Key Influences on Stock Performance – Bullish Patterns for Two Cybersecurity Stocks

- Arthur Hill, CMT

Welcome to the Friday Chart Fix!

Trading is all about putting the odds in your favor. When picking stocks, we can improve our odds by staying on the right side of the market and focusing on names in leading sectors and industry groups. Today’s report starts with the market environment and a leading sector (tech). We then feature the leading uptrend in the Cybersecurity ETF and two names with bullish patterns.

- Market, Sector and Industry Group Influence

- Cybersecurity ETF in Leading Uptrend

- Bullish Continuation Patterns for Two Cybersecurity Leaders

Recent Reports and Videos for Premium Members

- Alphabet, Nvidia and Tesla: Analysis and Levels

- Bond ETFs Hold Breakouts as Base Metals Turn Back Up

- Four Stocks from Two Strong Groups (Industrials, Healthcare)

- Stock Market Remains Defensive as SPY Consolidates

- Click here to take a trial and gain full access.

Market, Sector and Industry Group Influence

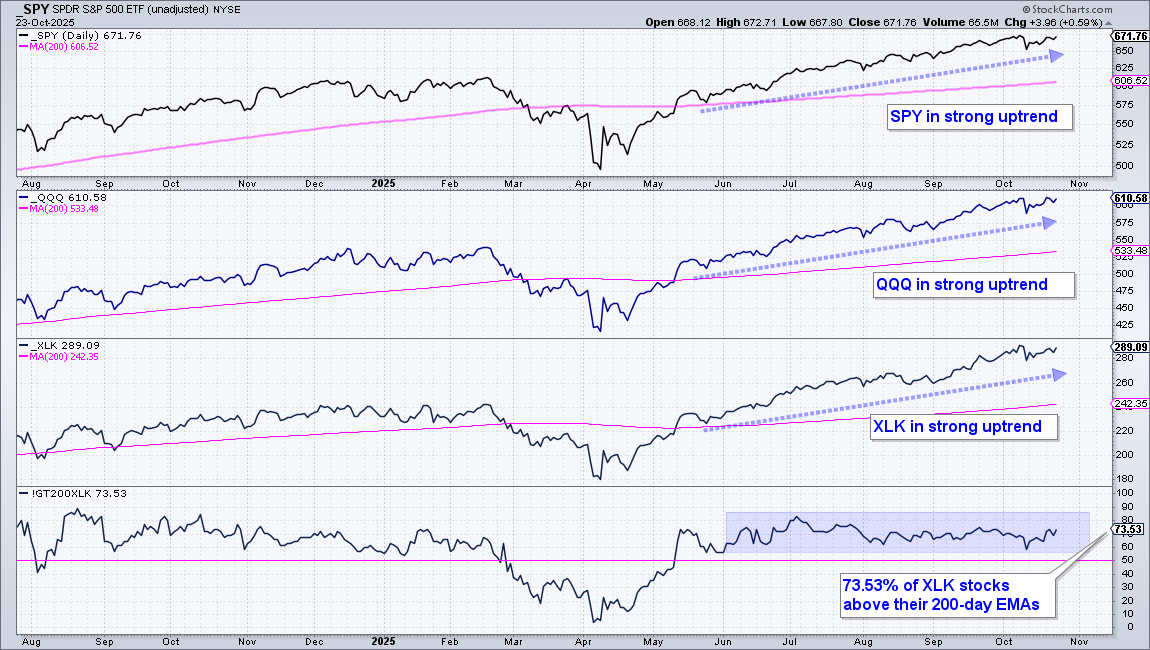

Many factors influence individual stock prices. Chief among these factors are the broad market environment, sector performance and industry group performance – in that order. Chartists should consider stocks during bull markets and stock alternatives during bear markets. There is clearly a bull market somewhere because SPY and QQQ hit new highs in October and remain well above their rising 200-day SMAs. Looking at sector performance, the Technology SPDR (XLK) is also in a leading uptrend and is the leading sector year-to-date (+24.91%). There is also broad strength within Technology because 73.55% of its stocks are above their 200-day EMAs. This is the second highest of the 11 sectors (XLU is tops with 100%!).

Looking for indicators with an edge? Check out the TIP Indicator-Edge Plugin for StockCharts ACP. Click here to learn more.

Cybersecurity ETF in Leading Uptrend

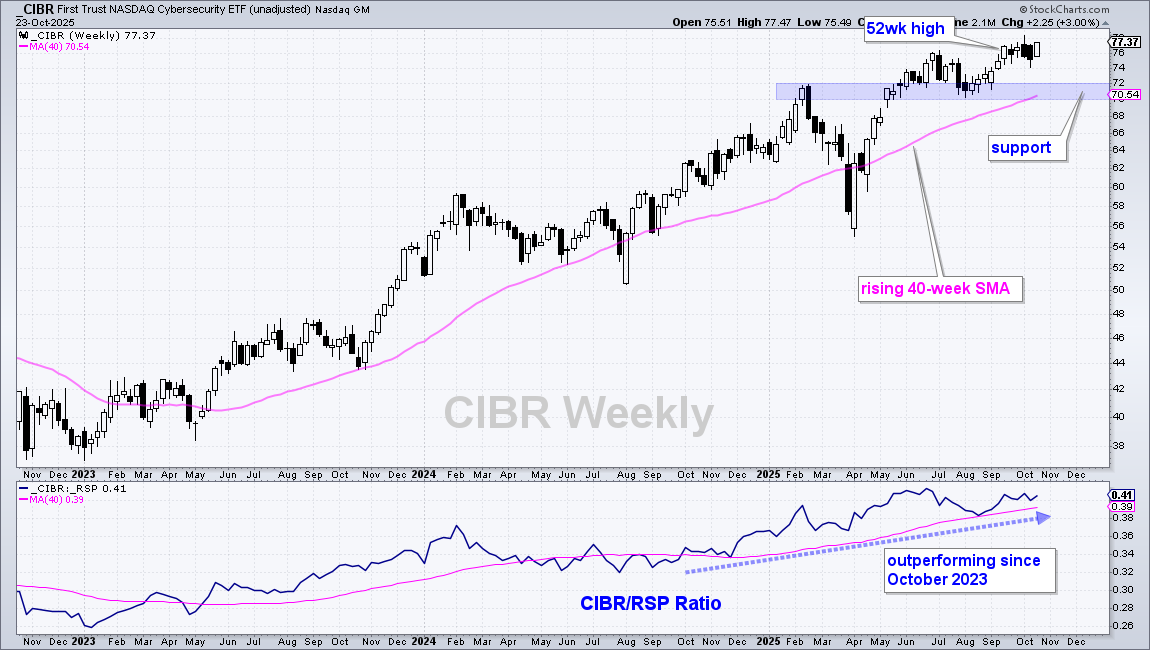

Within the technology sector, the Cybersecurity ETF (CIBR) is in a leading uptrend with price near a 52-week high and a rising relative performance line. Until these facts change, I expect this uptrend to continue. On the price chart, the trend is clearly up as CIBR hit 52-week highs from June to October and remains above the rising 40-week SMA. Broken resistance, the summer lows and 40-week SMA mark long-term support in the 70-72 area (blue shading). The bottom window shows the price-relative (CIBR/RSP ratio) turning up in late September 2023 and rising throughout 2025. This ratio rises when CIBR outperforms and falls when CIBR underperforms. The trend here favors relative strength because the price-relative is above its rising 40-week SMA.

Cup-with-Handle Pattern for Two Leaders

The market environment is bullish, technology is a leading sector and the Cybersecurity ETF sports a leading uptrend. This is an industry that warrants our attention for individual stock setups. Let’s look at two with classic bullish continuation patterns.

Popularized by William O’Neil of IBD, the cup-with-handle is a bullish continuation pattern. Here are some key characteristics. First, note that bullish continuation patterns form within uptrends and represent a consolidation within the uptrend. The cup forms with a pullback and recovery back to the prior highs. The handle forms with a shallower pullback or consolidation near the highs. Shallow pullbacks signal a decrease in selling pressure, which is a positive sign. The pattern highs mark rim resistance and overhead supply. A break above rim resistance signifies a material increase in buying pressure because demand overpowered supply. This breakout also signals the end of the consolidation phase and the resumption of the bigger uptrend.

The chart above shows CrowdStrike (CRWD) with the cup-with-handle forming above the rising 200-day SMA. The right side of the pattern looks like a surge-flag setup. CRWD surged from the 200-day to rim resistance and then consolidated within a tight range. With a surge on Thursday, the stock broke rim resistance and recorded a fresh 52-week high. The lower window shows the price-relative (CRWD/RSP ratio) rising since early September as CrowdStrike outperforms. Note that I featured this stock in late August as it tested the 200-day SMA with a classic correction.

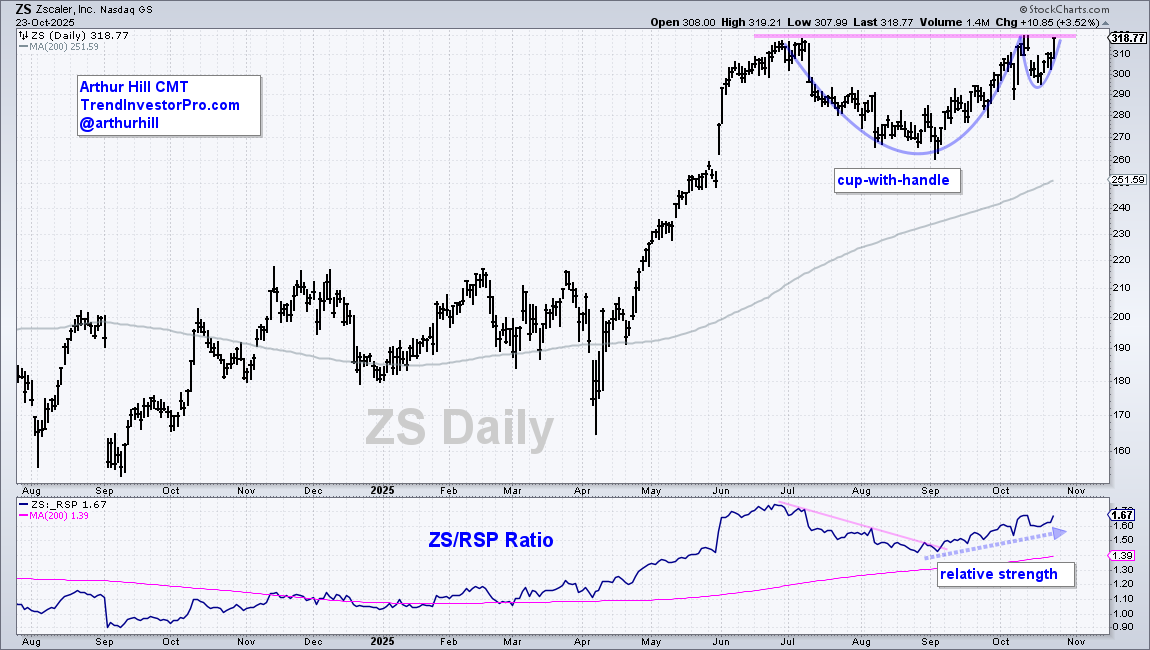

The next chart shows Zscaler (ZS) forming a cup-with-handle well above the rising 200-day SMA. ZS is currently challenging rim resistance and a breakout would confirm the pattern. The lower window shows the ZS/RSP ratio turning up in early September as ZS resumed its relative strength uptrend. Note that I featured ZS in early September as it firmed near a key retracement.

Recent Reports and Videos for Premium Members

- Alphabet, Nvidia and Tesla: Analysis and Levels

- Bond ETFs Hold Breakouts as Base Metals Turn Back Up

- Four Stocks from Two Strong Groups (Industrials, Healthcare)

- Stock Market Remains Defensive as SPY Consolidates

- Click here to take a trial and gain full access.