There are lots of flag breakouts here in March. Some triggered in early March, some last week, some this week and some are still working, which means price is still near the breakout zone. There were short flag/pennants that lasted a week or so (KRE), shallow flags (IJR), falling flags that lasted three weeks (SPY) and sharper falling flags that lasted four weeks (QQQ, IBB).

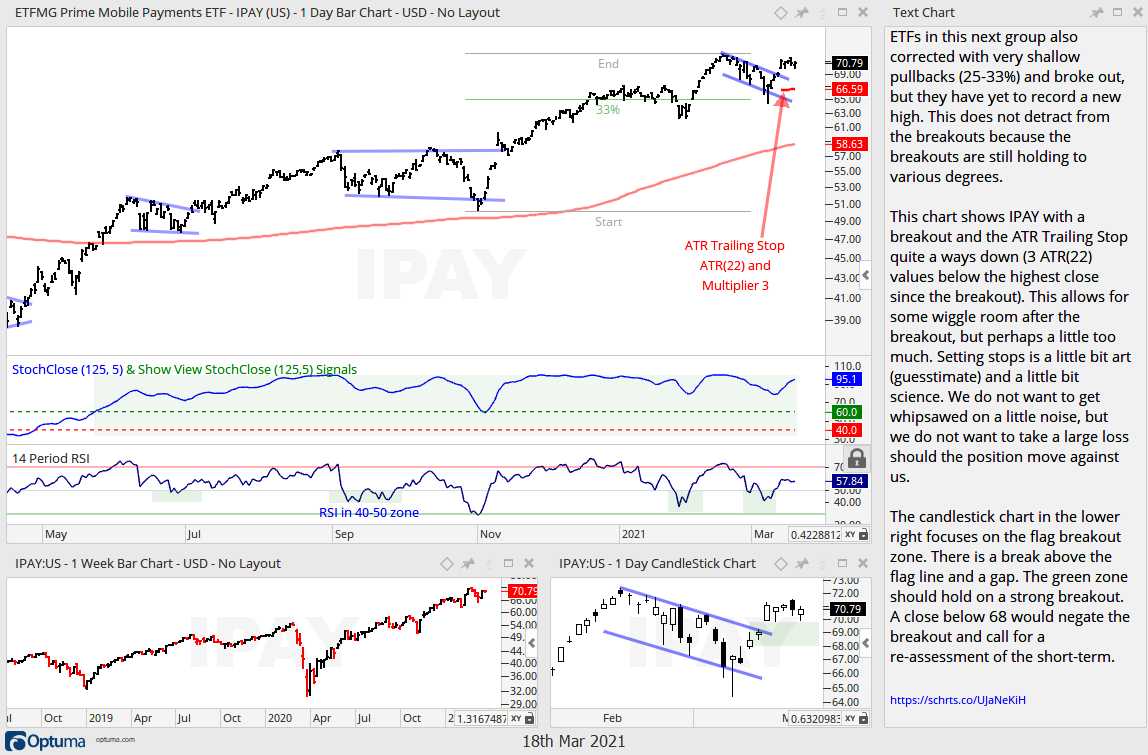

The shallow flags retraced 25 to 33 percent of the October-February advance, while the steep flags retraced 67 percent of their October-February advance. The deeper retracement shows most selling pressure on the pullback. For example, the pullback in the Mobile Payments ETF (IPAY) was shallow (33%) and this showed modest selling pressure. The pullback in the Biotech SPDR (XBI) was deep (67%) this showed stronger selling pressure.

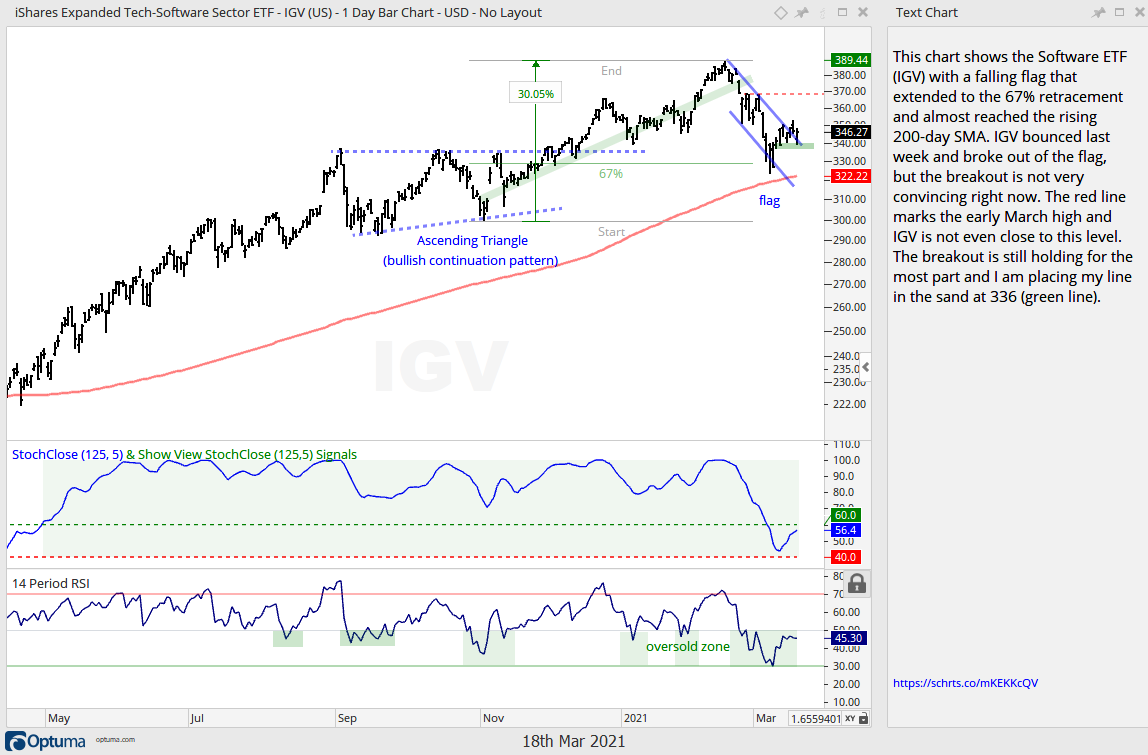

The tech and growth related ETFs continue to underpeform. SKYY, HACK, FINX, IGV, FDN, PBW, TAN, IBB and XBI retraced 50 to 67% of the October-February advance and bounced here in March. Despite this bounce, all eleven ETFs are down over the last 13 days. This means they did not exceed the highs hit on March 1st or 2nd. Not only did these ETFs correct harder, but they also produced some of the weakest bounces. XLY is the only one that exceeded its early March high. The tech-related ETFs, in particular, are looking shaky and could have further to correct.

Early February Flag/Pennant Breakout, Surge, Overextended

USO, DBE, XLE, XES, XOP, AMLP, FCG

This chart shows a new chart layout that I am experimenting with on USO a few others today. The big window shows daily bars with RSI and StochClose. RSI turns blue when it dips into the oversold zone (30-50). StochClose is bullish when shaded green and unshaded when bearish. StochClose has been bullish since mid October and RSI was oversold just once since then.

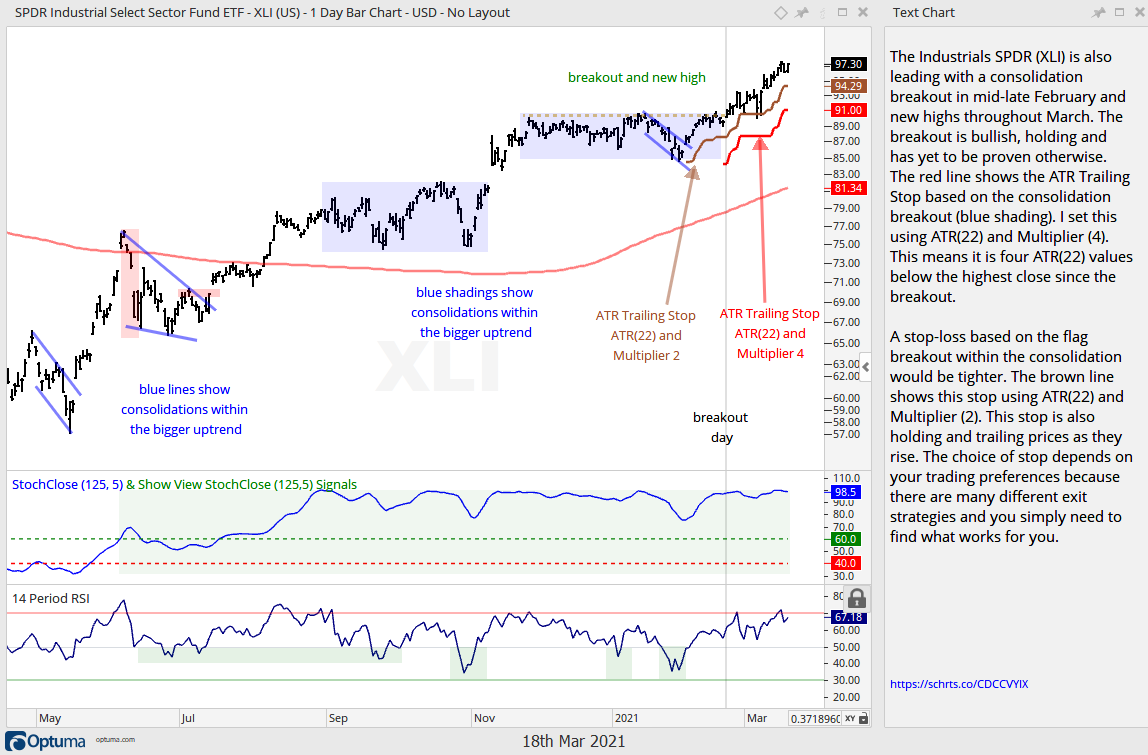

Consolidation Breakout mid February, New Highs

XLI

Strong Surge off 200-day, New High

XLRE, REZ

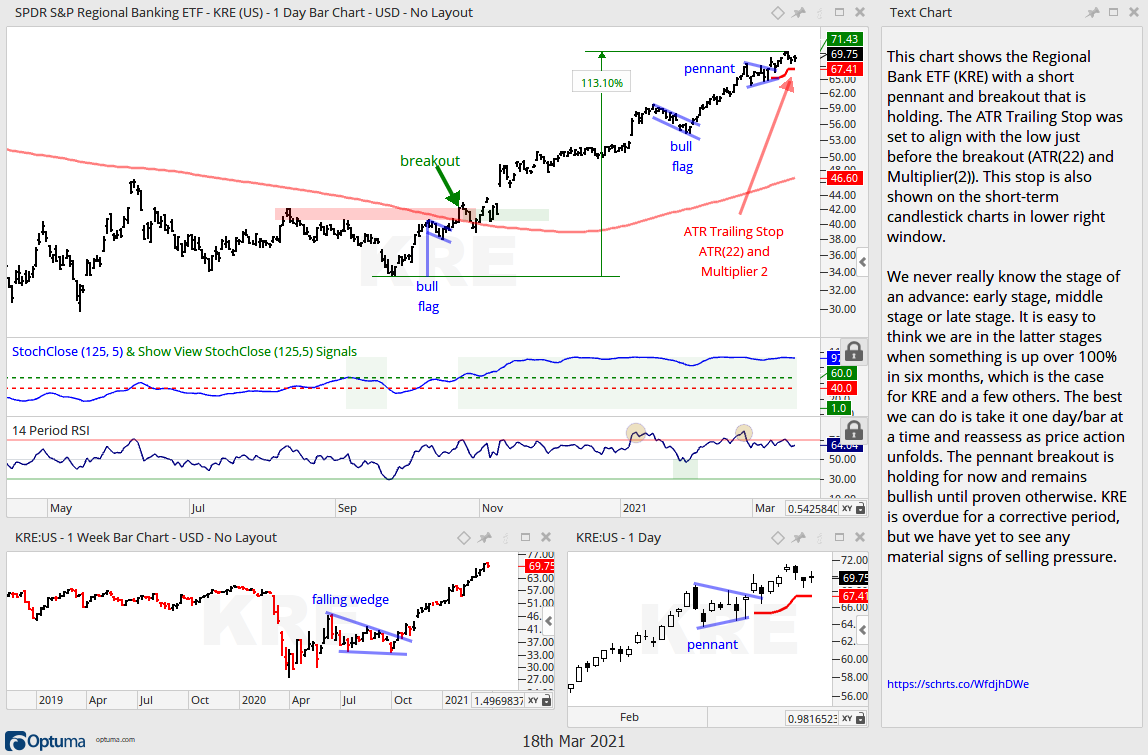

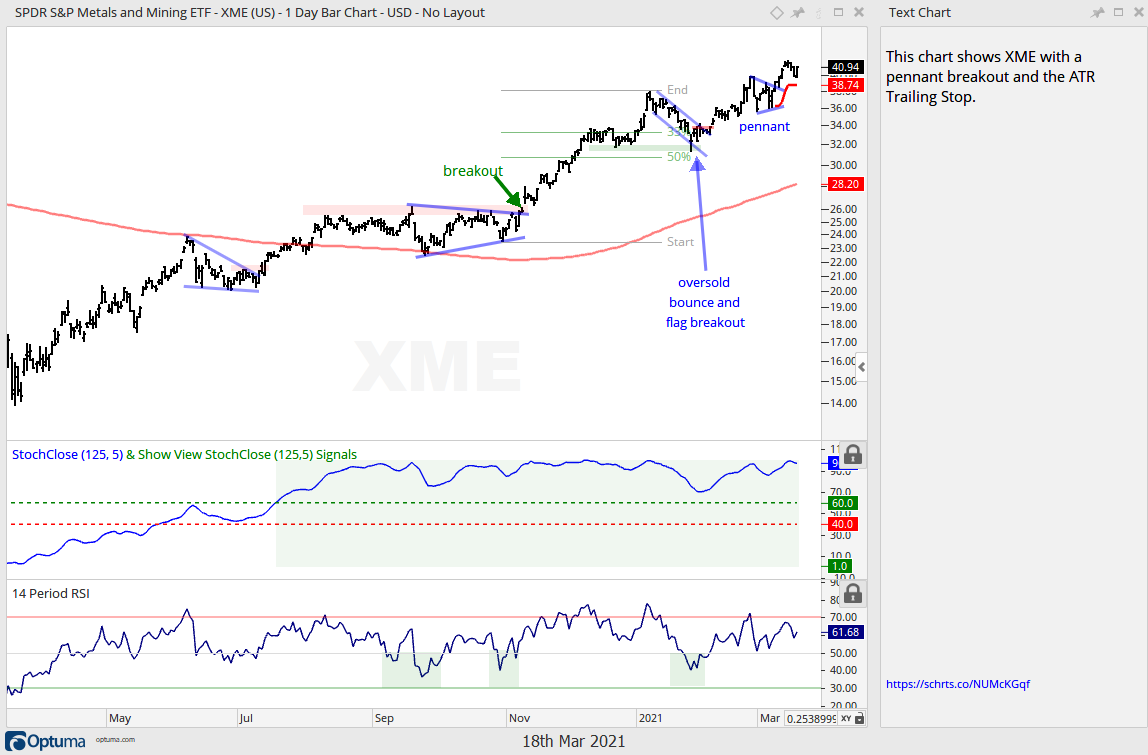

Short Flag/Pennant, Breakout, New High

XLB, XLC, XLF, KRE, KIE, XME

You can learn more about ATR Trailing stops in this post,

which includes a video and charting option for everyone.

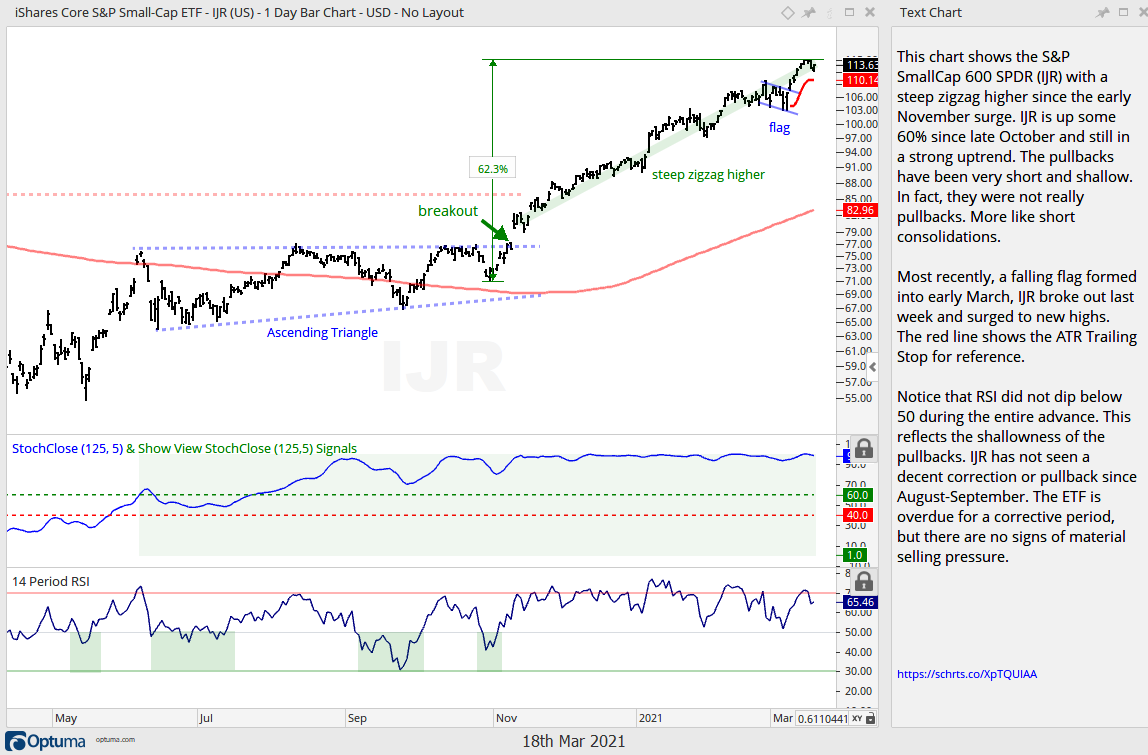

Short Flag, Flag Breakout, New High

IJR, MDY

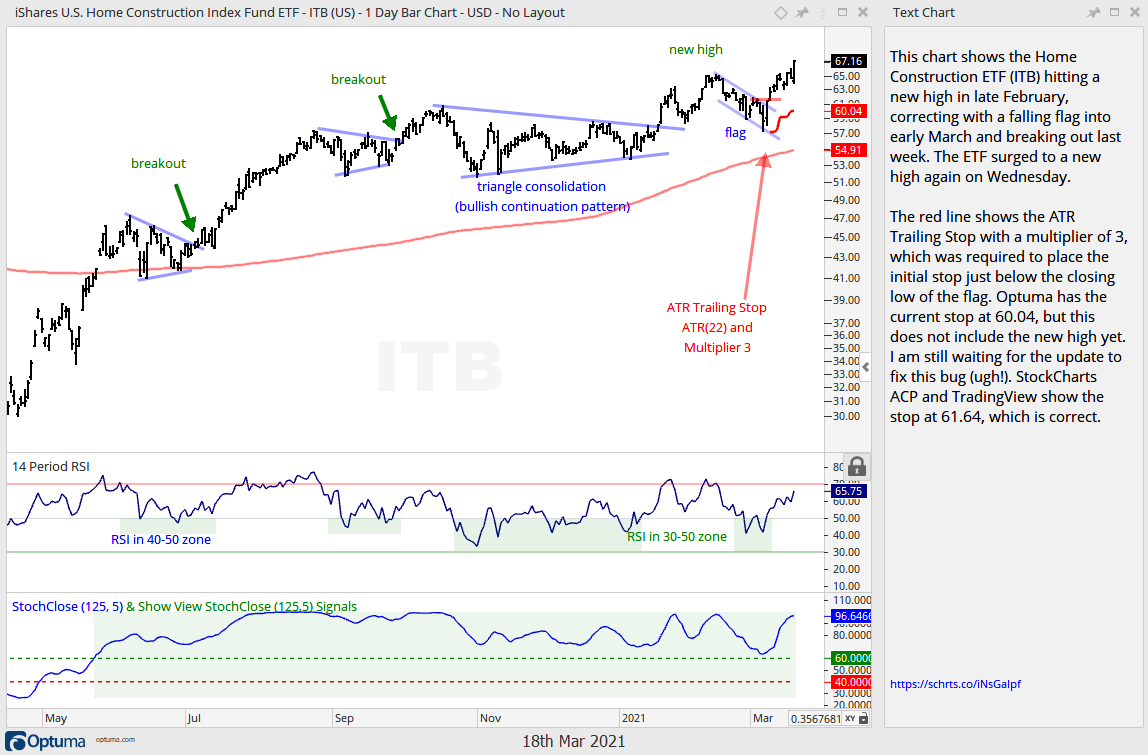

25-33% Retracement, Flag Breakout, New High

SPY, IWM, XAR, ITB

You can learn more about ATR Trailing stops in this post,

which includes a video and charting option for everyone.

25-33% Retracement, Flag Breakout, No New High

IPAY, REMX, DBB, DBA

50% Retracement, Flag Breakout, No New High

QQQ, XLK

Multi-week Channel/Consolidation, Breakout Working

XLV, IHF, PHO

50-67% Retracement, Steep Flag, Breakout Working

SKYY, HACK, FINX, MJ, IHI

67% Retracement, Steep Flag/Channel, Breakout Working

XLY, IGV, FDN, PBW, TAN, IBB, XBI

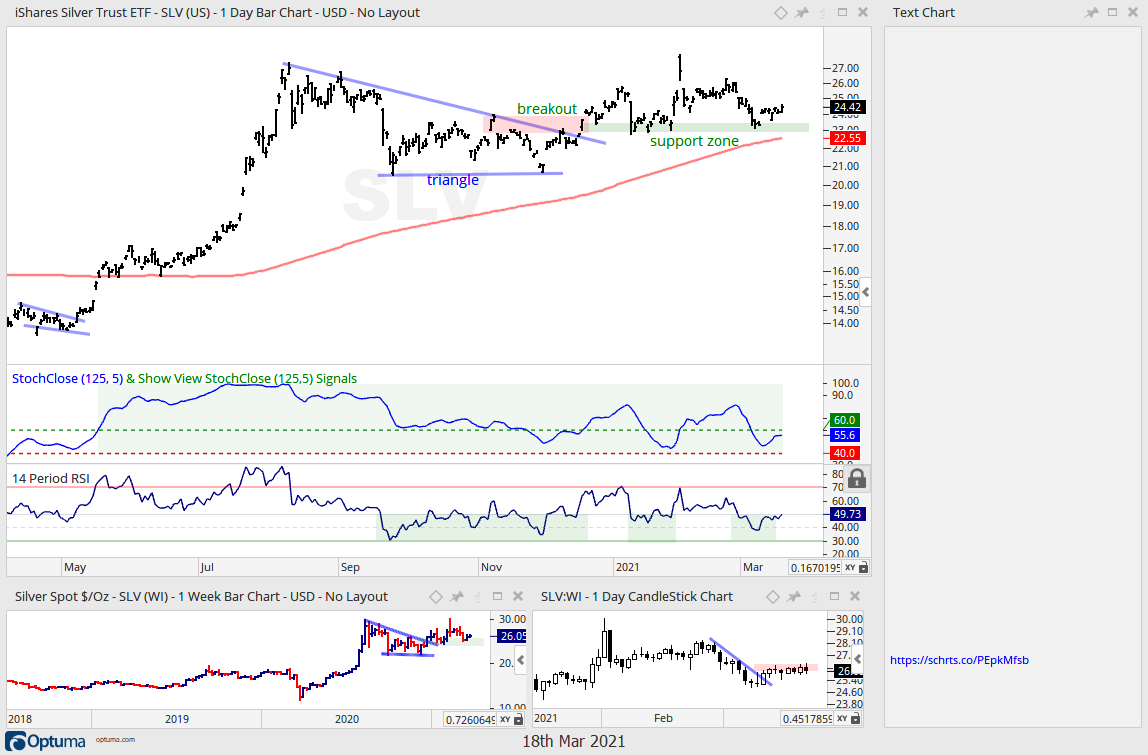

Mid December Breakout, Breakout Zone Holding

SLV

ETFs from here are lagging over the last few months or in downtrends. Note the gold and Treasury bonds are the weakest of all right now.

2 week Surge Near 200-day, Channel Breakout: XLP, XLU

33-50% Retracement, Falling Flag, No Breakout: HYG

Firming after Selling Climax: TIP

Downtrend: TLT, AGG, LQ, GLD, GDX