SPY Reverses Long-term Uptrend with Outsized Move – Now What?

- Arthur Hill, CMT

The weight of the evidence shifted to the bears over the last few weeks. First, the major index ETFs reversed their long-term uptrends with Bollinger Band signals, our breadth models turned net negative and yield spreads widened. This report will focus on the breakdown in the S&P 500 SPDR (SPY), which represents the single most important benchmark for US stocks.

The SPY chart below shows weekly candlesticks and the 40-week SMA, equivalent to the 200-day SMA. On the top right, we can see a break below support from the January low and a break below the 40-week SMA with an outsized decline. An outsized decline is an exceptionally sharp and deep decline that can derail an uptrend. As of Thursday’s close, SPY had fallen over 9% in 15 trading days, the largest 15 day decline since September 2022. This exceptionally strong selling pressure pushed prices below the demand line (support) and a key long-term moving average. Note that a similar break occurred in January 2022, which we covered in a report and video on Friday.

Large-caps are also starting to lag the broader market. The middle window shows the SPY/RSP ratio breaking below its 40-week SMA for the first time since early March 2023. After outperforming for two years, large-caps (SPY) are underperforming the average stock in the S&P 500 (RSP). SPY also started underperforming RSP in January 2022, which is when the 2022 bear market started.

So now what? SPY became short-term oversold this week and ripe for a bounce. The broken support zone and underside of the 40-week SMA turn into the first resistance levels to watch (blue shading). We are now trading under a bear market regime so I would expect any bounce to fail in the 580 area.

We covered the following at TrendInvestorPro this week:

- Six of the nine breadth-model indicators triggered bearish signals.

- Yield spreads widened as stress increased in the credit markets.

- Six major index ETFs triggered bearish Bollinger Band breaks.

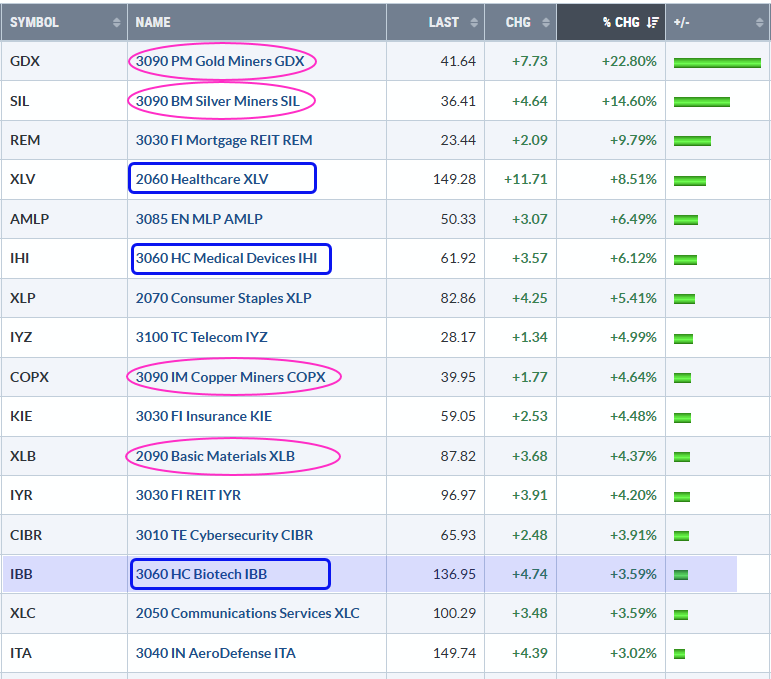

- Precious and industrial metals ETFs extended on breakouts.

- Applying lessons from the 2022 bear market to the current situation.

Click here to take a trial and gain immediate access!