Bear Market Participation Broadens

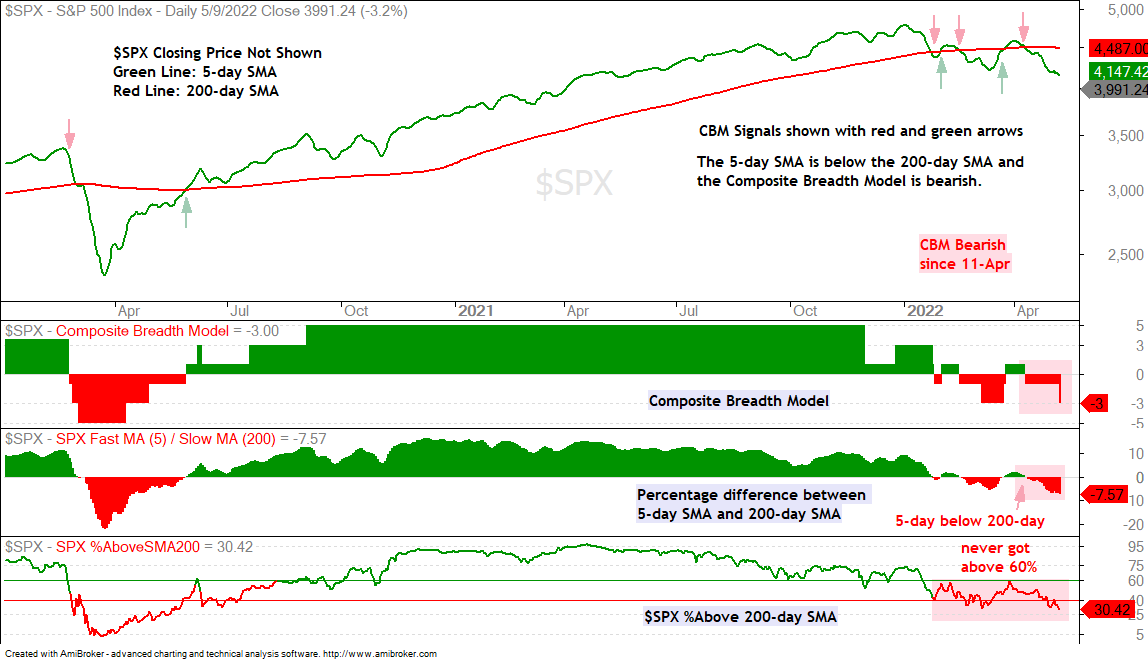

The ugly just got uglier. The Composite Breadth Model turned bearish on April 11th and the 5-day SMA for the S&P 500 crossed below the 200-day SMA that same day. At worst, this signaled that a bear market was underway and most stocks would succumb to selling pressure. At best, this signaled that risk in the stock market was above average and it would be difficult to make money on the long side.

The market continues to deteriorate as the Composite Breadth Model moved from -1 to -3. This is because the S&P 500 Trend Model Turned bearish on Monday. Just 30.4% of S&P 500 stocks are above their 200-day SMAs and the 5-day SMA is 7.6% below the 200-day SMA. Bearish outcomes are more likely when the S&P 500 is below its 200-day SMA and this is the case right now.

Some defensive group ETFs are holding up better than the broader market. These include the Consumer Staples SPDR (XLP), Food & Beverage ETF (PBJ), Utilities SPDR (XLU) and Dividend ETF (DVY). Note, however, that all four of these ETFs are down over the last four weeks. They are holding up better because they are down less, but they are not immune to broad market selling pressure. There are few places to hide right now. Even industrial metals were hit hard the last four weeks.

Going to Take a While

We need a trend changing event, a major upside breakout and/or a positive turn in the Composite Breadth Model to trade the long side for most stock-related ETFs. As far as short-term bullish setups within a bigger uptrend, we would need to wait for the trend-changing event and then look for tradable pullbacks. This will not happen overnight or in a few days. Truth be told, I do not know how long it will take or when it will happen. We are simply in a bear market until its is proven otherwise.

About the ETF Trends, Patterns and Setups Report

This report contains discretionary chart analysis based on my interpretation of the price charts. This is different from the fully systematic approach in the Trend Composite strategy series. In this ETF Trends, Patterns and Setups report, I am looking for leading uptrends and tradable setups within these uptrends. While I use indicators to help define the trend and identify oversold conditions within uptrends, the assessments are mostly based on price action and the price chart (higher highs, higher lows, patterns in play). Sometimes the chart assessment can be at odds with the indicators.

This Week's Scheduling

- Wednesday – 11 May: Market-ETF Video and Market Regime Update

- Thursday – 12 May: Market-ETF Report and Signal-Rank Table Update

Only 5 ETFs are Positive the last 15 Days

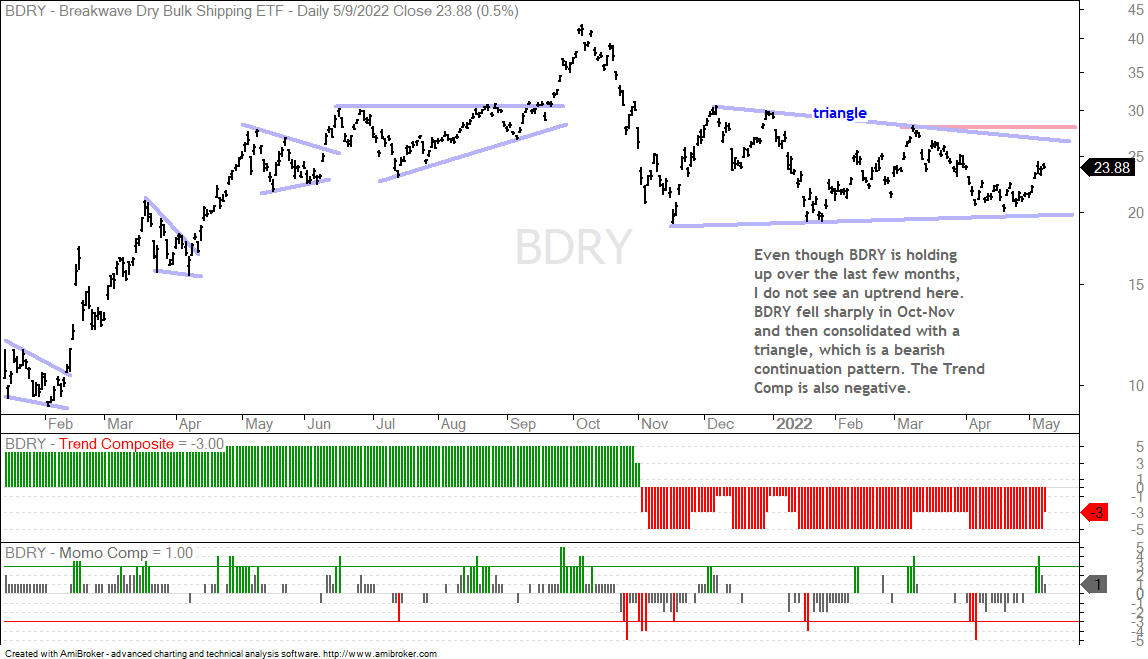

Selling pressure continues to intensify and spread. Of the 274 ETFs in the Master List, only five are positive over the last three weeks. They are the Dry Bulk Shipping ETF (BDRY), the Dollar Bullish ETF (UUP), the Home Construction ETF (ITB), the Global Carbon ETF (KRBN) and the Homebuilders ETF (XHB). Even the energy related ETFs were hit with selling pressure recently. It is rare to see pretty much everything decline (stocks, bonds, commodities, gold and non-Dollar currencies).

You can learn more about my chart strategy in this article covering the different timeframes, chart settings, StochClose, RSI and StochRSI.

You can learn more about exit strategies in this post,

which includes a video and charting options for everyone.

Copper Breaks Down as DBB Holds Out

The DB Base Metals ETF (DBB) plunged the last four weeks, but the Trend Composite remains positive (+1). The Copper ETF (CPER) also plunged and its Trend Composite turned negative on April 29th. CPER is following cash copper prices ($COPPER), which also broke below their February lows. DBB is equal parts (thirds) copper, aluminum and zinc. Aluminum broke below its February lows, but zinc remains above, even though it fell 19%. The selling pressure in industrial commodities could be related to demand destruction as stocks fall and the economic outlook dims. Whatever the reason, DBB is on the verge of turning long-term bearish and CPER has turned long-term bearish. Both are short-term oversold and ripe for bounces.

The Momentum Composite aggregates signals in five momentum-type indicators to identify short-term overbought and oversold conditions. This indicator is part of the TIP Indicator Edge Plugin for StockCharts ACP

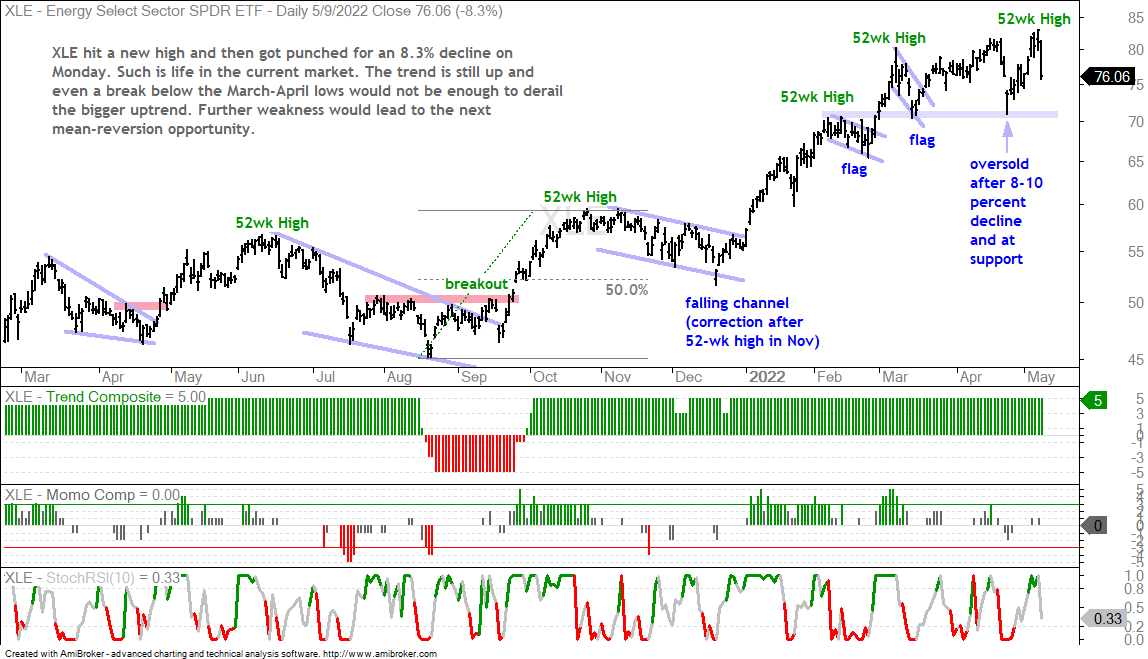

Energy-Related ETFs Get Hit

The Energy SPDR (XLE), Oil & Gas Exploration & Production ETF (XOP) and Natural Gas ETF (FCG) were hit with selling pressure the last two to three days and fell sharply. These three remain above their late April lows and are holding up better than the broader market. They are, however, still stock-related ETFs and still part of the economy. The Oil & Gas Equipment & Services ETF (XES), which is perhaps the most sensitive of the group, broke its late April low and became oversold. XES is also entering a potential reversal zone.

Market Notes to Consider

ETFs that are holding up with relatively shallow pullbacks after new highs: XLP, PBJ, XLU, IFRA, DVY, XME

ETFs that were hit hard the last few weeks, but are still Above their February Lows: XLB, XLV, PPA, ITA, IHF, MOO. MOO is only one with a positive Trend Composite.

Sectors with New Low for the Year: XLK, XLRE

Sectors with 52-Week Lows: XLY, XLF, XLI, XLC

The EW Consumer Discretionary ETF (RCD) and the Retail SPDR (XRT) hit 52-week lows.

Trend Composite Downtrend Signals within last 10 Days: XLB, COPX, PPA, ITA, XLV, XLRE, KIE, IHF, CPER, URA, SLV, JO

Tech-Related ETFs with 52-week Lows: SKYY, CIBR, FINX, FDN, IPAY, IGN, IGV

SOXX is just above its May 2021 low, but still in a downtrend overall.

Prior Report

Thursday’s Report (here) covered the following:

- Long-term Downtrend, Short-term Downswing with Resistance (SPY, QQQ)

- Going to Take a While

- Consolidations and Ranges After Sharp Declines (IWM)

- New Lows in Several Tech-Related ETFs (SKYY)

- Trading Against the Trend is Difficult (SOXX, IGV)

- Metals and Copper ETFs Establish Short-term Resistance (DBB, CPER, COPX)

- GLD Hits Potential Reversal Zone (plus SLV)

- Three Stock-Related ETFs with Wide Ranging Uptrends (PPA, XLV, IHF)

You can learn more about my chart strategy in this article covering the different timeframes, chart settings, StochClose, RSI and StochRSI.