This content is for subscribers. (Login or Subscribe)

SPY/QQQ Lead, Small/Mids Lag and Leading Sectors (w/ video)

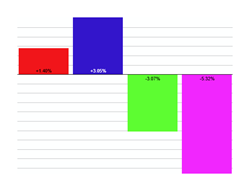

SPY and QQQ are in leading uptrends with fresh new highs in late July. The first chart shows SPY with the big trend-reversing breakout on May 12th. This is when it broke the late March high, negated the Double Top and gapped above the 200-day SMA. SPY extended to new

SPY/QQQ Lead, Small/Mids Lag and Leading Sectors (w/ video) Read More »