SPY Reverses Long-term Uptrend with Outsized Move – Now What?

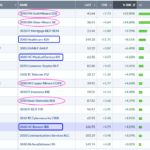

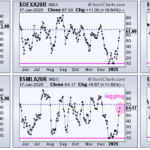

The weight of the evidence shifted to the bears over the last few weeks. First, the major index ETFs reversed their long-term uptrends with Bollinger Band signals, our breadth models turned net negative and yield spreads widened. This report will focus on the breakdown in the