What Happens to Bitcoin Should QQQ Correct?

- Arthur Hill, CMT

At the bottom of the table, the Consumer Staples SPDR (XLP) and Healthcare SPDR (XLV) have the weakest correlations to SPY (<. 10). These two may be the most immune to a correction in SPY.

Recent Reports and Videos for Premium Members

- Breakouts in ETFs related to banks, housing, retail and small-caps.

- Flag breakouts in tech ETFs and a classic setup in aero-defense.

- Breadth models remain bullish as yield spreads narrow.

- Two railroad stocks and an energy grid name with bullish setups.

- Bond vigilantes make an appearance.

- Click here to take a trial and gain full access.

Bitcoin, QQQ and Correlation

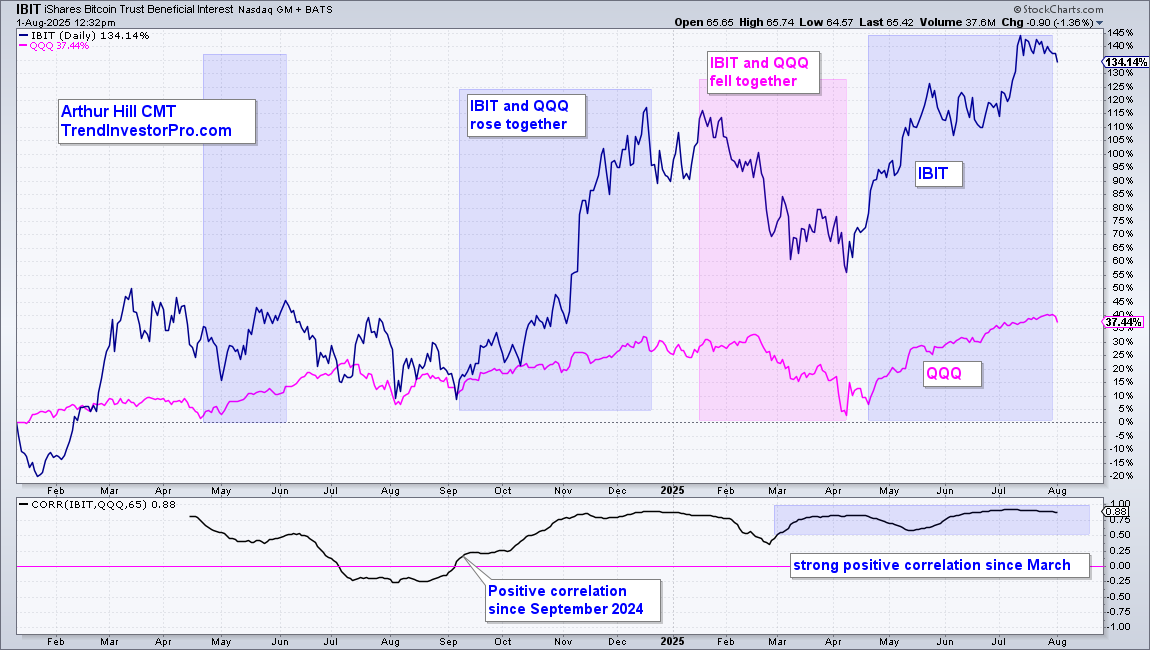

But what about equity alternatives, such as Bitcoin? For clues on Bitcoin, chartists can compare performance and use correlation analysis. The chart below shows Price Performance for the Bitcoin ETF (IBIT) in blue and QQQ in pink. IBIT is the clear winner since January 2024 with a 134% gain. QQQ is up a meager 37.5% (LOL).

The blue shading shows periods when they rose together and the pink shading shows a period when they fell together. Rising and falling together means they are positively correlated. This correlation is especially strong since late March 2025.

The indicator window quantifies this correlation using the Correlation Coefficient (65). This indicator was negative in July-August 2024, but positive since September 2024 and above .50 since March 2025. This shows a strong positive correlation the last five months, which makes sense because IBIT and QQQ are risk-on assets. As such, they will likely rise and fall together.