Weekend Video, Chart Notes and ChartBook Update

ETF Chart Notes for Saturday, February 29th

* These chart notes are also in the ChartBook PDF file (link above)

New 52-week Highs (during the week – unadjusted data)

- TLT, AGG, LQD, GLD, GDX

New 52-week Lows (during the week – unadjusted data)

- Major Index ETFs: RSP, MDY, IJR, IWM

- Sector SPDRs: XLI, XLE, XLB

- Equal-Weight Sectors: RCD, RTM, RYE, EWCO, EWRE

- Small-cap Sectors: PSCC, PSCD, PSCF, PSCM, PSCU

- Industry Groups: KBE, KRE, MJ, FCG, XES, XOP, AMLP, XME, REMX

- Other: PFF, EFA

This Week’s Leaders and Laggards:

TLT +4.91%, AGG +1.15%, LQD +0.33%, UUP -1.12%, HYG -2.59%, GLD -4.09%, PFF -4.6%, IEMG -6.16%, IBB -7.47%, XBI -8.31%

XOP -18.19%, FCG -17.55%, XES -16.74%, XLE -16.38%, MJ -15.59%, REMX -14.75%, KRE -14.63%, KBE -14.57%, GDX -14.45%, KIE -14.21%

Only three of the sixty ETFs in the core list advanced this week: AGG, TLT and LQD (bonds). Everything else declined, but the biotech ETFs (IBB and XBI) declined the least of the common stock ETFs. The banking and insurance ETFs (KRE, KBE, KIE) led the way lower with the banking ETFs hitting 52-week lows. Elsewhere, the small-cap ETFs (IWM, IJR), mid-cap ETF (MDY) and equal-weight S&P 500 ETF (RSP) hit 52-week lows. Note that I measured these based on the intra-week low.

EW S&P 500 Goes from New High to New Low

The S&P 500 EW ETF (RSP) moved from a 52-week high to a 52-week low in less than two weeks. The chart below shows the S&P 500 EW Index ($SPXEW) hitting a new high in mid February and a new low during the week. Chartists can use 52-week price channels to mark the 52-week high and low. The indicator window shows the 52-week Fast Stochastic (52,1), which measures the level of the close relative to the high-low range over the last 52 weeks. The cup is half full between 40 and 100 (upper half), and half empty between 0 and 60 (lower half). The indicator plunged below 20 this week. It may be oversold, but the cup (trend) is half empty (down).

Breadth Models Turn Bearish

As noted in Friday’s market timing report, the Index and Sector Breadth Models turned bearish this week. In addition, the High-Low Lines for the S&P 500, S&P MidCap 400 and S&P SmallCap 600 turned down and broke their 10-day EMAs. The High-Low Lines turned down because these major indexes recorded the most 52-week lows since December 2018. There was 103 new lows in the S&P 500 (20.6%)

SPY Breaks 40-week SMA

The S&P 500 SPDR (SPY) plunged below its rising 40-week SMA with the biggest weekly decline (11.16%) since October 2008. The ETF reached its August-October lows at its lowest point on Friday, but managed to close off the low. The PPO(1,40,0) moved below zero, which means SPY closed below the 40-week EMA. As the red zones on the chart shows, the 40-week EMA is often a battle zone and crosses often cluster. There were four crosses in March-April 2018 and seven crosses in October-November 2018. This means we could see a mean-reversion bounce back above the 40-week EMA (and 40-week SMA and 200-day SMA).

Just How Oversold is the S&P 500?

Even though this week’s decline did some serious technical damage to the long-term trend, the S&P 500 is seriously oversold by several metrics. The first chart shows the S&P 500 %Above 50-day EMA (!GT50SPX) moving below 5% for the eighth time in 20 years. Note that I am counting the 2008 cluster as one event and the double dips as one event. I do not expect a cluster like 2008, which is a guess, but we could very well see a double dip, as happened in August 2002, March 2009, August 2011 and December 2018.

- 21-Sep-2001 (bounce)

- 10-July-2002 (10 day cluster and no bounce)

- 5-Aug-2002 (Double Dip and bounce)

- 6-Oct-2008 (39 Day cluster and no bounce)

- 2-Mar-2009 (2% bounce)

- 5-March-2009 (no bounce)

- 9-Mar-2009 (Triple Dip and bounce)

- 4-Aug-2011 (no bounce)

- 19-Aug-2011 (Double Dip and bounce)

- 25-Aug-2015 (bounce)

- 24-Dec-2018 (bounce)

- 3-Jan-2019 (Double Dip and bounce)

- 28-Feb-2020 (???)

RSI(14) for the S&P 500 dipped below 20 for just the seventh time in 20 years. Note that RSI(14) did not exceed 20 during the financial crisis and bear market of 2008. However, RSI exceeded 20 twice during the 2001-2002 bear market and hit 20.31 in 2000. The chart below shows the dips and stats for these bounces. Note that the S&P 500 fell another 6% after RSI moved below 20 in September 2001 (911) and then surged some 13%.

- 18-Sept-2001 (6% decline and then 13% bounce)

- 22-Jul-2002 (~10% bounce)

- 8-Aug-2015 (~4-7% bounce)

- 25-Aug-2018 (~5% bounce)

- 24-Dec-2018 (~6% bounce)

- 11-Oct-2018 (~3% bounce)

- 28-Feb-2020 (???)

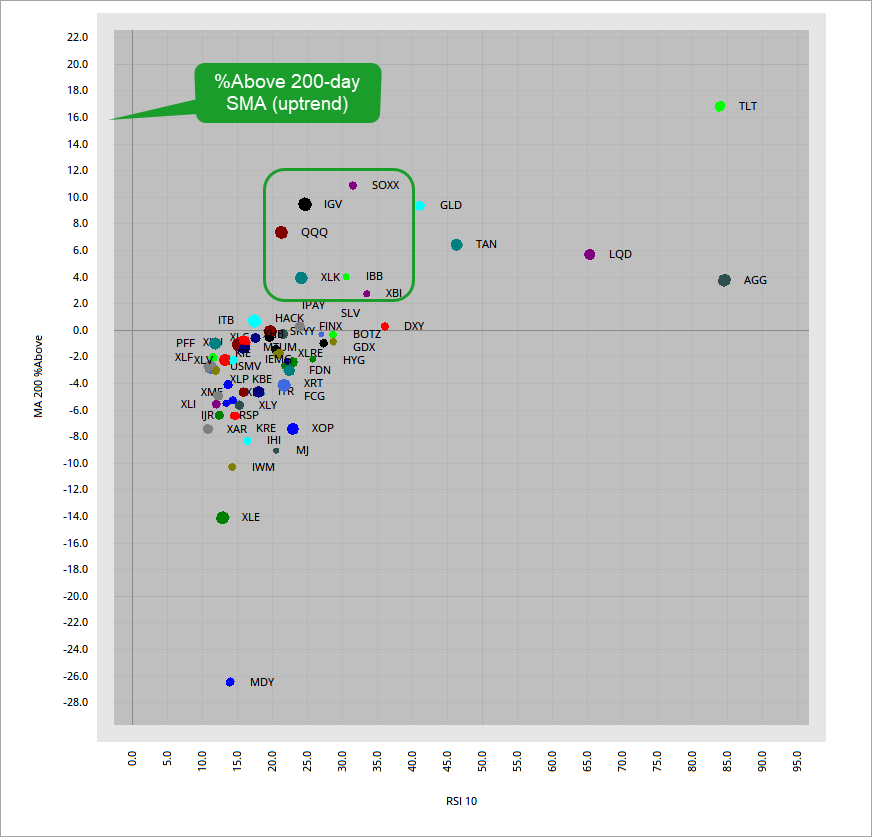

Scatter Plot: Strong Uptrend and RSI Oversold

The image below is a scatter plot with the percent above the 200-day SMA on the y-axis and RSI(10) on the x-axis. Everything above zero is above its 200-day SMA (top half). Everything on the left is oversold. The green box highlights six ETFs that caught my eye. They are in uptrends and well above their 200-day SMAs. And, RSI is either oversold or modestly oversold. Note that RSI(10) is above 30 for SOXX, IBB and XBI.

I expect an oversold bounce in the market and today’s focus will be on the ETFs that held up the best on the price charts. These are ETFs that did not overshoot their 61.8% retracements and/or held above their rising 200-day SMAs. Note that I am measuring the retracements from the October low to the February high. ETFs that retraced 61.8% corrected harder than ETFs that retraced 38.2%. ETFs that returned to the October low are weaker than ETFs that held above the October low. ETFs that broke their October lows are weaker than ETFs that held their October lows. Overall, I think ETFs that firmed near the 61.8% or 38.2% retracements held up the best.

QQQ and XLK Firm Near Key Retracements

The first two charts show the Nasdaq 100 ETF (QQQ) and Technology SPDR (XLK) closing near their 61.8% retracement zones over the last two days. Both kissed their rising 200-day SMAs on Friday’s low and closed with a fractional gain on the day. RSI is also oversold for both.

Software and Semis Hold Up Well

The next two charts shows the Software ETF (IGV) and Semiconductor ETF (SOXX) with similar setups. Both fell less than 10% last week and actually held up better than 44 of the ETFs on the core list of 60. I would even consider the Cloud Computing ETF (SKYY), Mobile Payments ETF (IPAY) and FinTech ETF (FINX) as part of this group.

Biotechs ETFs Firm Near 38.2% Retracement

The Biotech ETF (IBB) and Biotech SPDR (XBI) both moved below their 38.2% retracements on Thursday and Friday, but rebounded on Friday and even closed higher on Friday. Note that RSI(10) already moved above 30 for these two. Outside of the bond and gold ETFs, RSI(10) is above 30 for just three ETFs (IBB, XBI and SOXX). IBB seems a bit stronger because it closed near the 38.2% retracement on both days.