Financial Sense – Charts for Interview on October 30th

- Arthur Hill, CMT

These are the charts from my interview with Jim Puplava of Financial Sense on Thursday, October 30th.

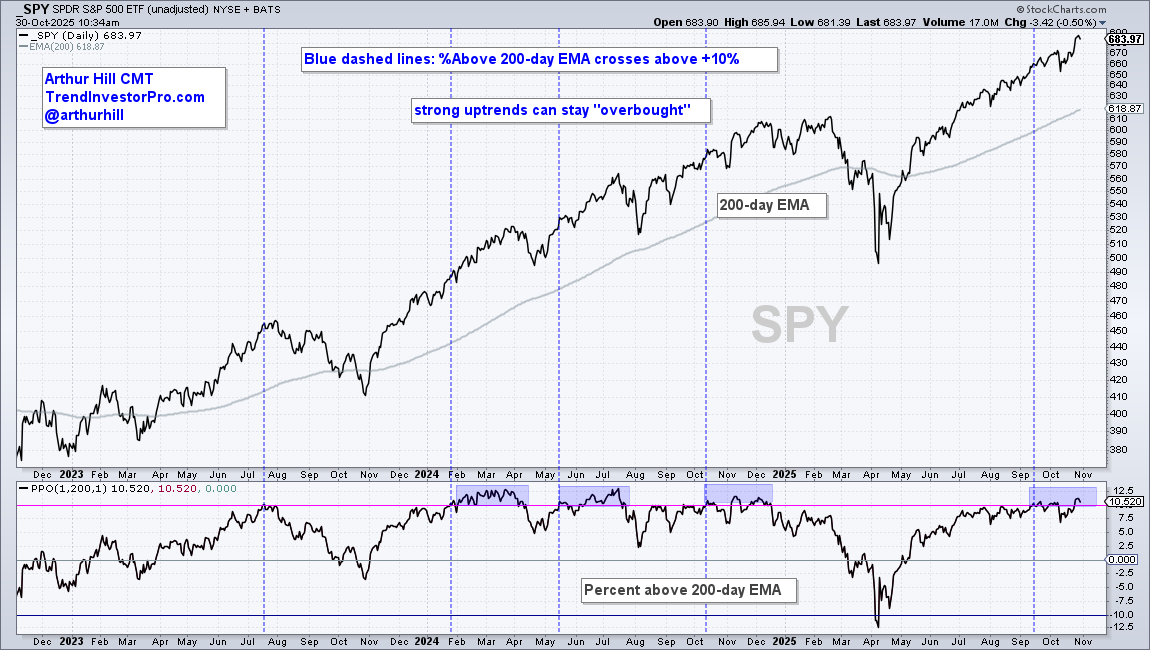

- SPY became overbought, but overbought conditions can persist.

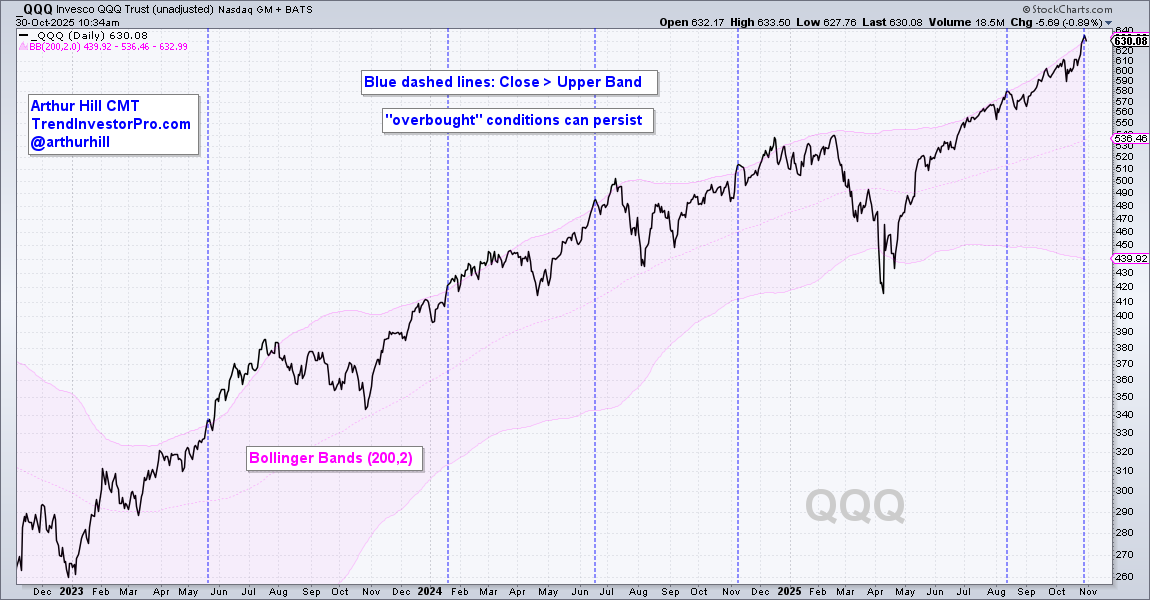

- QQQ exceeded the upper Bollinger Band (200,2) to signal froth.

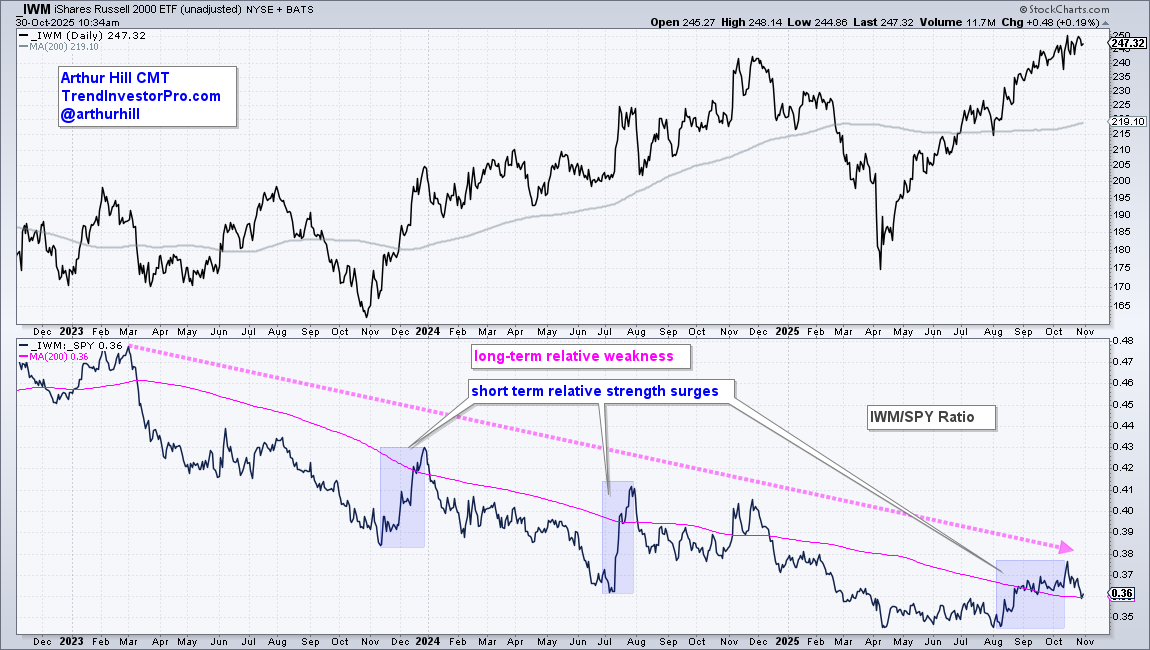

- Small-caps are still lagging large-caps.

- SPX %Above 200-day and New Highs are still net bullish.

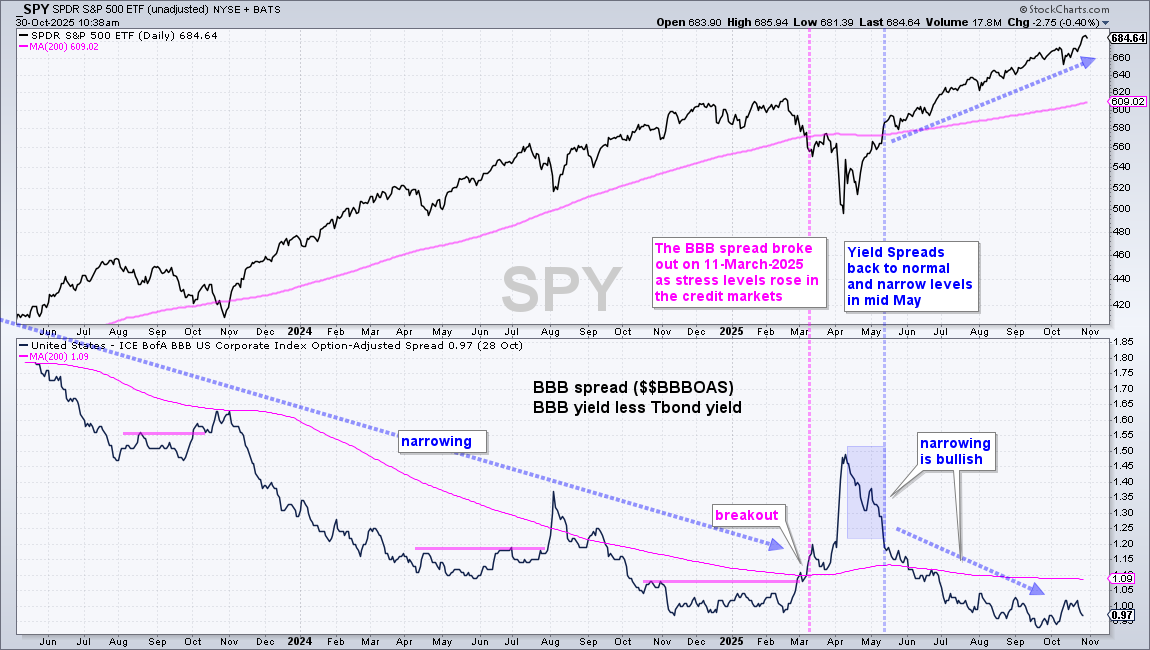

- The BBB yield spread shows no signs of stress in the credit markets.

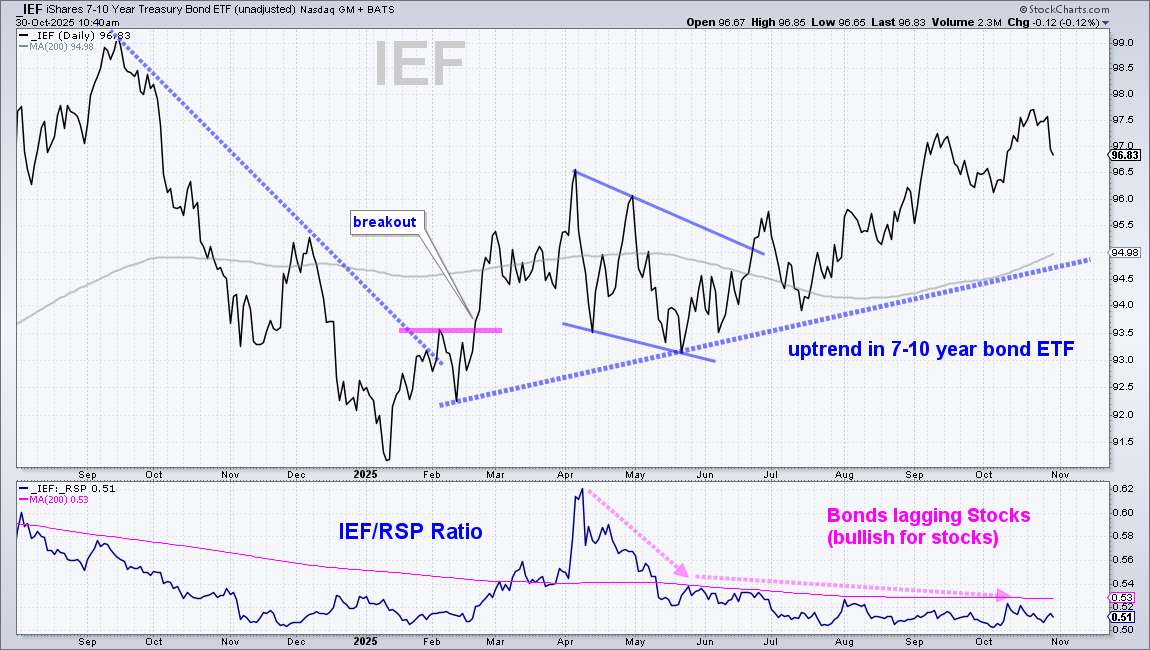

- The 7-10Yr TBond ETF is trending higher, but underperforming SPY (risk on).

- The Mag7 ETF has yet to become overbought.

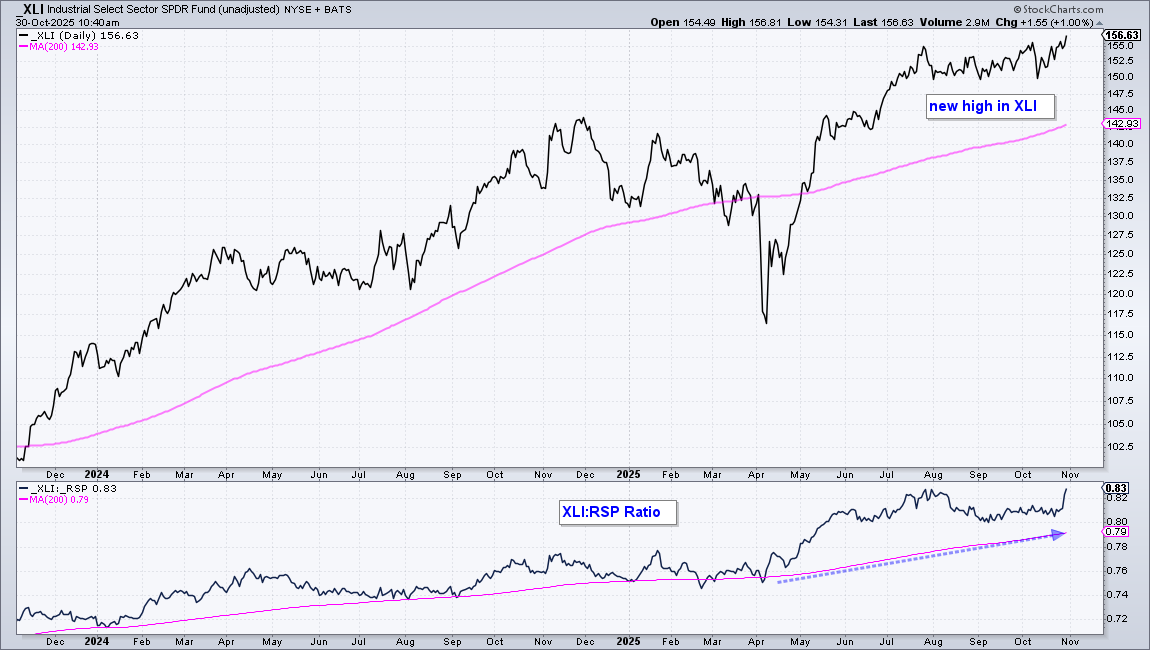

- Industrials are also strong with XLI hitting new highs in October.

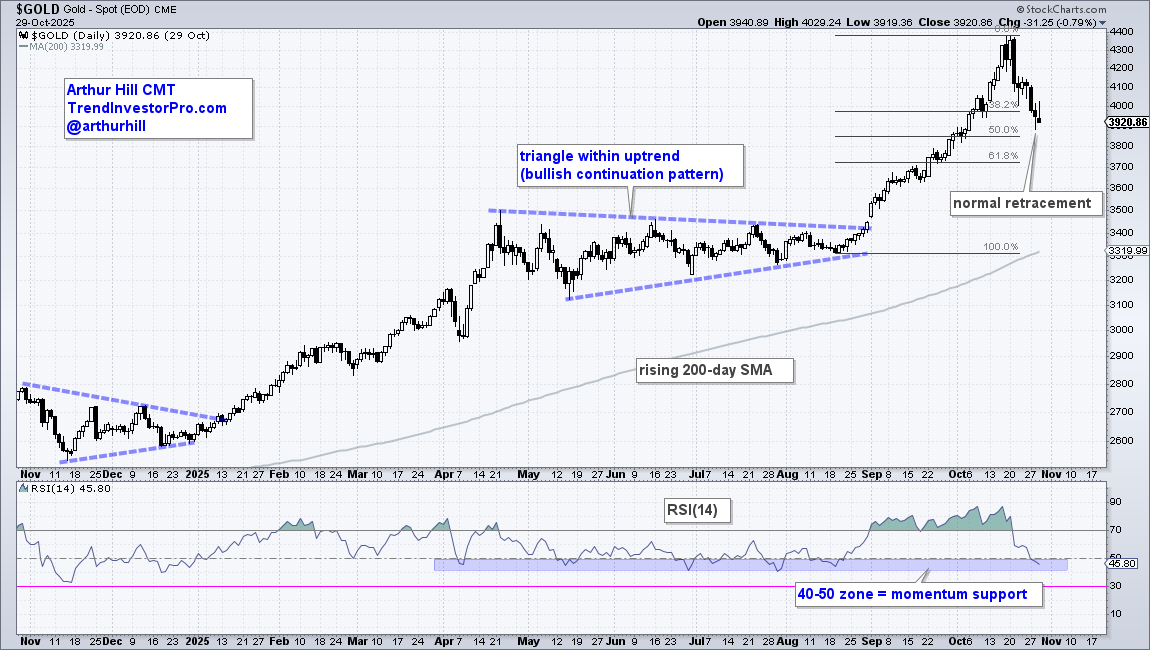

- The decline in gold looks like a normal retracement within an uptrend.

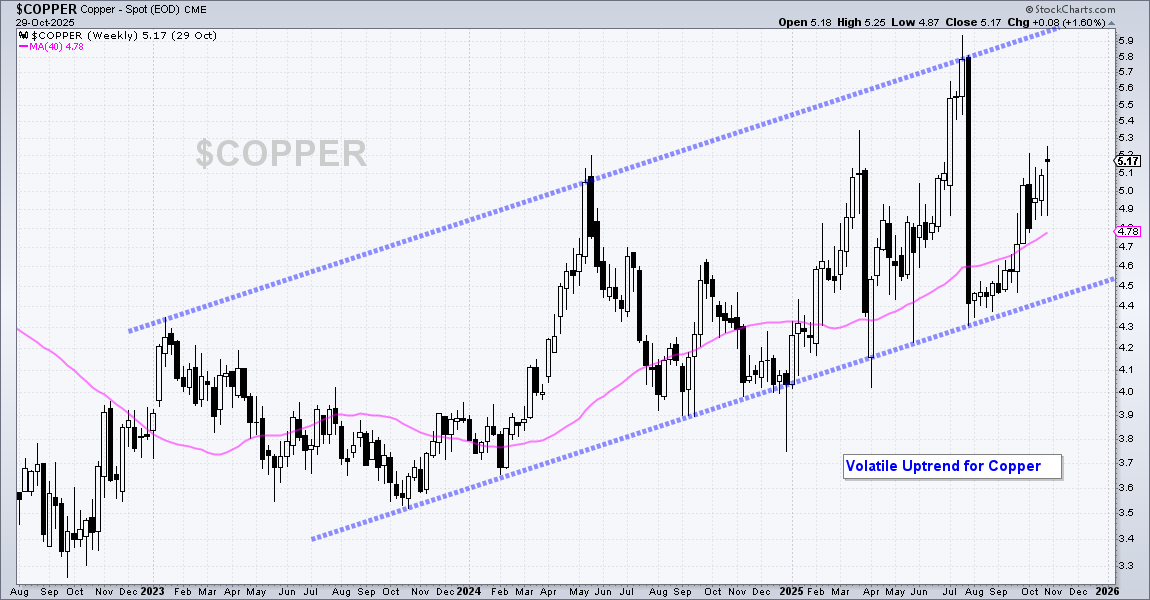

- Copper is in a strong and volatile uptrend – expect new highs.

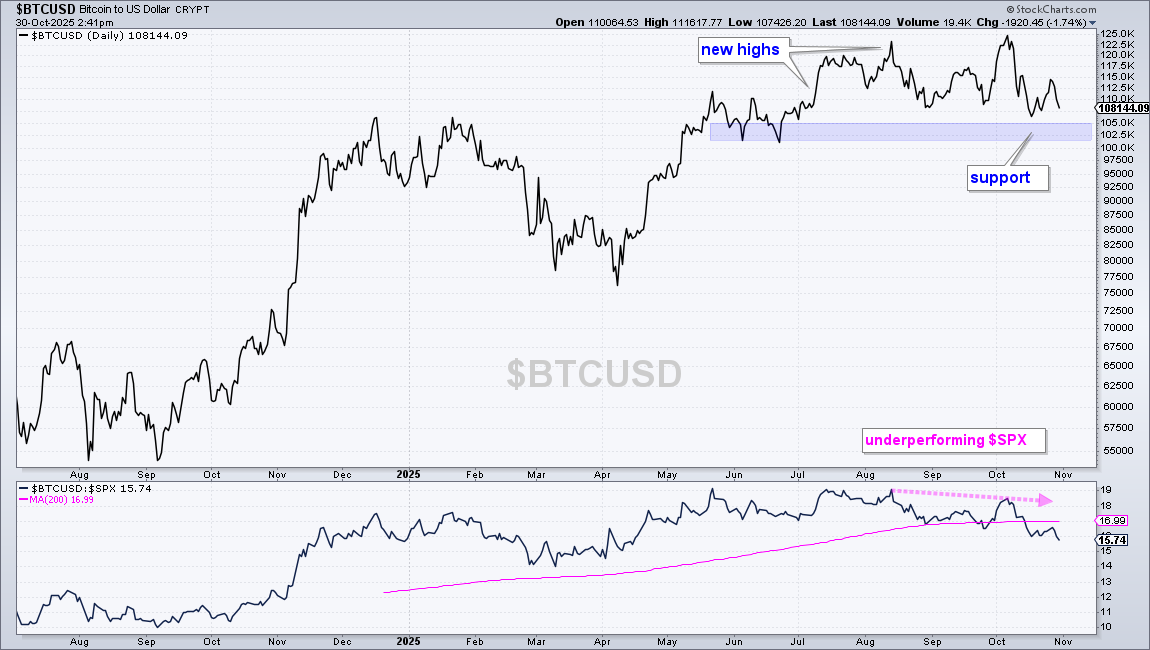

- Bitcoin is underperforming the S&P 500, but remains in an uptrend.

Recent Reports and Videos for Premium Members

- Setups in three Defensive ETFs and a Two Mag7 Stocks

- Bonds Break Out as Gold Forms Small Bullish Pattern

- Trend Signals and Momentum Scores for Dow 30 and Sector SPDRs

- Click here to take a trial and gain full access.

SPY is more than 10% above its 200-day EMA since September.

QQQ moved above upper Bollinger Band - more than 2 StdDevs above 200-day

Small Caps are still underperforming large-caps.

Breadth is more bullish than bearish, but most new lows since April.

The BBB yield spread shows no signs of stress in the credit markets.

Bonds are are trending higher, but still underperforming stocks (risk on)

MAG7 ETF has yet to become overbought, but it is getting close.

XLI hit new highs in October. There are some pockets of strength outside tech.

Recent Reports and Videos for Premium Members

- Setups in three Defensive ETFs and a Two Mag7 Stocks

- Bonds Break Out as Gold Forms Small Bullish Pattern

- Trend Signals and Momentum Scores for Dow 30 and Sector SPDRs

- Click here to take a trial and gain full access.