Changing of the Weights

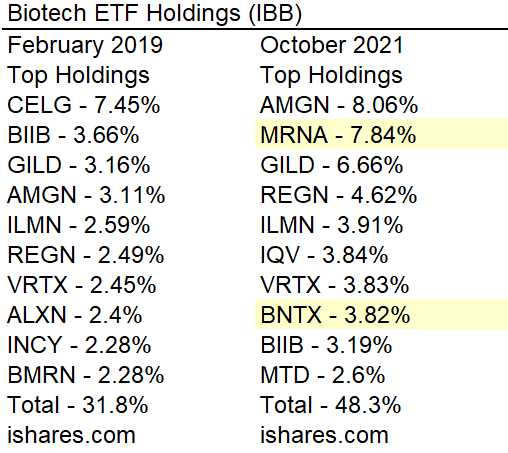

The Biotech ETF (IBB) is a rather peculiar ETF because of the performance differentials among its components and the changing of the weights. Moderna (7.84%) and BioNTech (3.82%) account for almost 12% of the ETF. These two stocks were not even part of IBB in February 2019 and now they are in the top ten. The image below shows the top ten components in February 2019 and the top ten here in October.

Market cap weighted ETFs and indexes reward uptrends and momentum. Stocks with the biggest gains increase in market cap and their weighting within the ETF automatically increases. Poor performing stocks decrease in market cap and their influence within the ETF decreases. We have seen this momentum effect at work in QQQ and SPY over the last few years.

Mixed Performance for Components

Overall performance for the top IBB stocks is mixed. Amgen (AMGN), Gilead (GILD), Illumina (ILMN), Vertex (VRTX) and Biogen (BIIB) are below their 200-day SMAs and down over the last three months. Five are above their 200-day SMAs (green shading). Moderna (MRNA) and BioNTech (BNTX) are above their 200-day SMAs, but below their 50-day SMAs and correcting after big advances. The CandleGlance charts below show each with the 65-day Rate-of-Change in the indicator window. Notice that BIIB and ILMN made huge round trips after advances of 55% and 40%, respectively (yellow shading). Picking individual biotech stocks is tricky business.

The top ten components for IBB account for 48% of the ETF and these big stocks are the main drivers. The other 256 stocks account for around 52%. Yes, you read right – 256. All told, there are 266 stocks in the Biotech ETF (IBB). Crazy! For those keeping score at home, there are 187 stocks in the Biotech SPDR (XBI), which is an equal-weight ETF.

An Erratic Uptrend for IBB

I will be the first to admit that technical analysis is a challenge with individual biotechs and the biotech ETFs. They have above average volatility and their price charts are more erratic. Even so, biotech as an industry is promising as a long-term theme. On the price chart, IBB is below its 200-day, but I think the long-term trend is still up. IBB hit 52-week highs in February and August, and remains above the spring lows. Overall, a wide rising channel is possible (green lines).

Short-term, the ETF became oversold several times from September 28th to October 11th (green arrows). Oversold is when the Momentum Composite dips to -3 or lower. The decline into the 155 area also retraced around two thirds of the 24% advance, which is still normal for a pullback within a bigger uptrend. IBB firmed the last few weeks and the first StochRSI pop triggered on October 12th with a move above .80. This shows a short-term momentum thrust that can foreshadow a short-term breakout. The red line marks short-term resistance from last week’s high and a breakout here would be short-term bullish.

XBI Attempts to Base

Depending on your timeframe, the Biotech SPDR (XBI) is either weaker or stronger than IBB. XBI is below its May low, while IBB remains above its May low and is stronger long-term. Short-term, XBI is above its August low, but IBB is below its August low. The price chart is also mixed as XBI consolidates the last five months (since May). The dotted lines show a possible Descending Triangle, which is a bearish continuation pattern. A break below support would confirm this pattern.

On the bullish side, XBI established support in the 120 area in May and is testing this zone here in October. The consolidation could be a big base. Also note that the February-May decline retraced just over two thirds of the prior surge, which was 73%. Biotechs are allowed overshoots. Short-term I am watching the September-October downswing for the early clue. XBI did the old pop and drop the last two weeks to establish resistance at 129 (red shading). A breakout here would reverse the downswing and provide the first bullish sign.