The intermediate trend is the dominant force at work for most stock-related ETFs and this trend is up. This is basically the uptrend from late March to mid June. The bears fired a shot across the bow last week with a sharp decline, but the bulls answered with a reversal day on Monday and pop on Tuesday. Most importantly, price action on Monday-Tuesday affirmed support for several ETFs and established a reaction low for others. These lows now hold the first key going forward and I am marking these lows as first support on most charts. But first, we will look at bonds and gold because they have bullish patterns taking shape.

Asset Classes: the Big Three

Gold, bonds and stocks represent asset classes with clear differentiation. Lately, gold and bonds are showing negative correlation to stocks, as is the Dollar. This means they are moving in opposite directions: stocks rise as gold, bonds and Dollar fall.

The Gold SPDR (GLD) and the 20+ Yr Treasury Bond ETF (TLT) stalled out as the S&P 500 SPDR (SPY) moved higher from mid April to early June. SPY is still in an intermediate uptrend, but is teetering on a breakdown and reversal. Meanwhile, GLD is stuck in a holding pattern and TLT corrected from mid April to early June.

The next chart shows the 20+ Yr Treasury Bond ETF (TLT) forming a possible cup-with-handle, which is a bullish continuation pattern. The long-term trend is up with a new high in March, price above the rising 200-day SMA and a positive PPO(20,200,0). TLT corrected after challenging the March high and this correction is showing signs of reversing near the 61.8% retracement. Notice that the PPO(12,29,9) turned up and moved above its signal line. The next bullish step would be a break above last week’s high.

The next chart shows weekly prices for GLD and this is one of the strongest uptrends in the markets right now. GLD broke out of a three year base last summer and surged to a new high in March. The ETF stalled as stocks surged the last three months, but this stall looks like a classic bull flag (a consolidation after a sharp advance). This makes it a bullish continuation pattern and a breakout at 165 would signal a continuation of the uptrend.

SPY Recaptures 200-day SMA

The S&P 500 SPDR (SPY) bounced right where it should have bounced. Broken flag resistance, the 50-61.8% retracement zone and 200-day SMA combined for support in the 300 area. RSI(14) was also in the 40-50 zone, which represented a mild oversold condition. This bounce now needs to hold. A close below Monday’s close (307) would negate the bottle rocket breakout. A close below Monday’s low (296) would break support and the 200-day SMA. Most other stock-related ETFs will take their cue from price action in SPY.

Note that SPY is not included in the groupings below because it is right in the middle as far as performance is concerned. MTUM and TAN are also excluded.

TIP is Stronger than TLT

When running my StochClose rankings, I accidently chose the master list with around 200 ETFs. This list includes the TIPS Bond ETF (TIP), which is based on inflation-protected Treasury bonds, and TIP is near the top of the ranking. I pulled up the chart and found that it is stronger than TLT. TIP is much closer to its March-April highs, held its mid April low and already exceeded its late May high. Overall, the chart shows a surge and triangle consolidation with a breakout in the making. Perhaps those monetary and fiscal drugs are working here as well.

Plotting Strength and Weakness

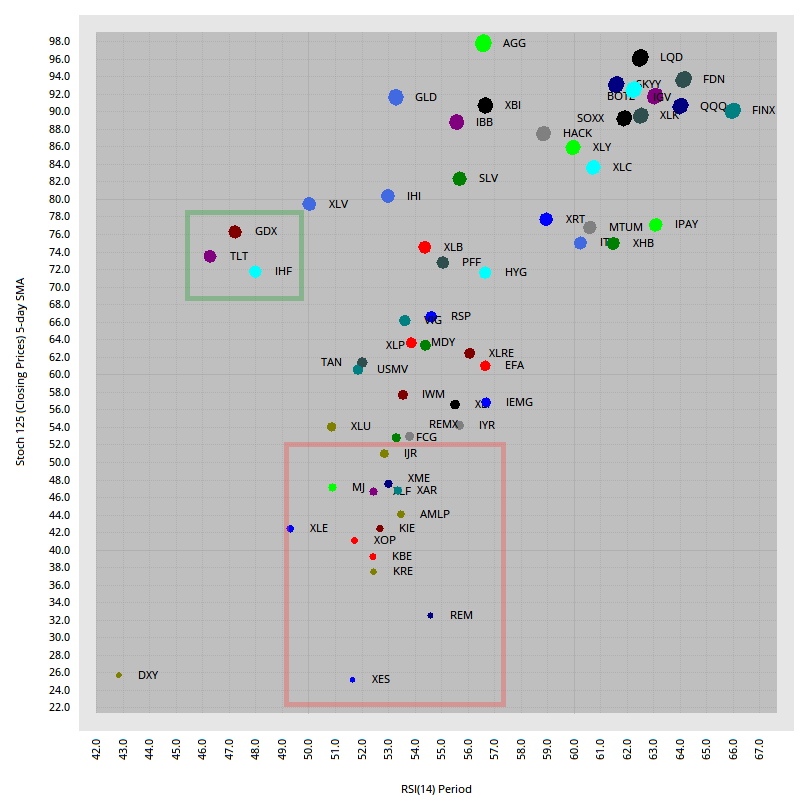

The scatter plot shows ETFs sorted by StochClose (125,5) on the y-axis and RSI(14) on the x-axis. ETFs in the upper third are in strong utprends and leading (StochClose>70). ETFs on the left third are somewhat oversold (RSI<50). In contrast to last week, there no overbought ETFs this week (RSI>70). Overall, StochClose is above 60 for 39 ETFs and below 40 for just 4 (KRE, REM, XES, UUP/DXY). I am mostly drawn to ETFs that are in uptrends and somewhat oversold. This means StochClose above 60 and RSI below 50. GLD fit the bill last week. This week, we can see TLT, GDX and IHF in the upper left (green box). Small-caps, finance and energy are still lagging (red box).

ETFs Ranked by StochClose

There is not much change in the StochClose rankings. Unsurprisingly, many took hits with last week’s plunge. Exceptions included the Aggregate Bond ETF (AGG) and Corporate Bond ETF (LQD), which top the rankings (thanks, Chairman Powell). This right here tells us that the current market environment is NOT normal. Stocks are on a tear and yet corporate bonds show the most chart strength. Among other StochClose gainers, the Gold SPDR moved up in the rankings with a bounce this week. TLT also moved up, but has yet to crack the top 20.

New High and Leading

LQD

The Corporate Bond ETF (LQD) is the only ETF to hit a new high this week. Personally, I am not sure what to do with AGG, LQD and HYG because of Fed involvement. Can we ignore the Fed and just focus on the chart? Not sure. Anyhow, the chart below shows a flag breakout in late May and extension to new highs here in June.

Near New High and Above 200-day

QQQ,XLK,XLY,SKYY,HACK,FINX,FDN,IGV,SOXX,BOTZ

ETFs in the next group are leading the market since late March. These ETFs were some of the first to break back above their 200-day SMAs and all recorded new highs in early June. They were hit with last week’s sharp decline, but bounced back this week and established the first support level to watch going forward.

The chart below shows QQQ, which is the leader of this tech-related pack. An evening star candlestick pattern formed with Thursday’s sharp decline, but the bulls answered with a surge on Monday. This surge established a reaction low that I am calling support. A move below Monday’s low would forge a lower low and suggest some sort of downtrend, especially if this week’s bounce fails to exceed the early June high. A support break would argue for a correction after the massive 40+ percent advance. A “normal” correction would retraced around 33 to 38.2 percent of the prior advance and this could extend to the 220 area.

The next chart shows the Semiconductor ETF (SOXX) hitting a new high in early June, falling sharply last week and bouncing this week to establish first support. A break here could usher in a correction back towards the rising 200-day, if the Fed does not step in sooner.

Intermediate Uptrend, Above 200-day, but below Feb High

XLC, XLV, XLB, IPAY, ITB, XHB, XRT

ETFs in this next group are also leaders from late March to early June with some of the biggest moves. They are above their 200-day SMAs, but did not tag new highs and are not as strong as ETFs in the group above. Nevertheless, the intermediate uptrend from late March to early June is the dominant trend right now.

The next charts show two ETFs from the all important Consumer Discretionary sector: the Retail SPDR (XRT) and the Home Construction ETF (ITB). These two are also largely US-centric ETFs with business dependent on the domestic economy. Both are holding their intermediate uptrends and both established support with bounces on Monday. Both also bounced near their 200-day SMAs and break below the support zones would reverse the three month uptrend.

Consolidation Breakout

AGG

The Aggregate Bond ETF (AGG) gets its own group because it broke out of a flag-like consolidation pattern. This is no doubt with help from corporate bonds and Fed buying.

New High and Consolidation or Correction

IBB, XBI, GDX, GLD, TLT

ETFs in this next group are perhaps the most “interesting right now. I already covered GLD and TLT. The IBB and XBI charts look similar to GLD over the last few months. The chart below shows IBB surging to a new high in mid May and then embarking on a consolidation the last five weeks. The Bollinger Bands narrowed and Bandwidth hit its lowest level since January. As Bollinger theorized, a volatility contraction is often followed by a volatility expansion.

IBB dipped below the lower Bollinger Band last week and quickly recovered. Perhaps this was just a head fake. In his classic book, Bollinger on Bollinger Bands, John Bollinger talks about the “head fake” break. This is when price breaks one way, reverses and ultimately breaks the other way. IBB is in an uptrend and a consolidation within an uptrend is a bullish consolidation. This means the odds favor an upside breakout.

Above 200-day and Long Stall

XLV, IHF, IHI

The next three ETFs come from the Healthcare sector and they are stalling above their 200-day SMAs, and below their February highs. The stall is wearing out its welcome, but it is still a consolidation after a sharp advance. All three dipped last week and RSI moved into the 40-50 zone to become mildly oversold. They bounced this week and RSI moved back above 50. This is the early signal for a mean-reversion bounce. The lows extending back to late April mark support. The chart below shows the Medical Devices ETF (IHI) with support in the 250 area.

Just below 200-day SMA with Rising Wedge

RSP, MDY, IWM, IJR, XLRE, IYR, XAR, IEMG, EFA

Now we get to ETFs that are in a rather strange situation. They all forged new lows during the March decline and remain well below their February highs. In addition, they moved back below their 200-day SMAs with last week’s decline and did not retake these moving averages yet. Furthermore, the advance from late March to early June formed a rising wedge and these patterns are typical for counter-trend bounces. Support breaks would reverse the intermediate uptrends and signal a continuation of the March decline.

The first chart shows IWM failing to hold above the 200-day SMA and forming a rising wedge with support at 133. The second chart shows MDY with support at 310.

Below 200-day with Steep Wedge/Channel

FCG, XOP, AMLP, REMX

ETFs in this group produced some of the strongest bounces from late March to early June. However, these bounces started from new lows and they are also below their falling 200-day SMAs. I am showing a chart for AMLP to illustrate a highly subjective trendline. Sure, there is a clear wedge on the chart and AMLP broke the wedge. In addition, the ETF bounced and the underside of the trendline became resistance. This is truly classic stuff that looks great, when it works. It may work this time, but don’t count on it working even 50% of the time and remember that these trendlines are subjective.

Counter-trend Bounce and June Reversal Near 200-day

XLF, XLI, XME, VIG

The Finance SPDR (XLF) and Industrials SPDR (XLI) led the market higher from May 14th to June 8th and moved above their 200-day SMAs in early June. The move above the 200-day did not last long as they fell back pretty hard last week. Both ETFs formed rising channels instead of wedges, but the implications are the same. The rising channels started from 52-week lows and failed near the 200-day SMAs. They are considered counter-trend advances and a channel break would signal a continuation of the March decline. I am, however, marking support at Monday’s lows to be in sync with the rest of the charts.

Just below 200-day SMA and Long Stall

USMV, XLP, XLU, PFF, HYG

ETFs in this group were leading early on, but stalled the last two months. Take the Consumer Staples SPDR (XLP) and Utilities SPDR (XLU) for example. They led on the initial bounce from late March to mid April and then stalled out over the last two months. This is probably because money moved into more offensive areas of the market, like technology. Both XLP and XLU broke out of flag-like corrections in early June, challenged their 200-day SMAs and then fell back to the breakout zones last week. These zones could offer support and give way to a bounce.

Counter-trend Bounce and Well below 200-day

XLE, KBE, KRE, KIE, MR

The Regional Bank ETF (KRE) also led the market from May 14th to June 8th, but did not tag its 200-day and fell sharply last week. The bounce from late March to early June is still considered a counter-trend bounce. I drew a rising channel by using an internal trendline, which cuts through the May low. Internal trendlines are the kings of subjective trendlines. These trendlines allow us to see anything we want on the chart.

In any case, perhaps the mid May dip was an overshoot. In addition, the slope of the lower trendline matches the slope of the upper line and the channel looks pretty good. The channel also matches up with Monday’s low for support. A break below this support zone would, therefore, reverse this upswing and signal a continuation of the bigger downtrend.

Very Weak Bounce and well below 200-day

REM, XES

We finish with the Mortgage Real Estate ETF (REM), which has one of the weakest bounces of all. REM did not exceed its 50% retracement and did not come close to its falling 200-day SMA. I drew a subjective wedge to define the advance and Monday’s low marks support.