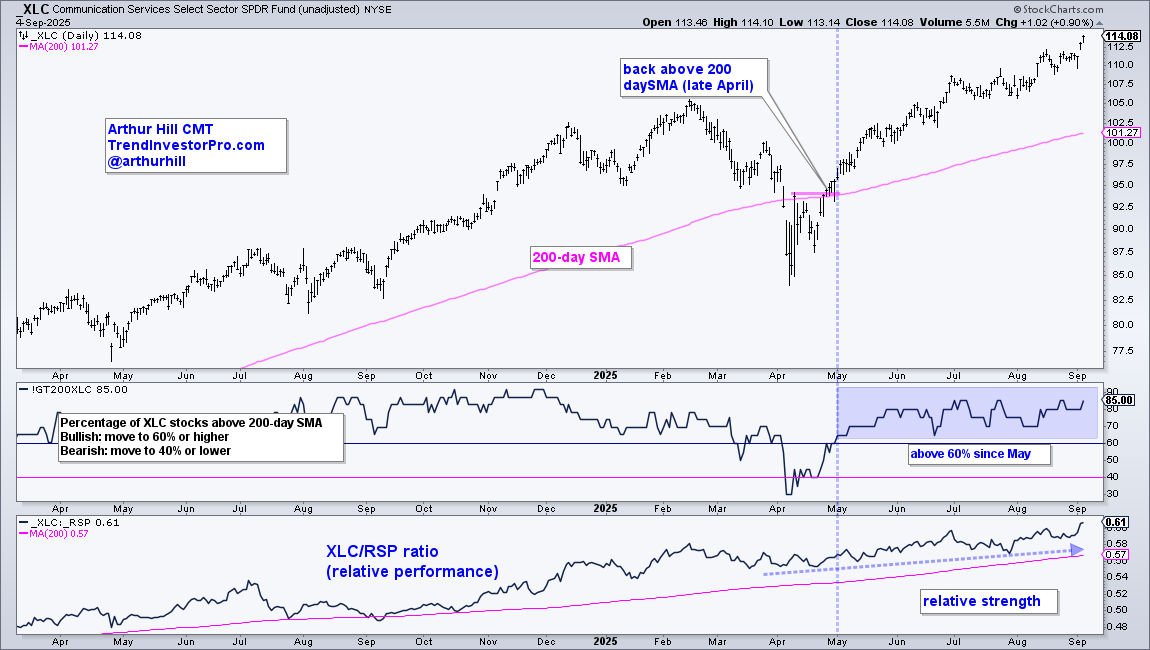

The Communication Services SPDR (XLC) remains in a strong uptrend, breadth is strong within the sector and it is outperforming the broader market. XLC is leading the sectors with a series of new highs since late June. This should not come as a surprise because XLC has been leading since May (blue dashed line). After the early April swoon, it was one of the quickest to recover because it recaptured its 200-day SMA and broke the April 9th high in late April. It has been nothing but uptrend since this breakout.

There was also a bullish breadth signal as the Percentage of XLC stocks above their 200-day SMA exceeded 60% in early May. This indicator has been above 60% since May and 85% of component stocks are currently above their 200-day SMAs. This shows broad strength within the sector. And finally, the bottom window shows the price-relative (XLC/RSP ratio) holding above its 200-day SMA since September 2024! After a dip in February-March, it turned back up in late April and hit new highs in June, July, August and September.

EW Technology Consolidates above Breakout

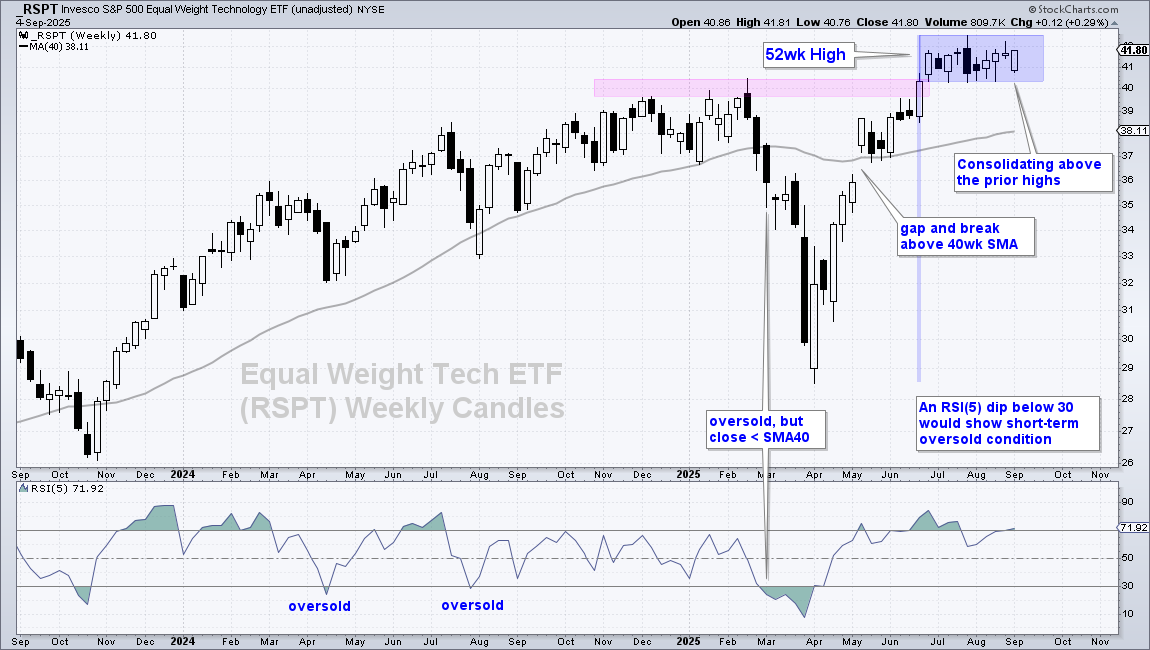

The EW Technology ETF (RSPT) surged to new highs in June and then consolidated with a trading range above these highs (blue shading). Clearly, RSPT is in a long-term uptrend. This is positive because the EW Technology ETF represents the average tech stock, not just the large-caps. The consolidation looks like a flat flag, which is a bullish continuation pattern. A breakout would confirm the pattern and signal a continuation higher. A break below 40 would negate the flag pattern.

Even though a break below 40 would be short-term negative, it would not reverse the long-term uptrend because RSPT would still be well above the rising 40-week SMA. This means a pullback could set up the next mean-reversion opportunity. The bottom window shows RSI(5) with two dips below 30 in 2024. These dips signaled oversold conditions that presented opportunities to trade within the uptrend.

EW Consumer Discretionary Sector Leads

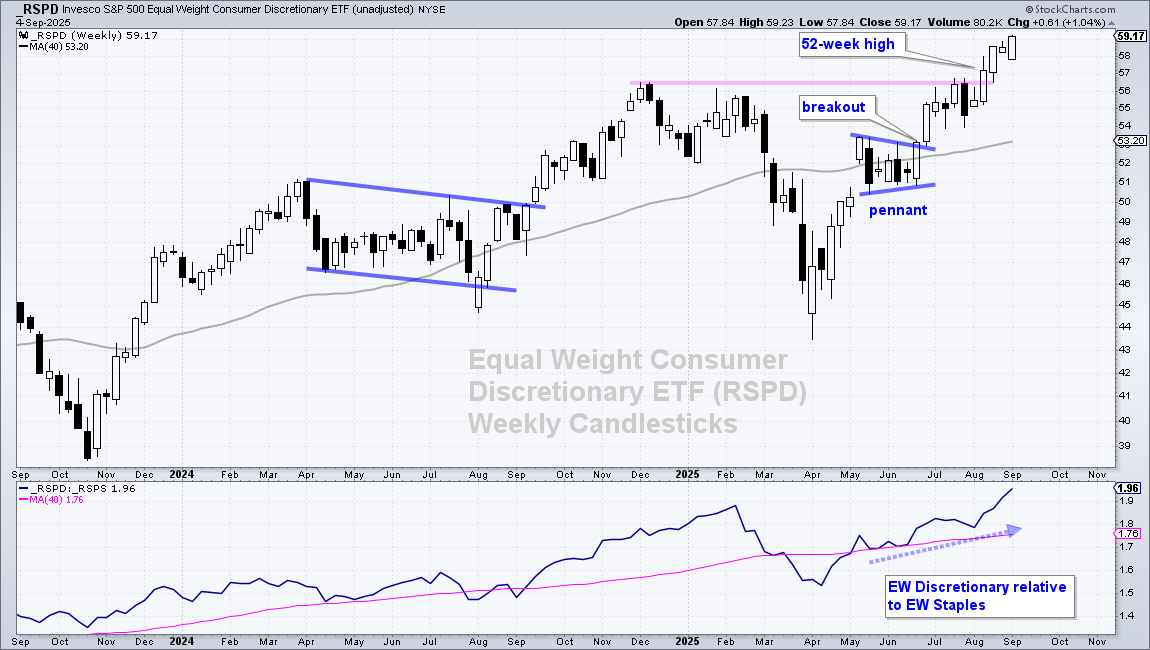

How bad can it be when the Equal-weight Consumer Discretionary Sector is hitting a new high? Answer: Not that bad. The chart below shows the EW Consumer Discretionary ETF (RSPD) gapping above its 40-week SMA in early May, breaking a pennant line in late June and hitting new highs in August-September. This is bullish because this sector represents retail, travel, autos, restaurants and homebuilding.

In addition to absolute strength, the EW Consumer Discretionary sector is outperforming the EW Consumer Staples Sector (RSPS). The bottom window shows the RSPD/RSPS ratio, which is the relative performance line. This ratio turned up in April, broke its 40-week SMA in early May and moved to new highs. Consumer Discretionary (risk-on) is outperforming Consumer Staples (risk-off).

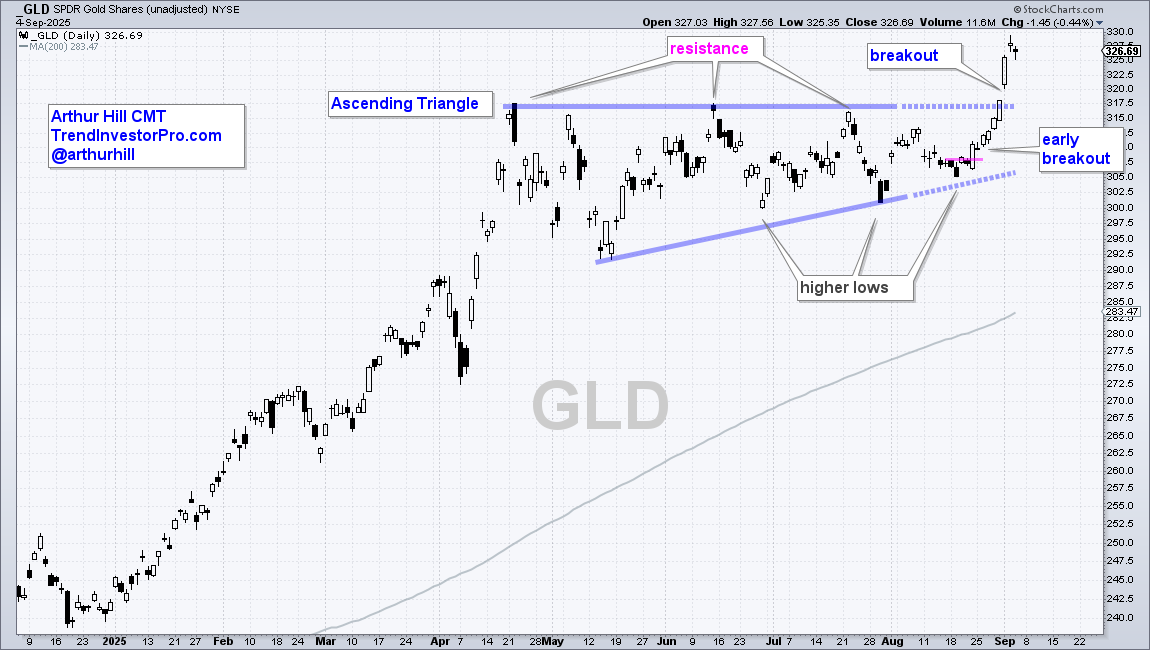

Dissecting the Ascending Triangle in the Gold SPDR

The Gold SPDR (GLD) surged to another new high with a 7.5% move from August 19th to September 3rd. This move was building for weeks as the ETF formed a classic bullish continuation pattern ahead of the surve. The solid blue lines show a classic Ascending Triangle from late April to early August. This pattern was there well before the breakout, and featured in the Premium Content at TrendInvestorPro. The flat upper line marks overhead resistance (supply), while the rising lower line defines demand. “Rising” is the key word here. Higher lows formed in late June, late July and mid August. These higher lows mean buying pressure (demand) is coming in at higher price levels, which is bullish. A break above the resistance line signals a victory over supply and confirms the pattern. Chartists looking to get a jump on the breakout can look for oversold conditions within the pattern or short-term breakouts, such as the one on August 22nd. These were also noted in Premium Content at TrendInvestorPro.

Zscaler Sets Up with Oversold Condition

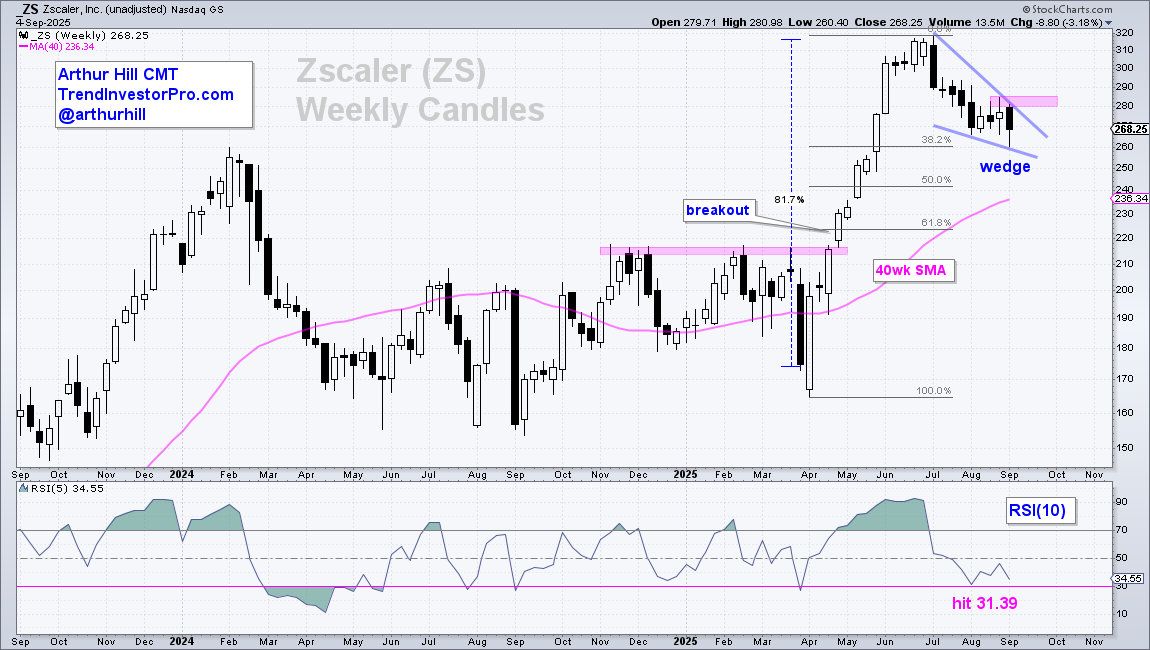

The next chart shows weekly candlesticks for Zscaler (ZS), which is part of the Cybersecurity ETF (CIBR). The stock and the ETF fell in July-August, but I view these declines as corrections within bigger uptrends. Note that ZS surged 81% in 12 weeks and became overbought. The stock worked off this overbought condition with a correction the last nine weeks. I view this as a correction because price is still well above the rising 40-week SMA (uptrend).

ZS piqued my interest because a classic correction is taking shape and the stock became short-term oversold (almost). First, the decline formed a falling wedge that retraced around 38% of the prior advance. The falling wedge is typical for a correction after a strong advance, as is the retracement amount. Second, RSI(5) hit 31.39 in early August, which is almost oversold. A setup is in the works and I am now looking for an upside catalyst. The August high mark resistance at 285 and a breakout here would be bullish.

Recent Reports and Videos for Premium Members

- SPY, QQQ and XLK Hold the Line (Key Levels to Watch)

- Fastenal Turns Leader and GE Becomes Oversold

- A Bullish Setup for the 7-10Yr TBond ETF

- Bitcoin ETF Forms Bearish Continuation Pattern

- Click here to take a trial and gain full access.