This content is for subscribers. (Login or Subscribe)

Trend Trio Signal for ITA – Few Uptrends – GLD Remains Frothy – Software Breaks Out

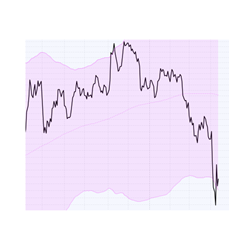

Chartists can also use the 200-day SMA and the direction of the 200-day SMA to compare performance. ETFs trading above their rising 200-day SMAs are performing better than those trading below their falling 200-day SMAs. Overall, 23 of the 72 core ETFs are trading above their rising 200-day SMAs.

Trend Trio Signal for ITA – Few Uptrends – GLD Remains Frothy – Software Breaks Out Read More »