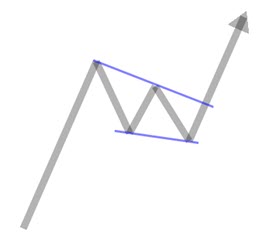

Testing the Zweig Breadth Thrust using other Indexes – Adding Beta and Diversification to the Strategy

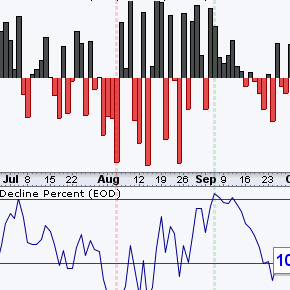

Today’s report will put the Zweig Breadth Thrust indicators for the various indexes to the test. My default breadth index is the S&P 1500 because it covers all bases and represents a broad swath of the US stock market. We can also generate ZBT signals using