This content is for subscribers. (Login or Subscribe)

Big Four are in Long-term Uptrends – Risk-On Environment

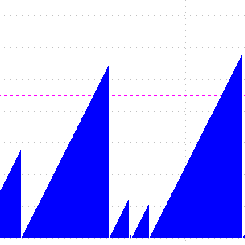

Stocks moved sharply higher on Friday with small-caps and mid-caps leading the charge. Friday’s big advance is not the first big move for these two groups. They also moved sharply higher on August 12th and 13th. August is shaping up to be a big month for small-caps and mid-caps. This report focuses on the big four

Big Four are in Long-term Uptrends – Risk-On Environment Read More »