The State of the Market – Trend, Breadth & Leadership – A Trend-Momentum Strategy

- Arthur Hill, CMT

Welcome to the Chart Fix!

Despite pockets of weakness, the weight of the evidence is bullish for stocks – and has been bullish for several months. Until the evidence changes, we should be exposed to names in leading groups. It is often a bumpy ride full of uncertainties, but the key, as always, is to step back, turn off the news and focus on the charts. SPY is in a long-term uptrend, breadth is clearly bullish and non-tech sectors are leading. Today’s report will cover these items and show a trend/momentum approach to find two candidate stocks in a leading sector.

- SPY in a Clear Uptrend with Bullish Breadth

- Finance, Healthcare and Industrial Stocks Lead

- Combining the Trend and Momentum for Stock Selection

- Two Healthcare Stocks for Consideration

Recent Reports and Videos for Premium Members

- Setups in three Defensive ETFs and a Two Mag7 Stocks

- Bonds Break Out as Gold Forms Small Bullish Pattern

- Trend Signals and Momentum Scores for Dow 30 and Sector SPDRs

- Click here to take a trial and gain full access.

SPY in a Clear Uptrend

The first chart shows SPY crossing above its 200-day SMA in mid May and hitting new highs in early January. The S&P 500 is the most important benchmark for US stocks. There is a bull market somewhere when SPY is above its 200-day SMA and hitting new highs. Sure, we could see a correction, but the trend is up until proven otherwise.

The indicator window shows the Momentum Composite, which aggregates overbought and oversold signals in five momentum indicators. Readings at -3 or lower signal conditions. It hit -3 in late November for the first oversold reading since the uptrend began. This means three of the five indicators were oversold. The Momentum Composite is one of 11 indicators in the TIP indicator edge plugin for StockCharts ACP.

Looking for indicators with an edge? Check out the TIP Indicator-Edge Plugin for StockCharts ACP. Click here to learn more.

Finance, Healthcare and Industrial Stocks Lead

The table below shows the percentage of stocks above their 200-day EMAs for four major indexes and the eleven sectors. Finance, Healthcare and Industrials are leading with the most stocks above their 200-day EMAs. These three account for 31.5% of the S&P 500. Technology is still the biggest sector with a 34.5% weighting. Tech is lagging with 58% of component stocks above their 200-day EMAs. Even so, the cup is still half full because the majority of its components are in long-term uptrends.

Also note that the S&P MidCap 400 has more stocks in long-term uptrends than the S&P 500. Even though the S&P 500 is lagging, 65% of its stocks above their 200-day EMAs. This is by no means weak because the vast majority of S&P 500 stocks are in long-term uptrends.

Combining the Trend and Momentum Composites

We are in a bull market with the healthcare sector leading. With this in mind, my strategy is to find healthcare stocks that are oversold within uptrends. An oversold condition means there was a pullback within the uptrend, which is an opportunity.

The next two charts show the Trend Composite in the bottom window and the Momentum Composite in the middle window. The Trend Composite is used to define the long-term trend, which is up in both cases. Once in an uptrend, the Momentum Composite is used to identify short-term overbought conditions within the uptrend. Oversold conditions provide traders with opportunities to trade in the direction of the bigger trend.

The first chart shows IDXX with a pullback into December and oversold condition on January 2nd as the Momentum Composite hit -4. A falling wedge formed on the price chart and the stock broke out with a surge the last four days.

The next chart shows CVS Health (CVS) with the Trend Composite positive (uptrend) and the Momentum Composite becoming oversold on December 2nd (-3). A falling wedge formed and the stock broke the wedge line with a gap surge on December 9th. The wedge looks like a correction within the long-term uptrend. The gap-breakout signals an end to this correction and a resumption of the uptrend.

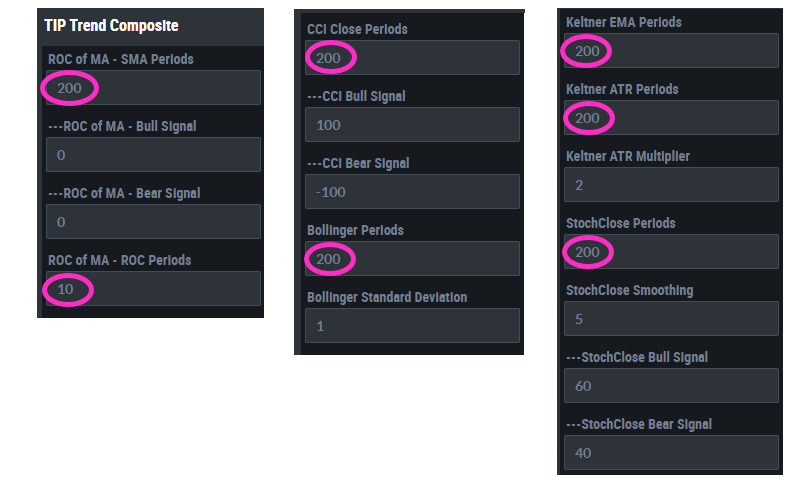

Trend Composite Settings

All indicators have default settings, which we can change based on our preferences. I am NOT using the default settings for the Trend Composite. Instead of 125 periods, I am using 200 periods for each of the five indicators. In general, I find that 200 periods works better for stocks (fewer whipsaws and longer trends). The image below shows these settings.

Recent Reports and Videos for Premium Members

- Setups in three Defensive ETFs and a Two Mag7 Stocks

- Bonds Break Out as Gold Forms Small Bullish Pattern

- Trend Signals and Momentum Scores for Dow 30 and Sector SPDRs

- Click here to take a trial and gain full access.