8 Trend-Following Indicators – Impulse/In-State Signals -Thresholds – Combining with Momentum (Premium)

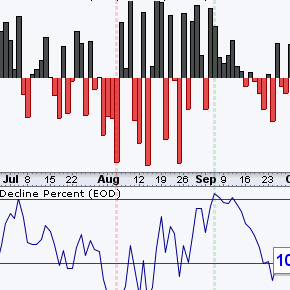

This report/video covers eight trend-following indicators: BBands, Keltner Channels, Donchian Channels, StochClose, %Difference betw SMAs, ROC of SMA, CCI-Close and eSlope. We show how to reduce whipsaws with smoothing and signal thresholds. Each indicator is explained with chart examples. These samples include good trades and bad trades because whipsaws are guaranteed.