StockMarketTV – Breadth Expands – Tech ETFs Correct – 3 Stock Setups

- Arthur Hill, CMT

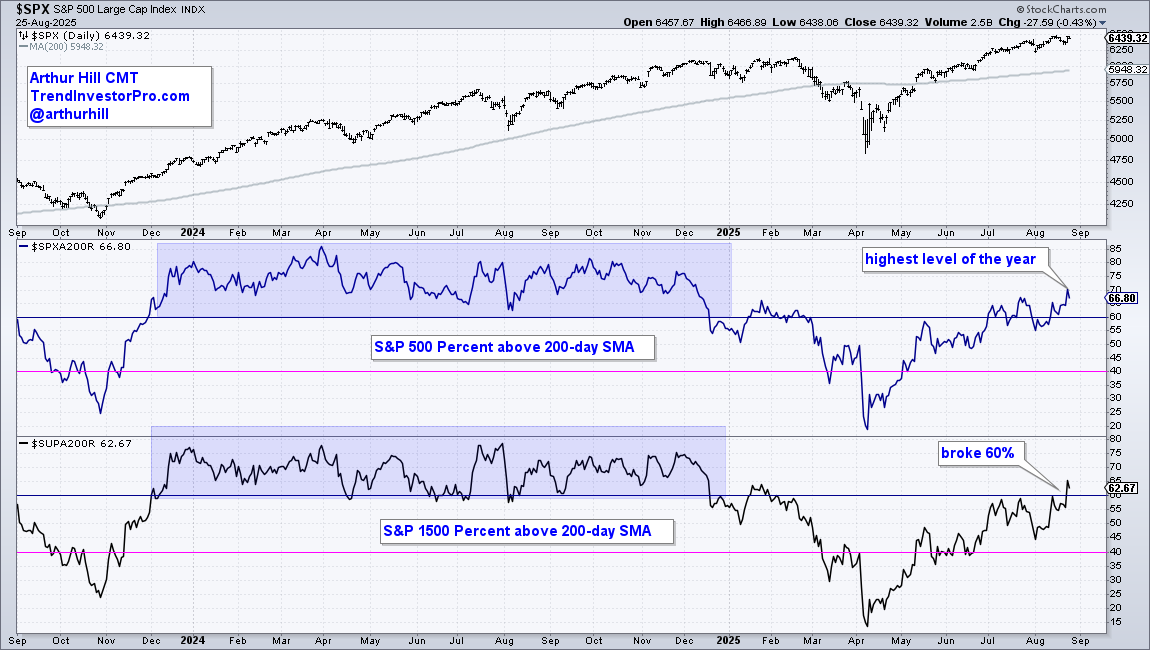

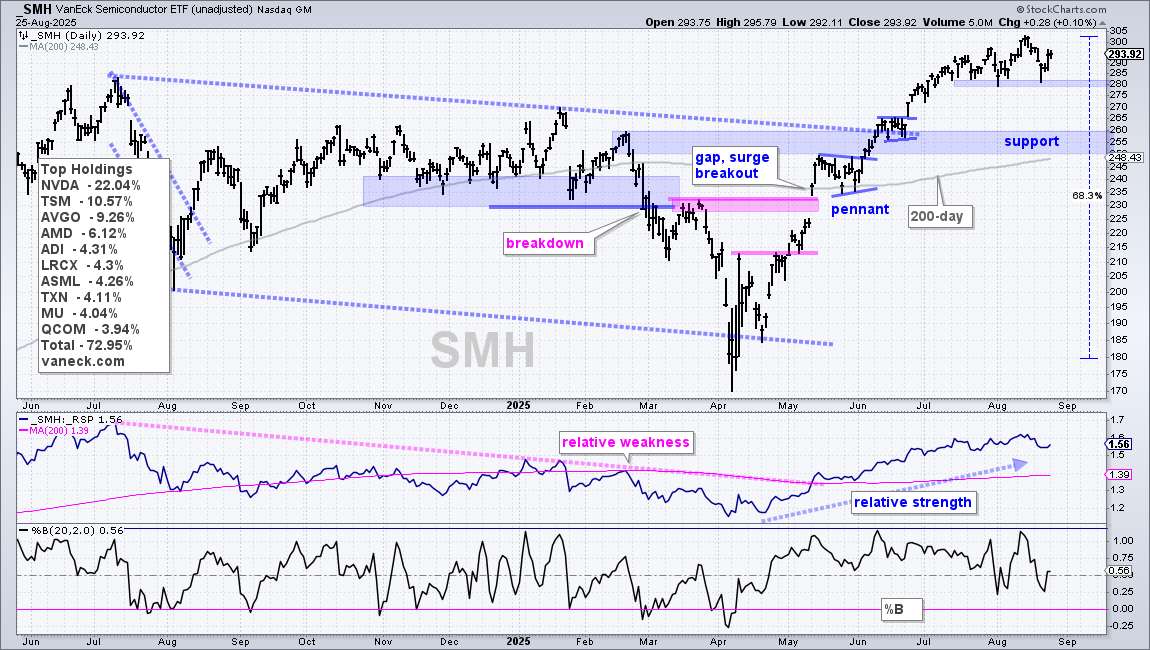

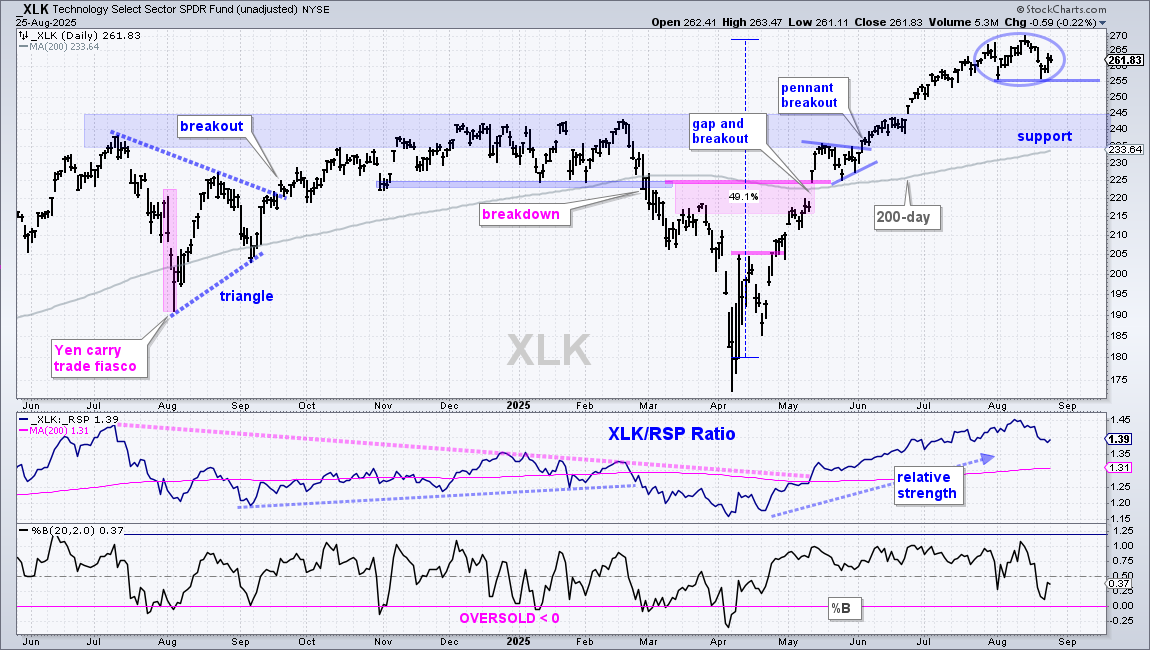

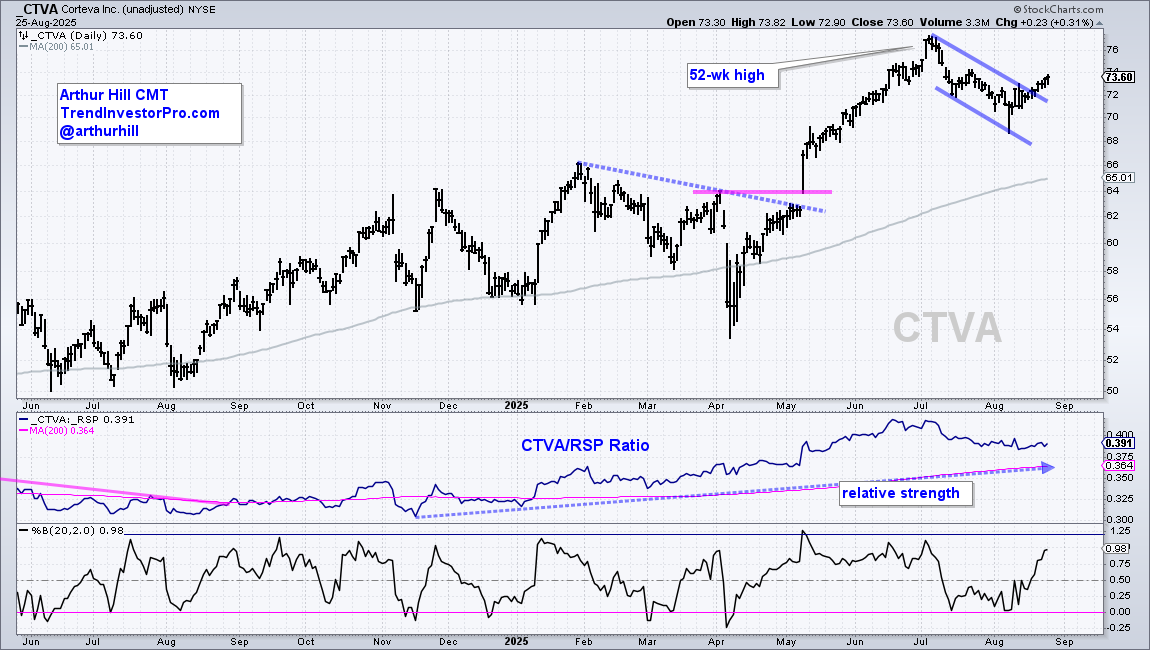

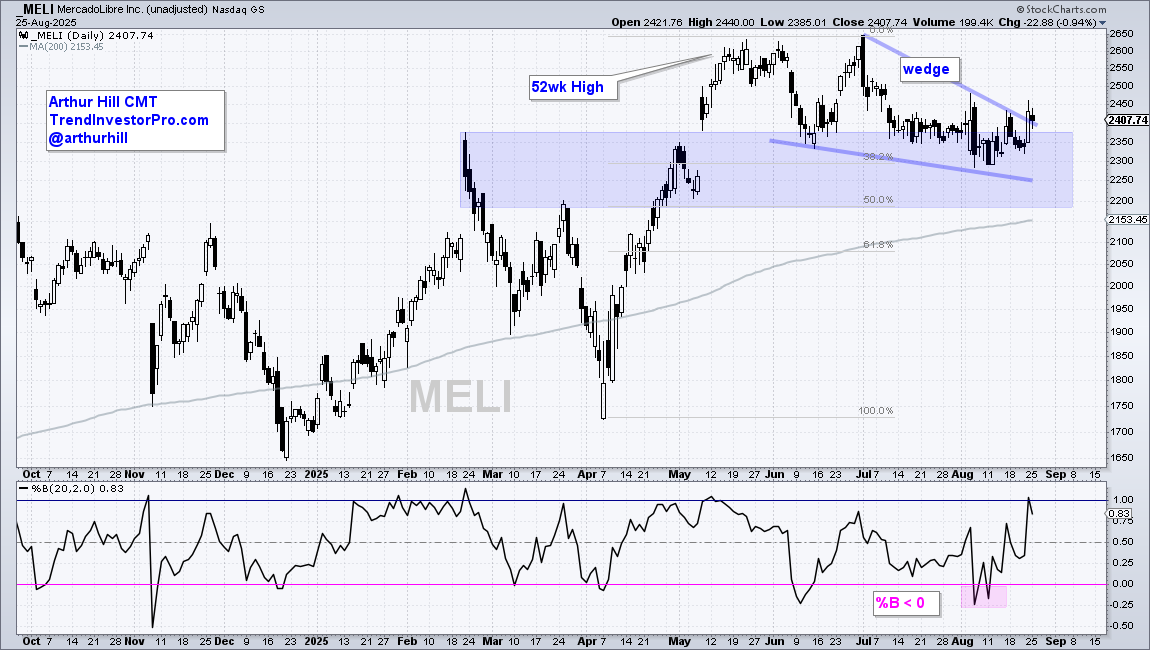

These are the charts from the StockMarketTV show on Tuesday, August 26th. Analysis starts with the long-term trends and support levels for SPY and QQQ. Upside participation expanded last week as the percentage of stocks above the 200-day surged. New highs are the next item to watch. Breadth improved as new leaders emerged and tech ETFs corrective. Watch XLK, SMH and MAGS for clues on the correction. There are also three stock setups.

Recent Reports and Videos for Premium Members

- Alphabet, Nvidia and Tesla: Analysis and Levels

- Bond ETFs Hold Breakouts as Base Metals Turn Back Up

- Four Stocks from Two Strong Groups (Industrials, Healthcare)

- Stock Market Remains Defensive as SPY Consolidates

- Click here to take a trial and gain full access.

Trend and Support for SPY

Trend and Support for QQQ

Watch High-Low Percent Next

Watch August Lows for XLK, MAGS and SMH

Three Tech ETFs with Short-term Corrections

Three Stocks with Trade Setups

Recent Reports and Videos for Premium Members

- Alphabet, Nvidia and Tesla: Analysis and Levels

- Bond ETFs Hold Breakouts as Base Metals Turn Back Up

- Four Stocks from Two Strong Groups (Industrials, Healthcare)

- Stock Market Remains Defensive as SPY Consolidates

- Click here to take a trial and gain full access.