This sample is taken from an actual report coving broad

market conditions, SPY/QQQ charts and leading ETFs

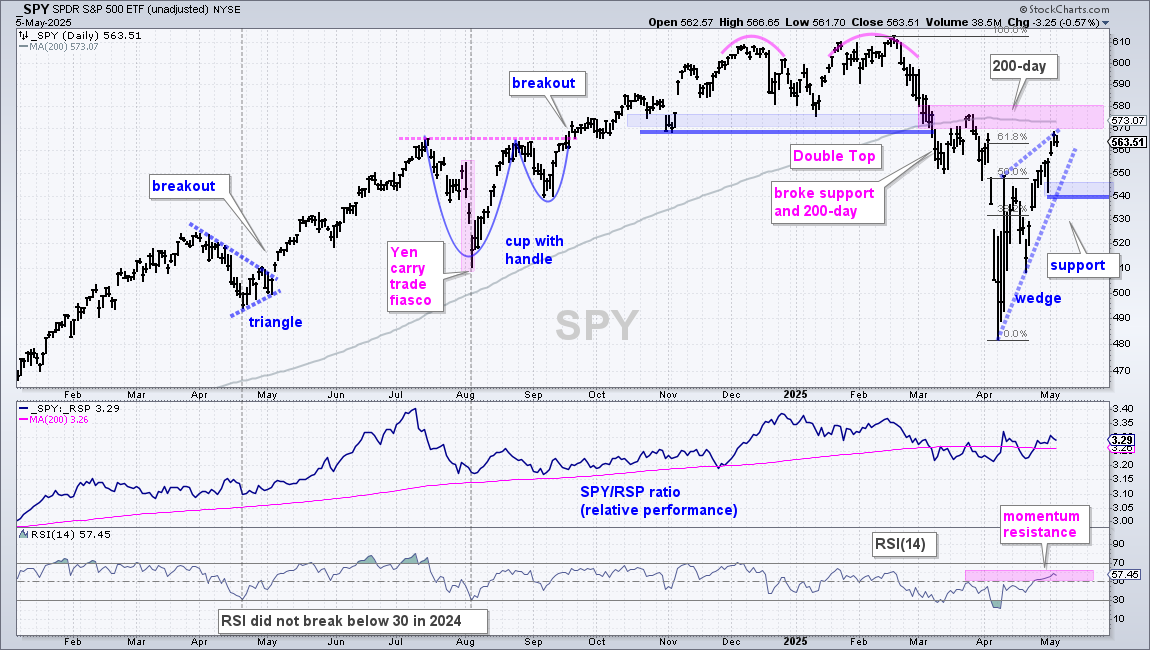

The weight of the evidence is mixed, at best, for the stock market. Our long-term trend and breadth indicators are bearish, but we did get short-term thrust signals towards the end of April. These signals remain in play so we will update the key levels to watch. Despite a record rebound the last few weeks, the March breakdowns remain and the short-term upswings look like counter-trend bounces. Stocks are also short-term overbought. Strategically, the long-term downtrends and bear market are negative. Tactically, upside could be limited as resistance levels come into play and short-term conditions become overbought.

Report Headlines

- Short-term Thrusts < Long-term Trend/Breadth

- SPY and QQQ Surge to Resistance Zones

- Technology SPDR Nears Resistance Zone

- Semiconductor ETF gets Counter-Trend Bounce

- Home Construction ETF in Strong Downtrend

- Trucking Index Consolidates Near Lows

- ETFs in Leading Uptrends

- One Clear Leader (ITA)

- Channel Breakouts (CIBR, ARKF, IHI)

- Rising Wedge Recoveries (XLF, IYZ, XLC)

- Modest Downtrends Mean Less Weakness (XLU, XLP, KIE)

Short-term Thrusts < Long-term Trend/Breadth

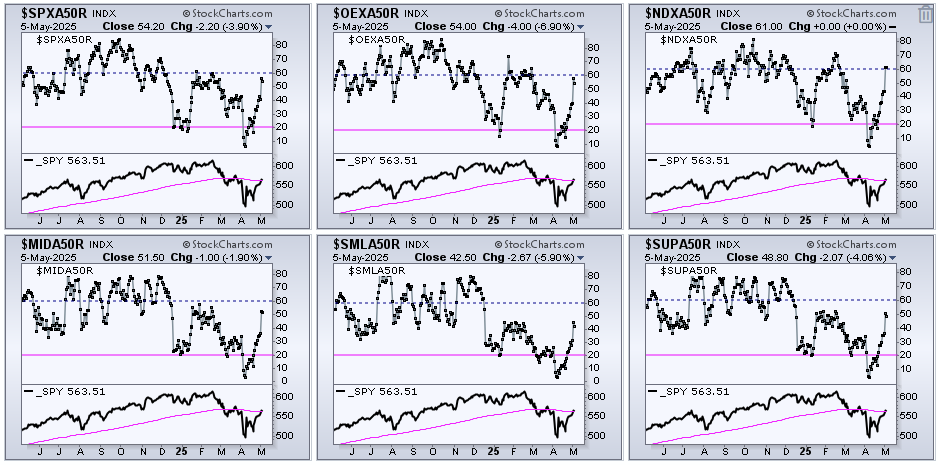

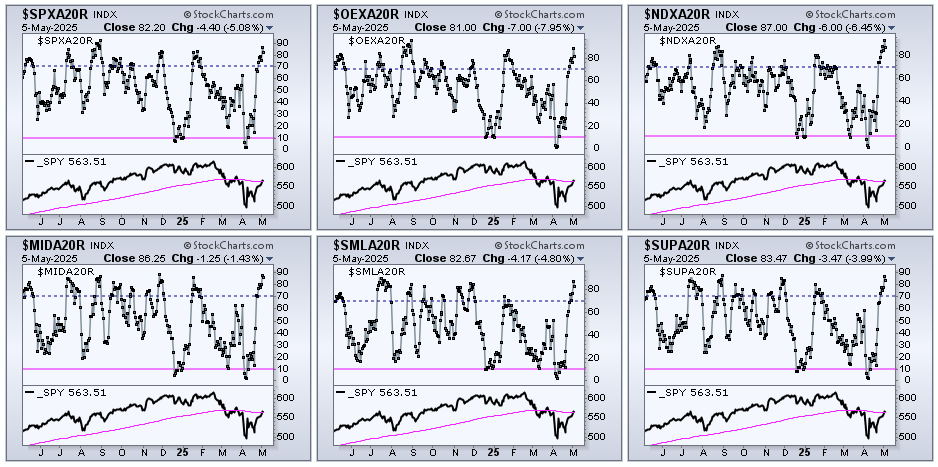

As noted in Saturday’s report, the market cup is filled half way right now. But is it half full or half empty? I think it is half empty because the long-term trend and breadth indicators show bear market and we have yet to see medium-term thrust signals from the %Above 50-day SMA indicators.

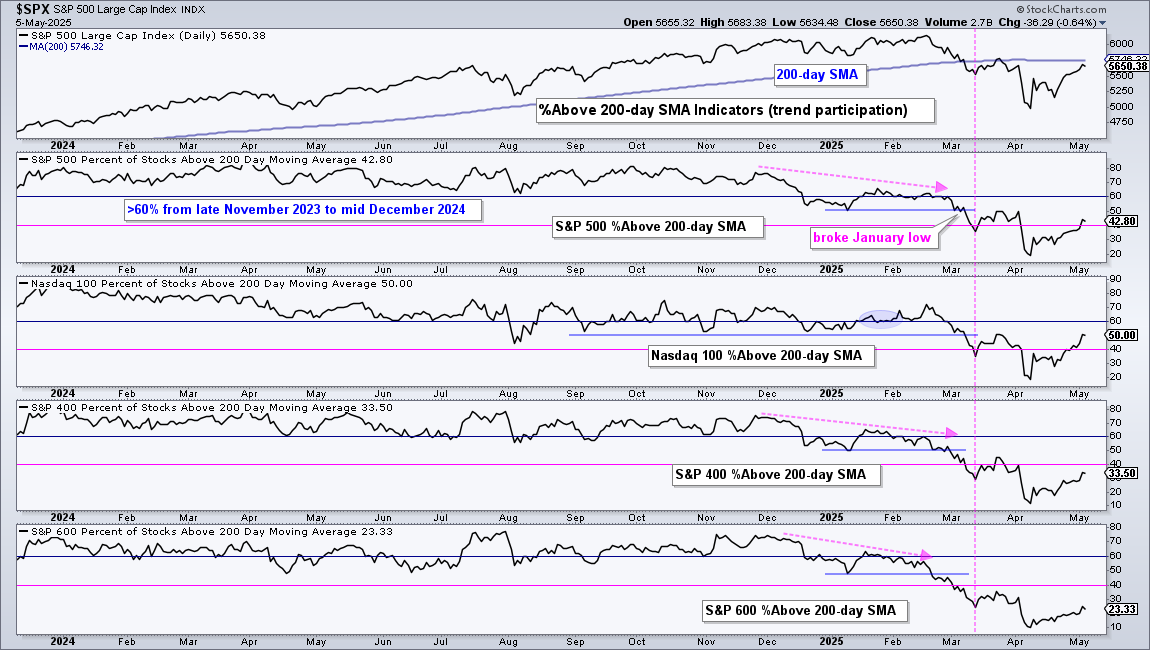

The chart below shows the %Above 200-day SMA indicators breaking down in March (pink line), becoming oversold below 20% in early April and rebounding into early May. These indicators need to exceed 60% before considering this more than a bear market bounce.

This sample is taken from an actual report coving broad

market conditions, SPY/QQQ charts and leading ETFs

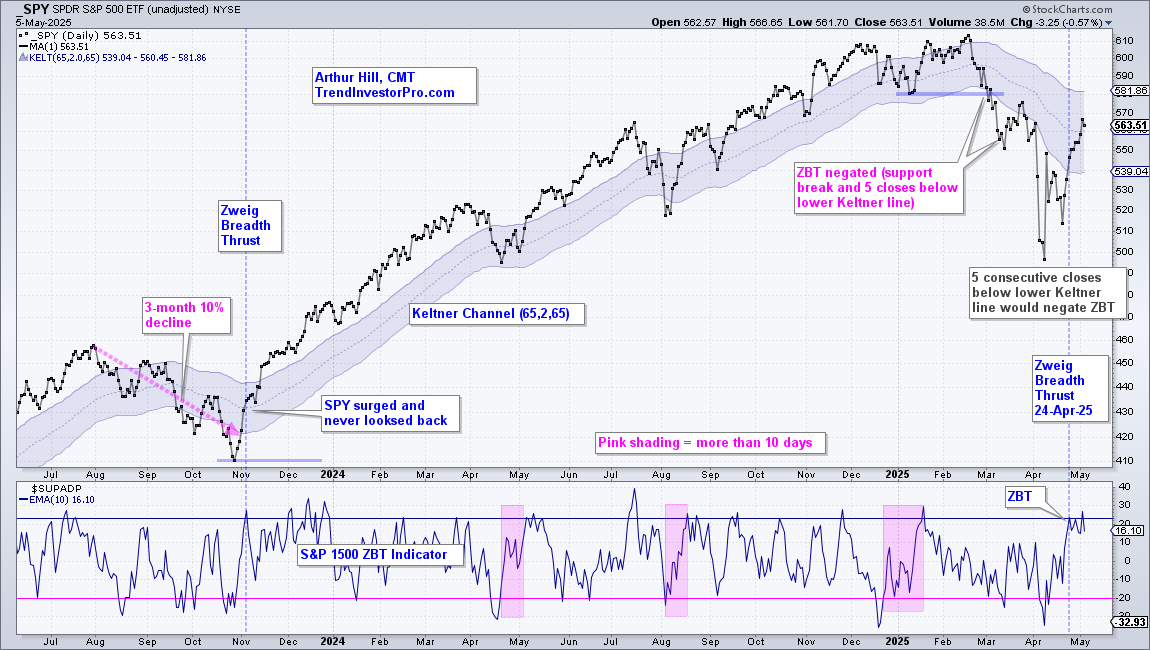

The 10-day EMA of S&P 1500 AD Percent ($SUPADP) dipped below -20% and surged above +23% within 10 days to trigger a Zweig Breadth Thrust on April 24th (bottom window). SPY (top window) moved above the upper Keltner line (65,2,65) on April 24th as well. This Zweig Breadth Thrust signal remains valid until SPY closes below the lower Keltner line for five consecutive days.

SPY and QQQ Surge to Resistance Zones

SPY broke double top support and the 200-day SMA with a sharp decline in early March. This is the break that broke the bull’s back and this signal has yet to be negated. Sine this break, the ETF plunged into early April, and then roared back into early May. It is as if April never happened. Keep in mind that March was the key month, not April. Even with the record rebound, SPY is at a resistance zone marked by the 200-day SMA, March support break, 61.8% retracement and late March high (pink shading). SPY is also short-term overbought after a 10% surge since April 22nd and RSI is in the 50-60 zone, an area that marks momentum resistance in a downtrend. Assuming we are still in a bear market and long-term downtrend, SPY is trading in an area to could mark a near-term top (end of the bear market bounce).

The next chart shows SPY with 78min bars for more granularity on the rising wedge. Notice that SPY fell 21.2% into April 7th and then surged 17.8 into May 2nd. There were also eight 5+ percent swings in April. These moves reflect above average volatility and risk.

SPY and QQQ are in a long-term downtrends and short-term overbought, which is not ideal. At worst, this is a bear market rally that could peak soon. Wedge breaks would reverse the short-term upswings. At best, SPY and QQQ are short-term extended and ripe for a rest. This means we could see a pullback or consolidation. A shallow pullback or consolidation could be positive. Let’s see how it unfolds.

This sample is taken from an actual report coving broad

market conditions, SPY/QQQ charts and leading ETFs

Tech, Semis, Housing and Trucking

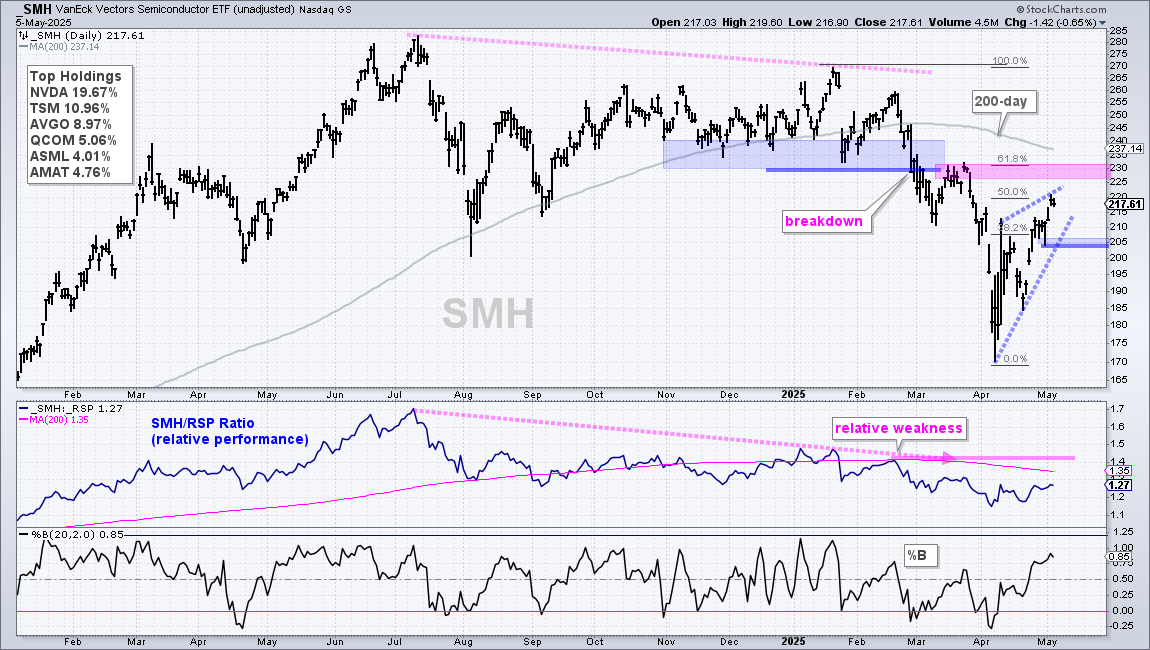

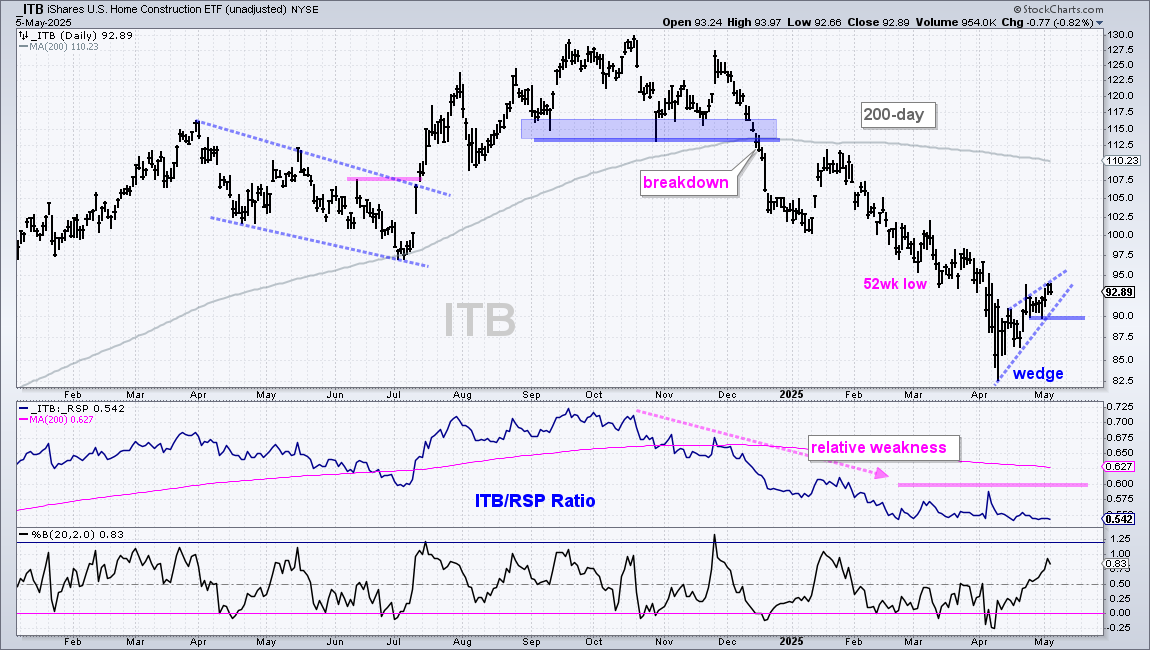

The next four charts focus on four important groups: tech, semis, housing and trucking. We want to see these groups in long-term uptrends and/or showing relative strength. They are not. Tech is the biggest sector in the S&P 500. It also represents the high beta trade (risk). Semiconductors are cyclical and an important part of the tech sector. Housing is an important barometer for the domestic economy. The trucking index is a litmus test for trade (goods entering the US). All four are in long-term downtrends and their performance bodes ill for the broader market.

The Technology SPDR (XLK) is leading over the last 10 days, but still below its 200-day SMA, which is now declining. As with SPY and QQQ, XLK is also near a moment of truth as it hits the 61.8% retracement line and nears the underside of the 200-day SMA. Broken support in the 225 area also turns into resistance. XLK is in a long-term downtrend, short-term overbought and near resistance (pink shading). This is not a bullish setup. At best, this is a wait and see situation.

The Semiconductor ETF (SMH) remains in a long-term downtrend with a 52-week low in early April and price well below the falling 200-day SMA. As with XLK, the bounce off the April low was strong, but it is still considered a counter-trend advance. One counter-trend advance will extend far enough to reverse the long-term downtrend, but the current advance has yet to extend far enough. As with many stocks and ETFs, a rising wedge formed in April and I am using last week’s low to mark support. A break below this low would reverse the rise and signal a continuation of the bigger downtrend.

The next chart shows the Home Construction ETF (ITB) breaking down in December, hitting a 52wk low in March and plunging in early April. ITB also recovered the last few weeks, but this is a counter-trend bounce because the long-term trend remains down. A rising wedge formed and a break below 90 would signal a continuation lower. Housing is an important part of the domestic economy. The downtrend and relative weakness in ITB are negatives for the broader market.

The next chart shows the DJ US Trucking Index ($DJUSTK) breaking down in late February, well before the broader market broke down in March. This index surged after the election, but gave it back in December, broke support in February hit new lows in March-April. $DJUSTK was volatile in April, but could not sustain its bounces and continues to underperform.

This sample is taken from an actual report coving broad

market conditions, SPY/QQQ charts and leading ETFs

ETFs in Uptrends and/or Showing Relative Strength

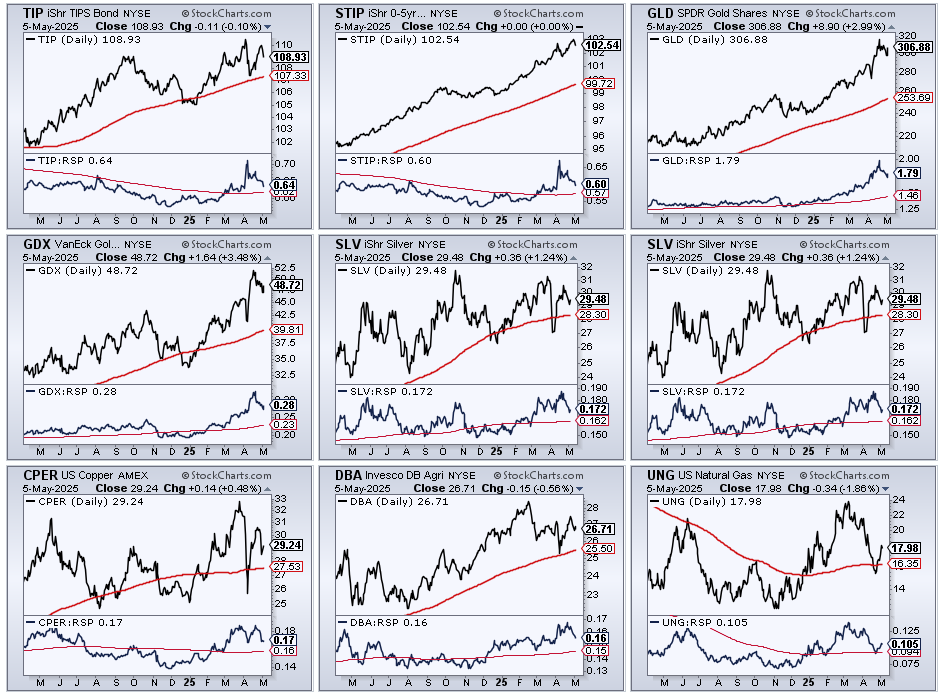

My core ETF list has 72 names with 59 equity ETFs, 4 bond ETFs, 7 commodity ETFs and 2 Crypto ETFs. I am position defensively because the weight of the evidence is bearish and most equity ETFs are in downtrends. I ran a scan to see which ones were trading above their 200-day SMAs and showing gains year-to-date. Note that SPY is down 3.85% year-to-date and QQQ is down 4.95%. Only 20 the 72 made the cut. Ten are equity ETFs, two are inflation protected bond ETFs (TIP, STIP), nine are related to commodities and one crypto (IBIT).

XLF, XLI, XLC, XLP, XLU, CIBR, KIE, ITA, IHI, IYZ, TIP, STIP, GLD, GDX, SLV, SLV, CPER, DBA, UNG, IBIT

The CandleGlance charts below show the leading bond and commodity ETFs. Note that gold, the Dollar, bonds, interest rates and stocks are likely to see extra volatility the next two days as the Fed starts its two-day meeting on Tuesday and makes its policy statement on Wednesday afternoon. I will cover gold, silver, bonds and the Dollar on Thursday, after the dust has settled.

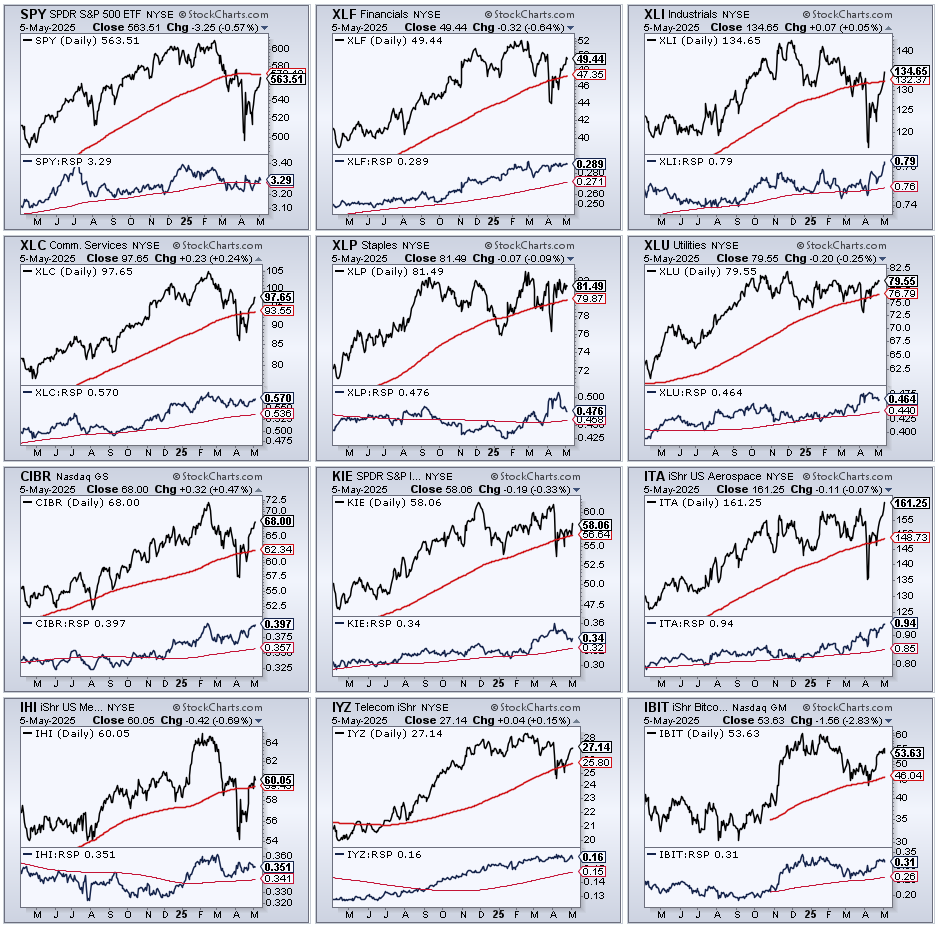

The CandleGlance charts below shows SPY, the 10 leading equity ETFs and the Bitcoin ETF (IBIT). The red lines are the 200-day SMAs for price and the price relative (XLF:RSP ratio). ETFs above their 200-day SMAs have, perhaps, some sort of uptrend. ETFs with price-relatives above their 200-day SMAs show some relative strength (or just less weakness).

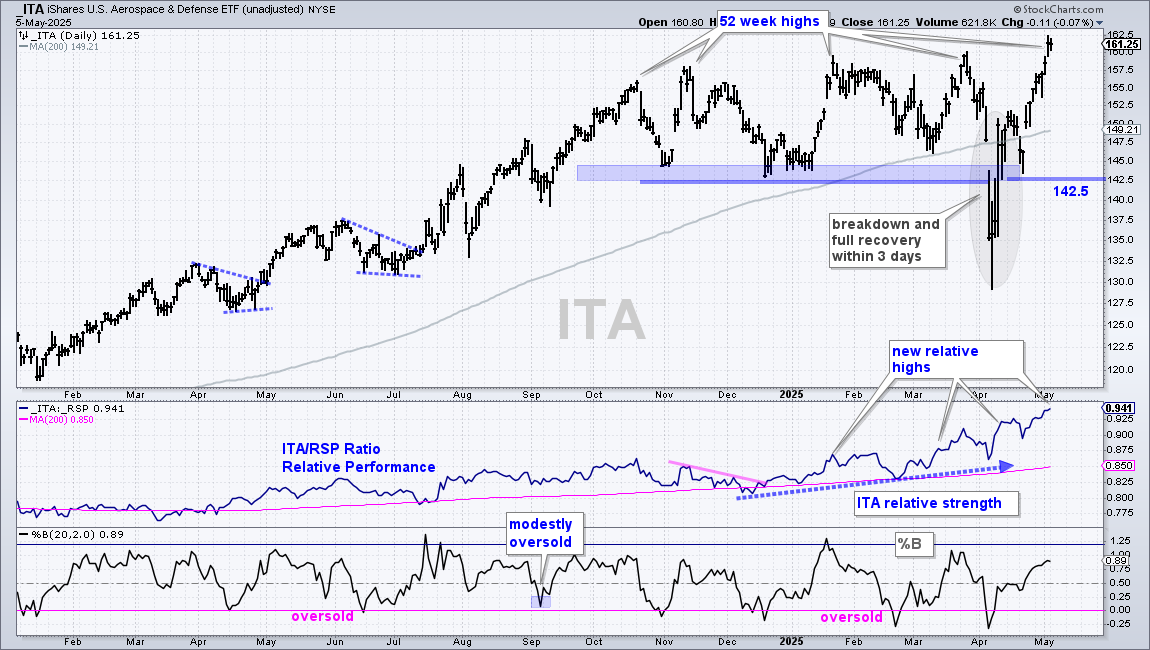

One Clear Leader (ITA)

The Aerospace & Defense ETF (ITA) is the strongest ETF in my core list because it is the only one to hit a new high in May. New highs reflect a strong and leading uptrend. In the top window, ITA was one of the first ETFs to recapture its 200-day SMA with a 3-day recovery surge (gray shading). It continued higher and hit a new high on Friday. Key support is set at 142.5. The middle window shows the price-relative (ITA/RSP ratio) hitting new highs in January, March, April and May (consistent relative strength).

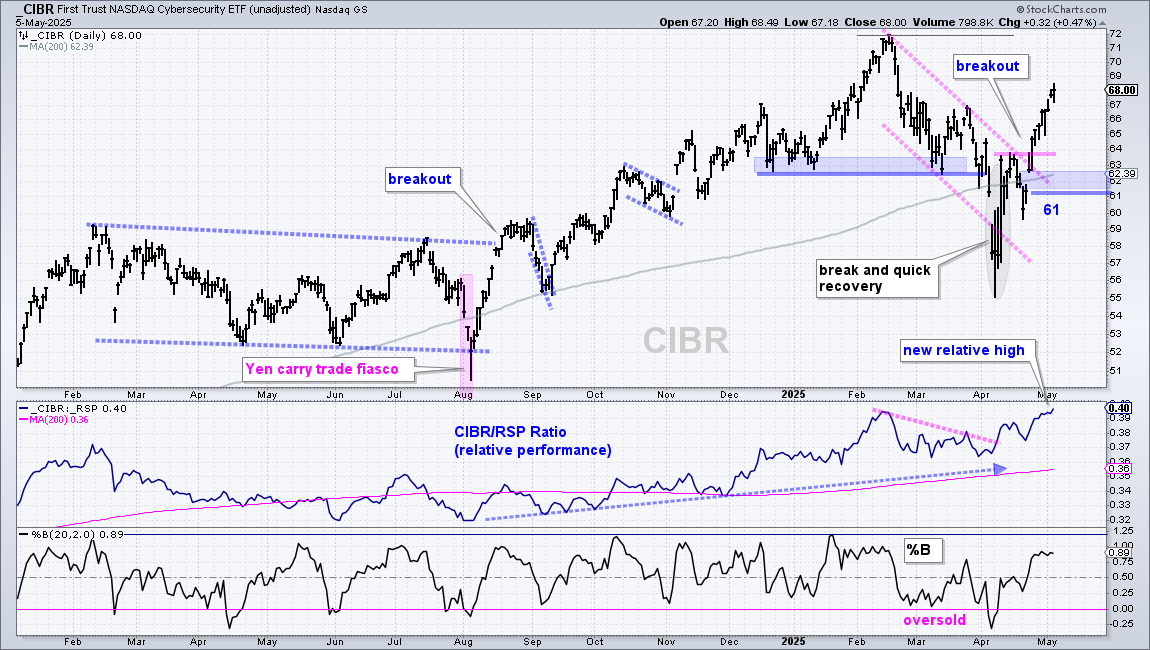

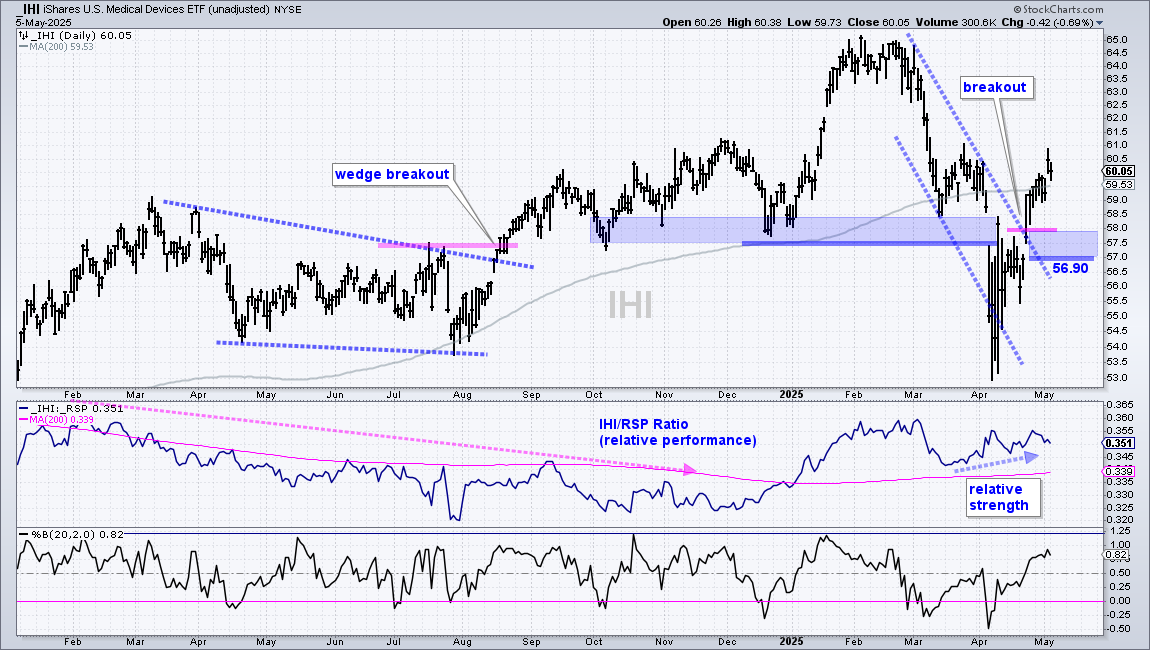

Channel Breakouts (CIBR, ARKF, IHI)

The next chart shows the Cybersecurity ETF (CIBR) with a break below the 200-day SMA in early April and a quick recovery. Cybersecurity is the strongest group within the tech sector. A falling wedge formed from mid February to mid April and CIBR broke out with a surge above 64. This breakout reversed the two month slide. The breakout zone and 200-day SMA turn support with my key level set at 61. Short-term, CIBR is overbought and ripe for a consolidation or pullback. The indicator window shows the price-relative (CIBR/RSP ratio) hitting a new high in early May as CIBR shows relative strength.

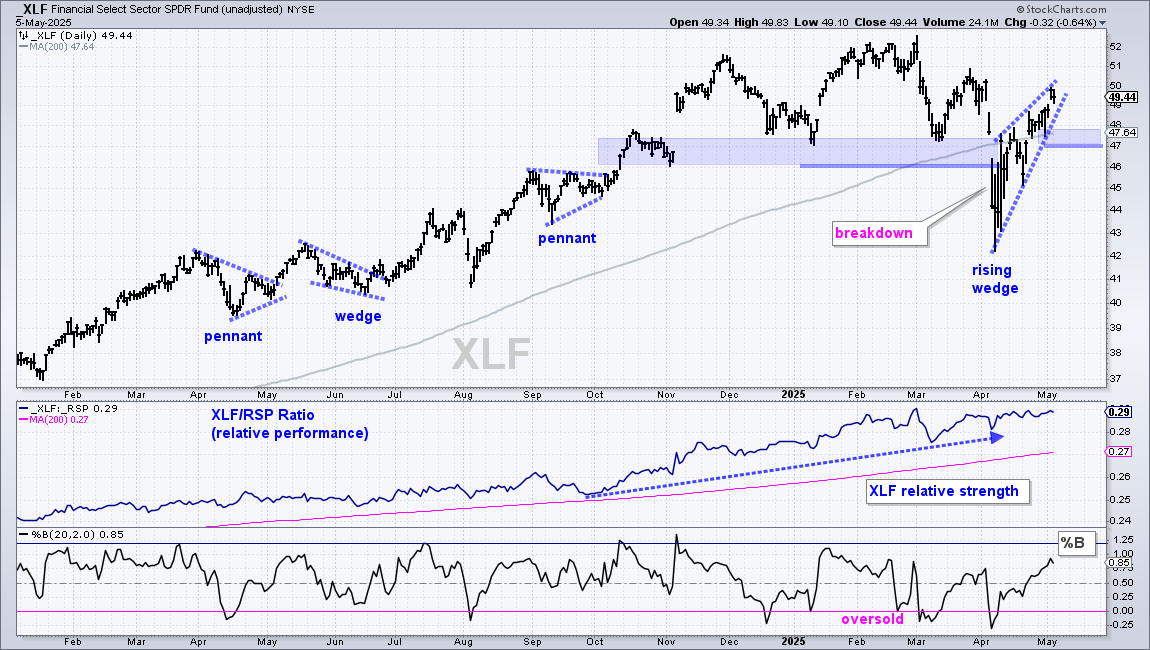

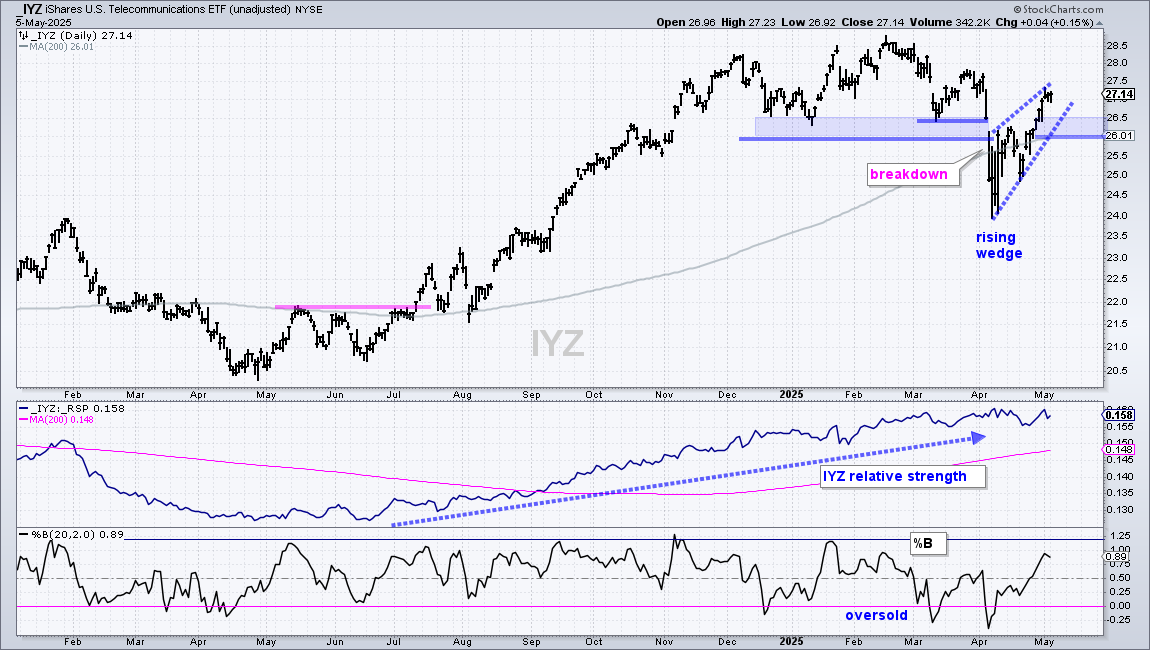

Rising Wedge Recoveries (XLF, IYZ, XLC)

The Finance SPDR (XLF) is showing relative strength with the price-relative (XLF/RSP ratio) trading new a new high (middle window). However, I think the long-term trend is down and the April bounce is a counter-trend move. XLF traded sideways from mid November to March, established support in the 46-47 area and clearly broke down in early April. The move back above 47 recaptured the support break and 200-day SMA, but looks like a sharp counter-trend bounce after the decline from 53 to 43. Wedge support is set at 47 and a break here would reverse the upswing.

I see a similar situation with the Telecom ETF (IYZ). The price-relative (IYZ/RSP ratio) is trading near a new high as IYZ shows relative strength. However, IYZ traded flat from December to March, established support in the 26-26.56 area and broke down in early April. The recovery back above 26 is impressive and IYZ is holding up better than most equity ETFs. Rising wedge support is set at 26 and a break here would reverse the short-term upswing.

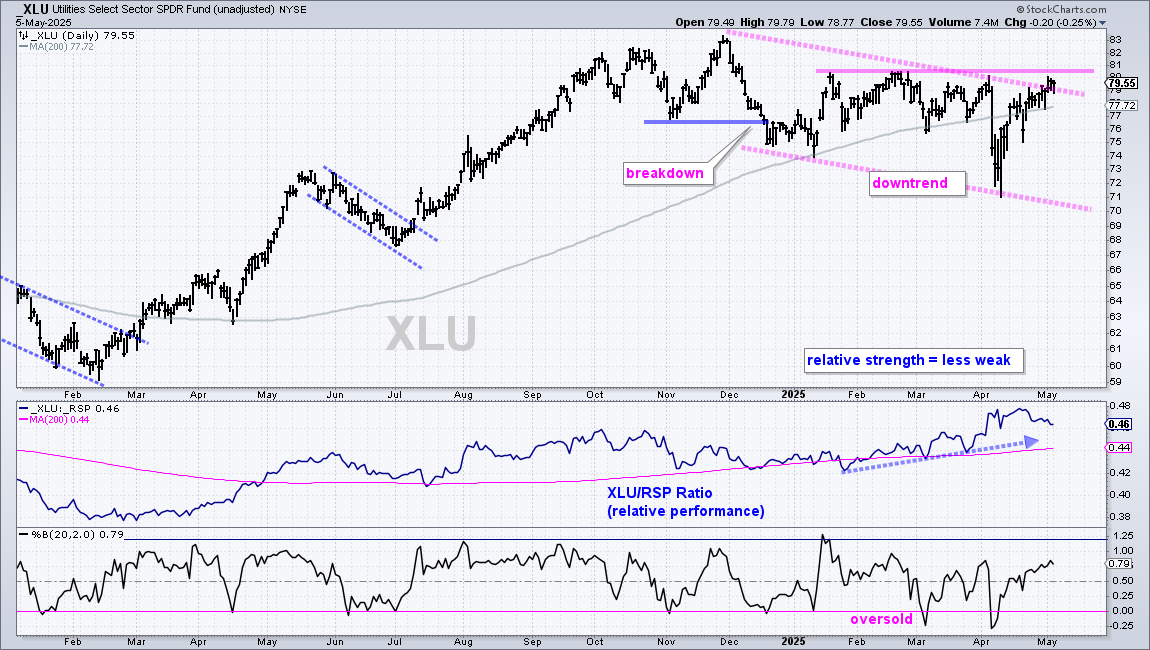

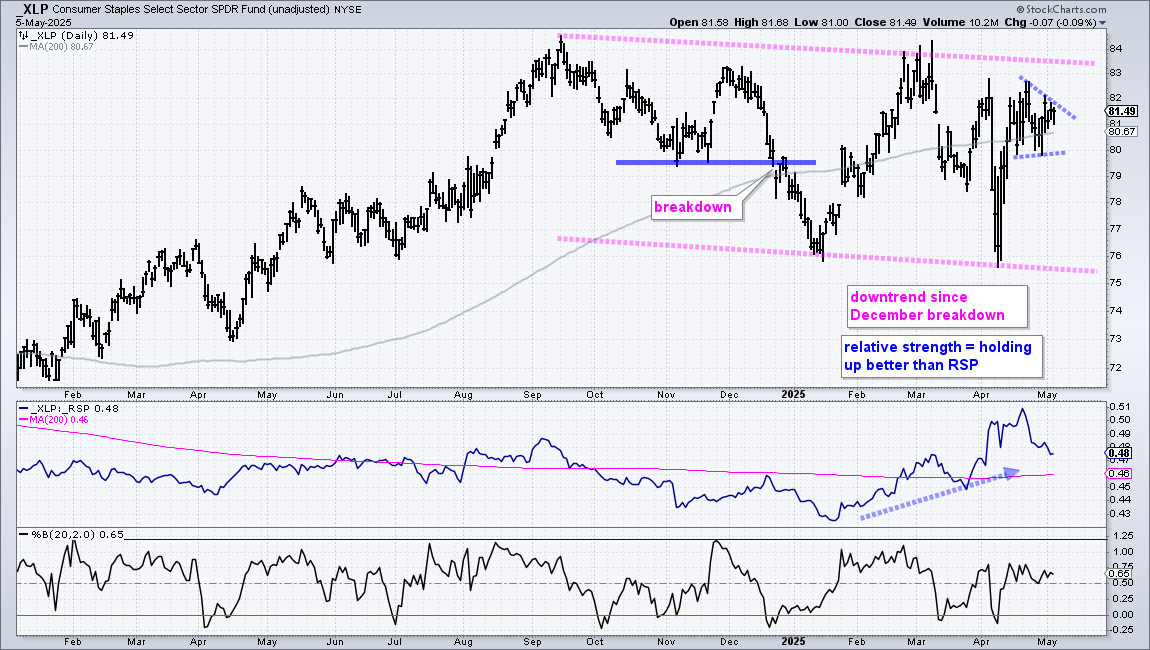

Modest Downtrends Mean Less Weakness (XLU, XLP, KIE)

The next charts show the Utilities SPDR (XLU), Consumer Staples SPDR (XLP) and Insurance ETF (KIE) in downtrends this year (pink dashed lines). However, the price-relatives (XLP/RSP ratio) are above their 200-day SMAs as they hold up better than the broader market over the last few months. This is a case where less weakness equals relative strength.

This sample is taken from an actual report coving broad

market conditions, SPY/QQQ charts and leading ETFs