Mag 7 Leaders/Laggards – 3 Trend Reversals – Analysis and Key Levels for Apple

- Arthur Hill, CMT

Welcome to the Chart Fix!

Mag 7 stocks powered the market higher from April to October, but sputtered since November with three breaking down on the price charts. Four of the seven, however, are still in long-term uptrends. Today’s report will start with the three laggards and then turn to Apple, which is a leader. Note that we cover Alphabet, Nvidia and Tesla in a separate report for subscribers.

- Alphabet, Apple and Telsa Outperform Broader Market

- Amazon, Meta and Microsoft are in Downtrends

- Apple Gets Oversold Bounce, Consolidates within Uptrend

Recent Reports and Videos for Premium Members

- Alphabet, Nvidia and Tesla: Analysis and Levels

- Bond ETFs Hold Breakouts as Base Metals Turn Back Up

- Four Stocks from Two Strong Groups (Industrials, Healthcare)

- Stock Market Remains Defensive as SPY Consolidates

- Click here to take a trial and gain full access.

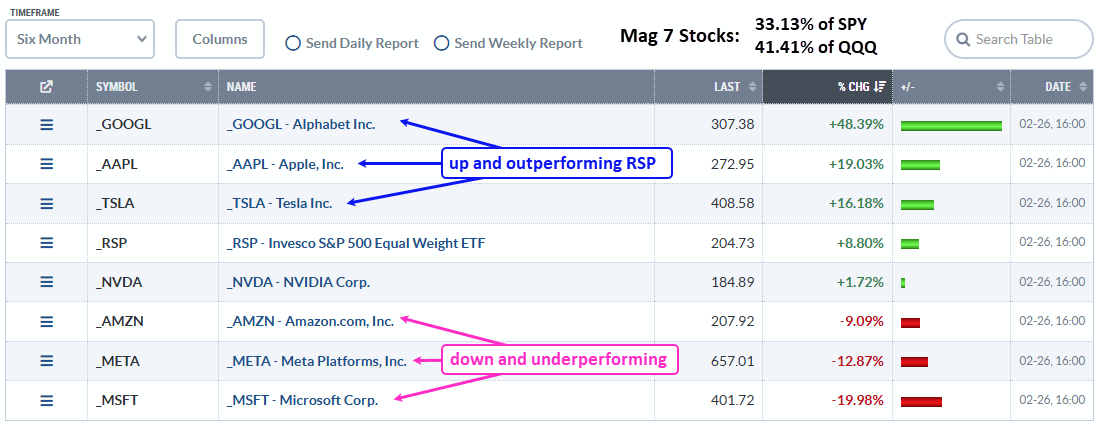

Mag 7 Leaders and Laggards

The table below shows the performance for the Mag 7 and the S&P 500 EW ETF (RSP) over the last six months. Alphabet, Apple and Tesla are the three leaders because they have the largest gains and are outperforming RSP, which is up 8.80%. Nvidia also sports a gain, but is underperforming the broad-based S&P 500 EW ETF. Amazon, Meta Platforms and Microsoft are the laggards because they are down over the last six months.

Mag 7 stocks are important when considering performance for the S&P 500 SPDR (SPY) and Nasdaq 100 ETF (QQQ). These seven stocks account for 33% of SPY and 41% of QQQ. SPY and QQQ can plod along as long as four of the seven hold up. The trouble starts when/if these leaders break down.

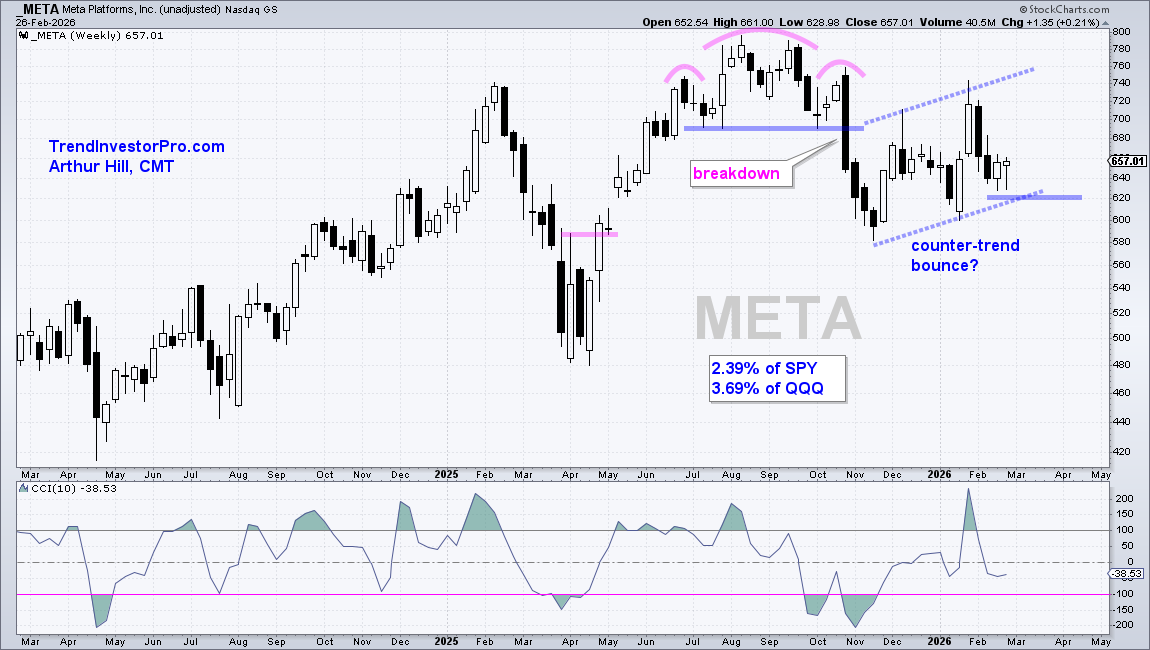

Breakdown Parade: Meta, Microsoft and then Amazon

The weekly candlestick chart shows META with a head-and-shoulders top and neckline break in October. META worked its way higher after the breakdown, but this looks like a counter-trend bounce. After a breakdown and sharp decline, a rising channel is typically a bearish continuation pattern, kind of like a rising flag. Currently in 640 area, the stock is at a make or break level as it trades just above channel support. A break below 620 would signal a continuation lower.

The next chart shows Amazon breaking a well-defined support zone (blue shading) with the February plunge. This break reversed the long-term uptrend. AMZN is currently consolidating below this support break, which turns first resistance (pink shading). A breakout at 220 would negate this trend reversal and call for a re-evaluation.

Apple Gets Oversold Bounce and Consolidates within Uptrend

The weekly chart below shows Apple (AAPL) in a long-term uptrend with a new high in early December and currently within 5% of this high. A triangle formed as price consolidated in a narrowing range. Typically, a triangle within an uptrend is a bullish continuation pattern, which means an upside breakout at 280 would signal a continuation of the long-term uptrend. Sometimes, however, prices break the other way and the trend reverses, as in March 2025. Thus, watch 255 on the downside.

The indicator window shows weekly CCI(10), which is used to identify oversold conditions within an uptrend. CCI became oversold with a move below -100 in January and then emerged from oversold levels as Apple turned back up. This was a short-term bullish signal. Note that I only look for oversold conditions during bull markets and long-term uptrends/.

Recent Reports and Videos for Premium Members

- Alphabet, Nvidia and Tesla: Analysis and Levels

- Bond ETFs Hold Breakouts as Base Metals Turn Back Up

- Four Stocks from Two Strong Groups (Industrials, Healthcare)

- Stock Market Remains Defensive as SPY Consolidates

- Click here to take a trial and gain full access.