This content is for subscribers. (Login or Subscribe)

Separating the Consistent from the Inconsistent (Premium)

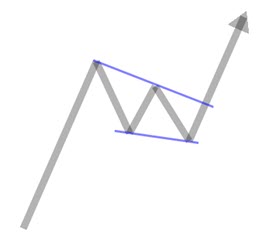

In an ideal world, trends would be consistent and persist for months. An ideal uptrend would march higher by consistently recording higher highs and higher lows. Once reversed, a downtrend would take over and work its way lower with lower lows and lower highs. There are plenty of chart examples for these consistence and persistent trends.

Separating the Consistent from the Inconsistent (Premium) Read More »