Strength in the US stock market is broad-based with 25 of the 46 (53%) equity-related ETFs hitting new highs over the last five days (including EFA). Of the 21 ETFs that did not hit new highs, several led the stock market over the last two weeks with big counter-trend bounces. Four energy-related ETFs were up double digits the last 11 days and XLE (+5.83%) is the leading sector over this time period.

Among the ETFs in uptrends, many are extended after big advances and I consider them to be in the trend monitoring stage. They are in clear uptrends after big breakouts and strong advances, but they are perhaps a little too extended for new positions. The S&P 500 SPDR, which serves as the benchmark, is up 10.95% since early October (54 days) and 3.24% the last 11 days. In fact, 25 of the 60 core ETFs are up more than 3% the last 11 days and 28 are up more than 9% the last 54 days. Wow, like shooting fish in a barrel.

The trend monitoring stage is when we simply monitor the existing trend and wait for the next setup to materialize. I do not know when the next setup will form and it is certainly possible that stocks continue higher into early January. Seasonal patterns remain bullish, the tape is clearly bullish and the Fed is playing Santa.

Holiday Scheduling

The NYSE and Nasdaq will close at 1PM ET on December 24th (Tuesday) and close completely on December 25 (Wednesday). Volume levels will be light next week and I do not expect much change in the overall patterns at work. This is a good time for all of us to spend some time with friends, family and loved ones. Next week TrendInvestorPro will only publish on Friday (December 27th). I will publish a condensed version of the ETF Grouping and Ranking Report, update the ChartBook and provide a video that day. Merry Christmas!!

ETFs to Watch

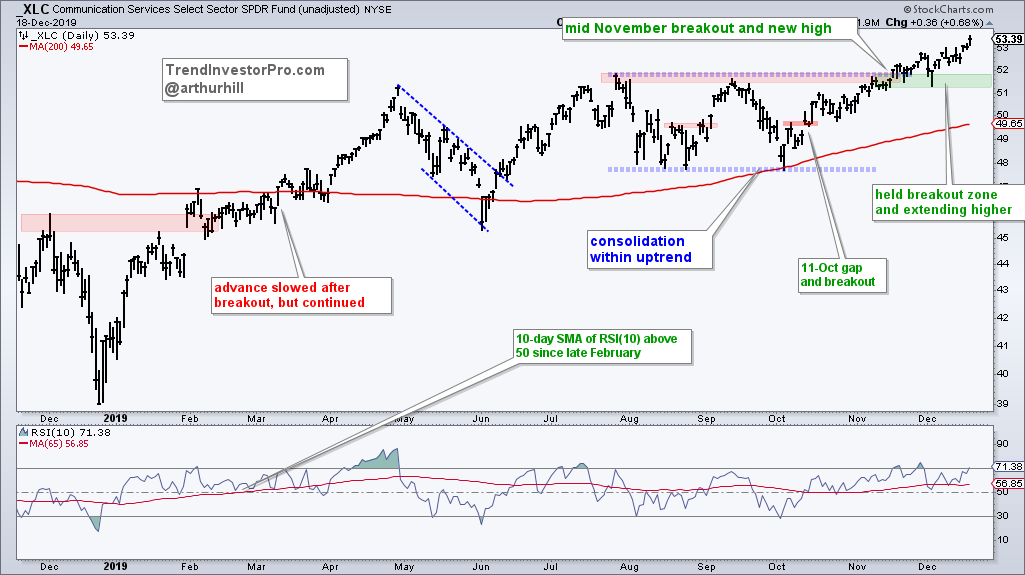

- The Communication Services SPDR (XLC) extended on its breakout with gains the last two weeks.

- The Aerospace & Defense ETF (ITA) fell the last four weeks and RSI moved below 30 to become oversold.

- The Real Estate SPDR (XLRE) is lagging overall, but still in an uptrend as RSI became oversold (<30).

- The Gold SPDR (GLD) and Gold Miners ETF (GDX) remain with falling wedges and both are near resistance.

- The Dollar Bullish ETF (UUP) could be forming a triangle within a bigger uptrend as it trades near support from the prior low and 50% retracement.

What to know more about the methodology behind the ETF grouping and ranking? Click here for an article with lots of chart examples and a video.

ETF Grouping and Ranking

1) Leading Gainer, 52-week High and Overextended

XLV, IBB, IHF, XBI

2) October Breakout, Strong Extension and 52-week High

SPY, QQQ, XLK, XLF, SOXX, KBE, KRE, EFA, BOTZ, IEMG

3) Early November Breadth, Modest Extension and 52-week High

IJR, IWM, MDY, RSP, XLB, IHI, XLC

4) Tortoise Uptrend and 52-week High (or near)

KIE, VIG, USMV, XLP, HYG

5) Wedge Breakout and Holding Breakout

IGV, HACK, IPAY, FINX, SKYY, FDN

6) Recent Breakout and Reversals

MTUM, XLY, XRT, XME, TAN, PFF, XLU, LQD

7) Uptrends, but Lagging and Stalling (3-8 weeks)

XLI, REM, ITB, XHB, ITA

8) Peaked in October and Correcting

XLRE, IYR, UUP

9) Peaked in September with Falling Wedges

GDX, GLD, SLV, TLT, AGG

10) Downtrends of Some Sort

XLE, XOP, XES, FCG, AMLP, REMX, MJ

1) Leading Gainer, 52-week High and Overextended

XLV, IBB, IHF, XBI

We will start out with the leading gainers over the last 54 days (since early October). The Biotech ETF (IBB), Biotech SPDR (XBI) and Healthcare Providers ETF (IHF) are up over 20% and trading near new highs. The combination of new highs and biggest advances make them the leaders. The Healthcare SPDR (XLV) is the leading sector with a 16% gain and new high this week. All four are clearly in long-term uptrends, but quite extended after big moves and ripe for a rest. IHF actually rested with a pennant and broke out of the pennant this week.

2) October Breakout, Strong Extension and 52-week High

SPY, QQQ, XLK, XLF, SOXX, KBE, KRE, EFA, BOTZ, IEMG

The next group of ETFs broke out in early October and moved higher with strong extensions. These ETFs also recorded new highs recently and are clearly leading the broader market. They are up from 8.4% (EFA) to 18.4% (SOXX) the last 54 trading days.

The chart below shows QQQ with the early October breakout and strong extension above 209. QQQ pulled back for three days in early December and did not come close to the breakout zone (195). The ability to hold ABOVE the breakout zone showed limited selling pressure and relative chart strength. QQQ then quickly resumed its advance with another move to new highs. Admittedly, the move since early October is getting a little long in tooth (overextended), but there are no signs of selling pressure as the bulls keep apply pressure.

The Semiconductor ETF (SOXX) broke out in late October, pulled back with a bull flag and extended higher with a sharp advance the last three weeks. The top of the flag marks a broken resistance zone that could turn into support should SOXX pull back.

These ETFs are all in uptrends, but they are up sharply since early October and even since early December. These advances show no signs of letting up though and pullbacks could be minimal until early next year.

3) Early November Breadth, Modest Extension and New High

IJR, IWM, MDY, RSP, XLB, IHI, XLC

The next group of ETFs are in strong uptrends, but they are not quite as strong as those in groups 1 and 2. Yes, I am splitting hairs because the ETFs in group 3 are also hitting 52-week highs. They broke out a little later (early November versus late October) and their post-breakout extensions are not as strong. For example, QQQ is around 7% above its breakout zone, while IWM is around 4% above its breakout zone.

Speaking of IWM, the ETF broke out of a big falling channel in early November. The breakout did not immediately extend as IWM stalled around the 158 area in mid November and then took off the last four weeks. The breakout held and the ETF hit a new high on Wednesday. What could be more bullish?

The Materials SPDR (XLB) broke out of a triangle consolidation and hit a new high in early November. Even though the ETF fell back with a falling flag, the breakout zone held for the most part. More importantly, XLB broke out of its flag with a gap nine days ago and this breakout zone is clearly holding.

The Communication Services SPDR (XLC) was a little late to the breakout party with a breakout and new high on November 14th. XLC then dawdled around the breakout zone until early December and then moved higher the last two weeks. The ETF hit a new high on Wednesday and clearly belongs with the leaders. The top two holdings, GOOGL (24%) and FB (19%), account for 43% of the ETF.

4) Tortoise Uptrend and 52-week High (or near)

KIE, VIG, USMV, XLP, HYG

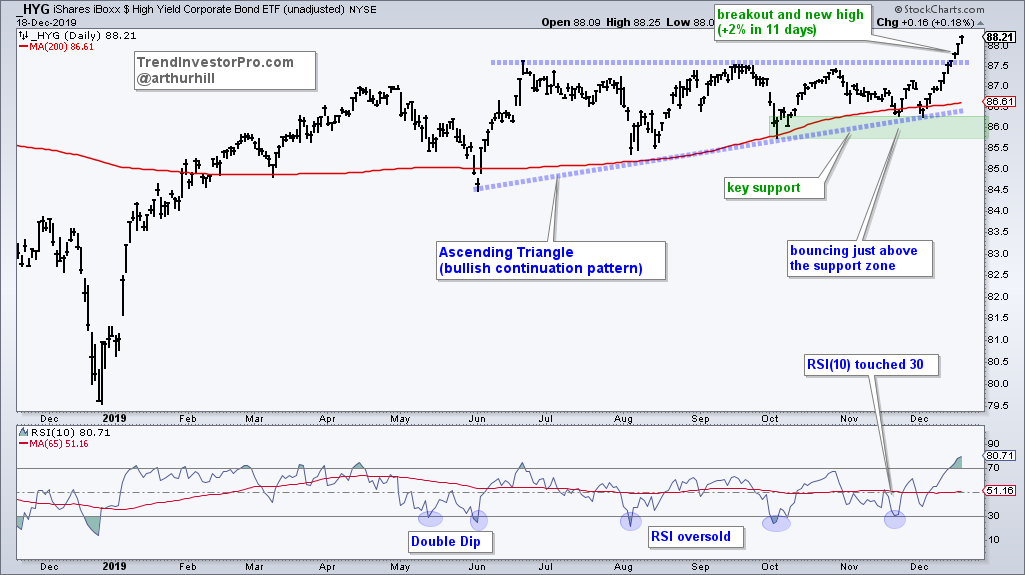

The next group of ETFs represent the tortoise uptrends. They are in clear uptrends and near 52-week highs. The first four ETFs have been in this group for some time (KIE, VIG, USMV, XLP). The fifth, the High-Yield Bond ETF (HYG), is a newcomer with an Ascending Triangle breakout and new high. I put HYG in this group because it is up a whopping 2% the last 11 days (note the sarcasm). This puts it right in the middle of the core ETF list for 11 day Rate-of-Change. 30 ETFs are up more and 29 are up less (or down).

The chart below shows HYG becoming short-term oversold in late December and finding support near the Ascending Triangle trendline and rising 200-day SMA. The 11 day surge looks impressive on the chart, but it is still a turtle because the gain is just 2%. XLK can do that in two days! Nevertheless, a breakout and 52-week high in this junk bond ETF shows a strong appetite for risk in the financial markets. I suspect that strength in oil, which moved above $60, and energy-related shares is helping.

The Insurance ETF (KIE) shows a slow and steady uptrend since March. There are four consolidations, four breakouts and numerous new highs along the way. KIE also recorded a new high this week.

The Consumer Staples SPDR (XLP) recorded a new closing high on Monday and a new intraday high on Wednesday. XLP is just 3% above its July high, but the price chart still sports a steady uptrend. The breakout zone in the 61-61.5 area marks first support should the ETF pull back.

5) Wedge Breakout and Holding Breakout

IGV, HACK, IPAY, FINX, SKYY, FDN

The next group features the six tech-related ETFs with wedge breakouts of some sort. In an interesting twist, these six ETFs are actually up less than the Technology SPDR (XLK) and Nasdaq 100 ETF (QQQ) since early October. In particular, two big tech stocks are driving XLK and QQQ higher. MSFT accounts for 11.61% of QQQ and AAPL accounts for 12.45%. It gets even more extreme with XLK. MSFT accounts for 19.33% of XLK and AAPL accounts for 19.5%. Think you are getting broad tech exposure with XLK? Think again!

Led by new highs in Adobe (ADBE), Microsoft (MSFT), Autodesk (ADSK) and Activision (ATVI), the Software ETF (IGV) broke out in early November and hit a new high in late November. The ETF stalled over the last three weeks, but is holding well above its breakout and still in bull mode. Notice how RSI(10) bounced off the 40-50 zone the last five days. The dip to the 40-50 zone represents a very mild oversold condition and this is the first area to watch for a bounce. Top ten holdings: ADBE, MSFT CRM, ORCL, INTU, NOW, ATVI, ADSK, EA, WDAY

The FinTech ETF (FINX) also broke out of a falling wedge in November and then fell back with a small falling wedge (pennant) in early December. The ETF broke out of this smaller pattern as RSI(10) bounced off the 40-50 zone the last five days. Overall, the breakout zone turns into support and the breakout is valid as long as the ETF holds (call it 28.5).

The Internet ETF (FDN) is the weakest of the group as it struggles to extend after its wedge breakout. Despite a weak extension, the trend since early October is up as the ETF works it way towards the flat 200-day SMA. I still think the cup is half full and would re-evaluate on a close below 132. Top holdings: AMZN, FB, CSCO, NFLX, CRM, GOOGL, PYPL, EBAY, VRSN

6) Recent Breakout and Reversals

MTUM, XLY, XRT, XME, TAN, PFF, XLU, LQD

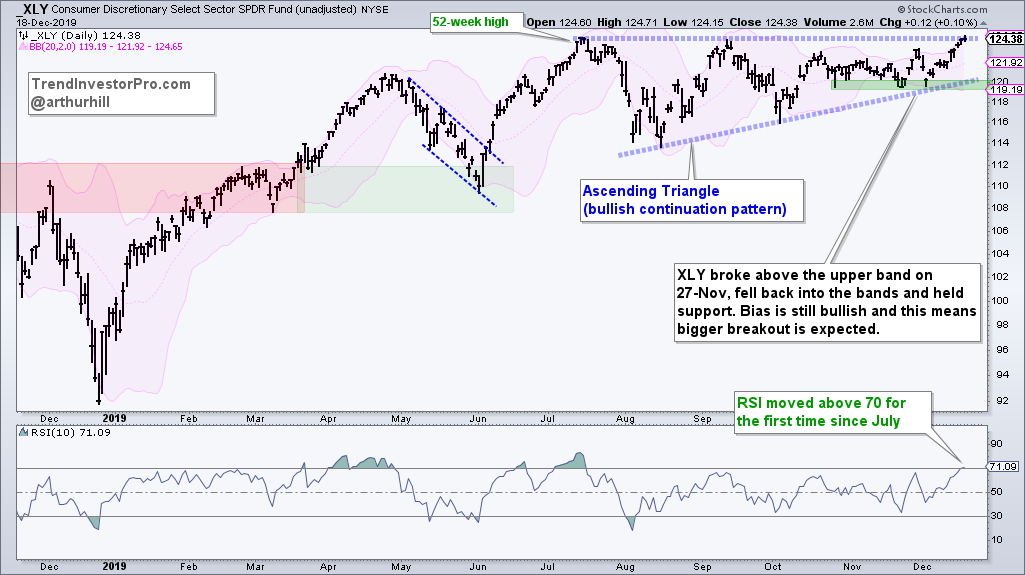

The ETFs in group six are quite mixed as far as their chart patterns are concerned. The S&P 500 Momentum ETF (MTUM) is consolidating at its breakout zone and trading near 52-week high. The Consumer Discretionary SPDR (XLY) broke out short-term and is challenging its 2019 highs with an Ascending Triangle. The Metals & Mining SPDR (XME) broke Double Bottom resistance to reverse a long downtrend, while the Solar Energy ETF (TAN) broke out of a Falling Wedge correction.

The first chart shows XRT breaking out in late October, holding the breakout zone with a consolidation into early December and breaking out of this consolidation with a surge the last five days.

XLY is on the verge of breaking out of its Ascending Triangle. XLY broke out of the narrowing Bollinger Bands in late November, tested support with a dip in early December and then made another run at resistance. The ETF is up six days straight, eight of the last ten days and RSI(10) moved above 70 for the first time since July. This means short-term momentum is the strongest in five months.

XLU made this group because it held support after its mean-reversion bounce and continued higher this week. XLU is now within 1% of a 52-week high and leaving XLRE in the dust.

7) Uptrends, but Lagging and Stalling (3-8 weeks)

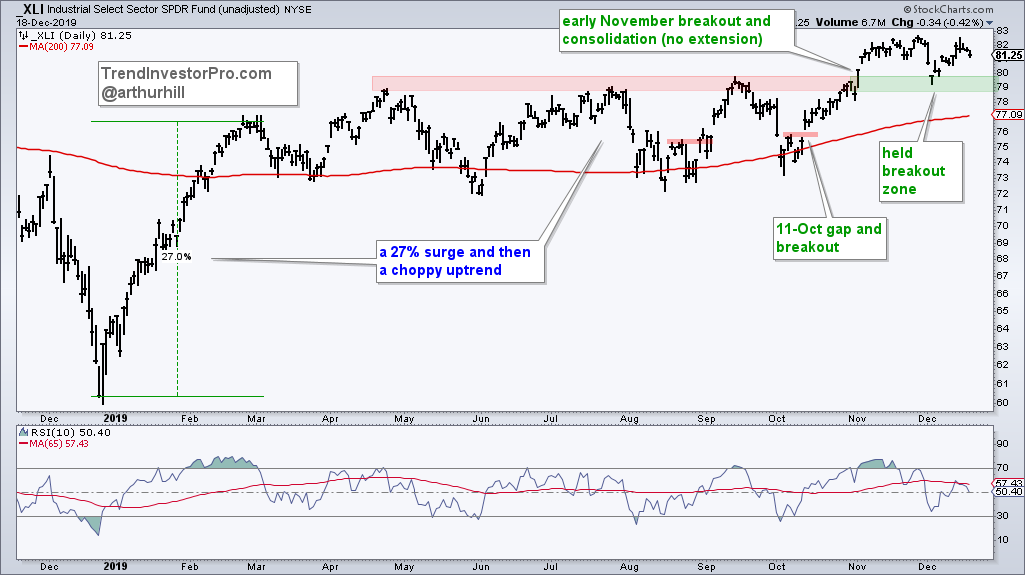

XLI, REM, ITB, XHB, ITA

ETFs in group 7 are in uptrends overall, but they have underperformed recently with pullbacks (ITA) or consolidations (XLI, ITB). The first chart shows XLI breaking out in early November, but failing to extend on this breakout. Instead, the ETF moved into a consolidation and has gone nowhere since mid November. The breakout held and remains bullish with the breakout zone marking first support in the 79 area. The inability to move higher the last six weeks is why XLI got a demotion.

The Aerospace & Defense ETF (ITA) is part of the Industrials sector and weighing on the sector. The next chart shows ITA with a steady uptrend since February and a new high in mid November. ITA then pulled back the last four weeks with a falling wedge type correction. This still looks like a correction within a bigger uptrend and RSI moved below 30. Thus, ITA is also setting up for an oversold bounce. Watch for a move above 30 to signal the oversold bounce and a wedge breakout to signal a continuation of the bigger uptrend.

The Home Construction ETF (ITB) hit a new high in late October and then moved into a consolidation. Keep in mind that SPY is up around 7% the last eight weeks and ITB is one of ten ETFs sporting a loss over this same period (-1.88%). Despite relative weakness since late October, ITB remains in an uptrend overall so this consolidation is viewed as a mere correction, not a topping pattern. Notice how ITB traded flat for three months from May to July, and then broke out to new highs. While I do not like to see relative weakness, I have yet to see enough weakness to affect the long-term trend. This means a dip below “support” at 43 could actually provide a setup for an oversold bounce.

8) Peaked in October and Correcting

XLRE, IYR, UUP

The ETFs in group 8 peaked in October and corrected over the last two months or so. The Real Estate SPDR (XLRE) and REIT ETF (IYR) fell back to their rising 200-day SMAs with falling wedge pattens, while the Dollar Bullish ETF (UUP) held above its 200-day with a consolidation the last two months. IYR is at an interesting juncture as it toys with the rising 200-day SMA and RSI(10) bounces from oversold levels. Thus, we have a long-term uptrend, a correction within that uptrend and a oversold bounce working.

The Dollar Bullish ETF (UUP) hit a new high in early October and remains in an uptrend overall. The sideways price action over the last few months could be a triangle consolidation within this uptrend. A consolidation within an uptrend is typically a bullish continuation pattern and the ETF is near the 50% retracement line. A move above the red resistance zone would reverse the downswing within this pattern and increase the chances of a bigger breakout. Such a move has yet to occur, but it would likely be negative for gold if it did.

9) Peaked in September and Formed Falling Wedges

GDX, GLD, SLV, TLT, AGG

The ETFs in group 9 peaked before the ETFs in group 8 and their falling wedges are both larger and longer. The precious metals ETFs are holding up better than the bond ETFs because the latter are failing at resistance. GLD and GDX are still near resistance and have yet to turn down. A breakout in the Dollar would likely weigh on gold. GDX and SLV will follow gold so we really only need to focus on GLD.

GLD peaked in early September after a 23% advance and retraced around 38% of this advance with a falling wedge. We have a two-steps forward (+23% advance) and one-step backward (38% retracement) in play, but the falling wedge defines the immediate trend (down). Peering into the wedge, we can see a slight rise since mid November. A break below 137 would reverse this slight advance and signal a continuation of the multi-month downtrend. On the flipside, a break above 140 would be the first sign that GLD is breaking out of its wedge.

The 20+ Yr Treasury Bond ETF (TLT) is weaker than GLD because it already failed at resistance. TLT bounced off the 50% retracement line in early November and surged to wedge resistance in early December. This breakout attempt failed as the ETF turned lower the last two weeks. The falling wedge remains in play and this downturn targets a move towards the 132 area.

10) Downtrends of Some Sort

XLE, XOP, XES, FCG, AMLP, REMX, MJ

ETFs in group 10 are in downtrends of some sort. All but XLE recorded new 52-week lows in late November or early December. The Energy SPDR (XLE) held well above its October low in early December with a falling wedge. By this metric, XLE held up better than the other energy-related ETFs in early December. XLE went on to break out of the falling wedge and surge around 6% the last 11 days. The 11 day moves are impressive, but they are occurring within bigger downtrends and ETFs in this group are still among the weakest in this core ETF list.