102 Days above 50-day – New Lows – Tech Power – Commodity Bulls – Oil Gets Interesting

- Arthur Hill, CMT

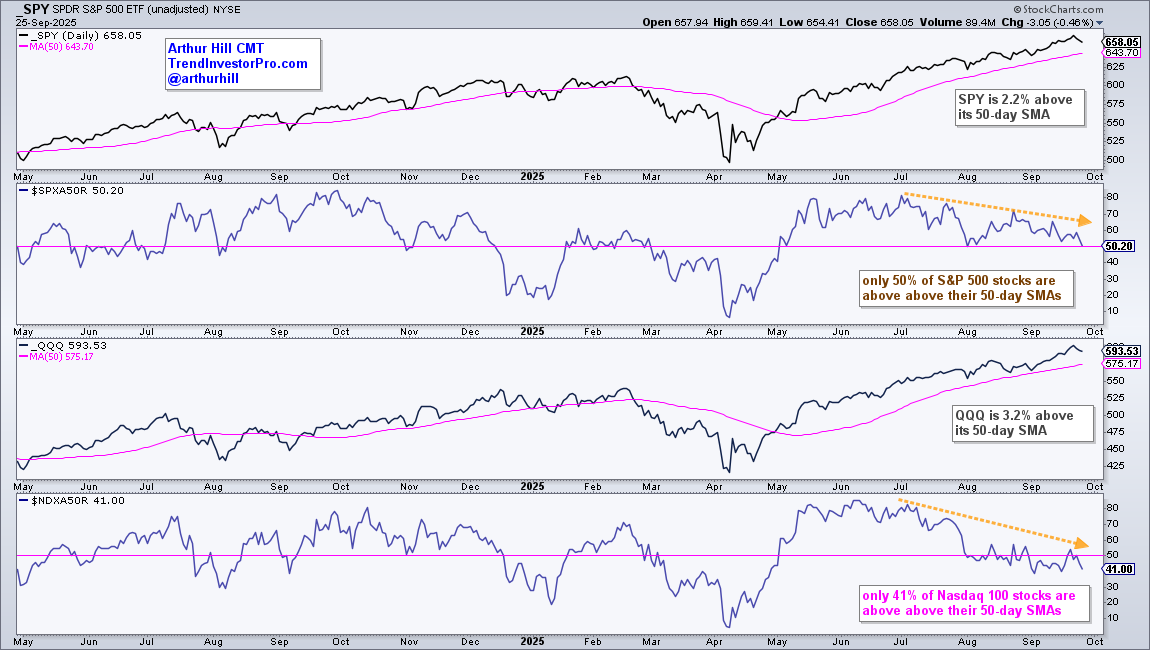

Welcome to the Friday Chart Fix! SPY reached a milestone this week as it held above its 50-day SMA for more than 100 days, which was the seventh such occurrence since 2000. Even though SPY is 2.2% above its 50-day, only half of its components are above their 50-day SMAs and new lows are expanding. However, a correction in SPY could remain elusive until tech stocks and the MAG7 buckle. Elsewhere, it is a bull market in commodities and even energy is starting turn up.

Recent Reports and Videos for Premium Members

- Setups in three Defensive ETFs and a Two Mag7 Stocks

- Bonds Break Out as Gold Forms Small Bullish Pattern

- Trend Signals and Momentum Scores for Dow 30 and Sector SPDRs

- Click here to take a trial and gain full access.

SPY above 50-day SMA for 102 Days

SPY crossed above its 50-day SMA on May 1st and has been above this moving average for 102 days. This is the seventh time since 2000 that SPY has held above its 50-day SMA for more than 100 days. The chart below shows the prior milestones with the date the number hit 100 and the total number of days above the 50-day SMA. This shows just how shallow the pullbacks were since May, and that it has been a long time since a decent pullback. The bottom window shows Percent above MA (1,50,1), which is the percentage difference between the close and the 50-day SMA. SPY is 2.20% above its 50-day.

Percent above MA (1,50,1) is one of 11 indicators in the TIP Indicator-Edge Plugin for StockCharts ACP. Click here to learn more.

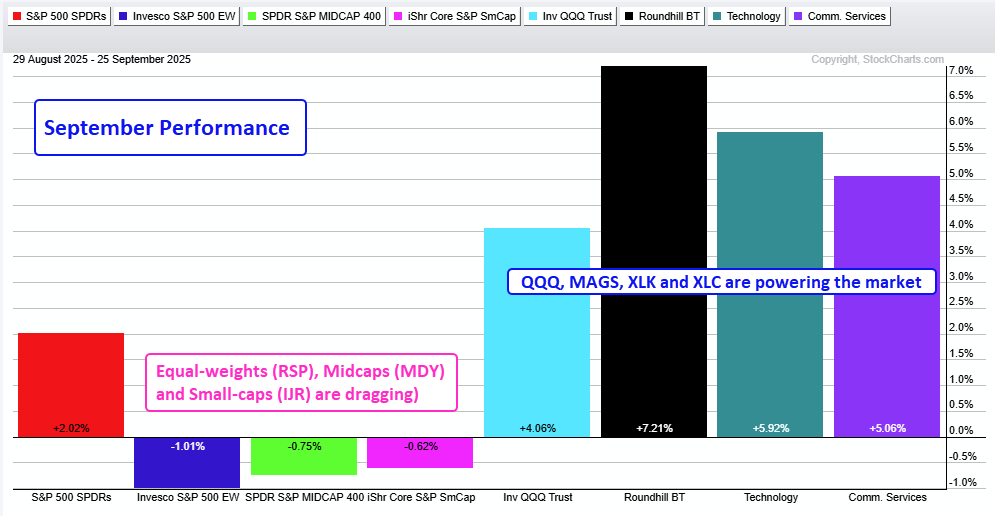

QQQ, MAGS, XLK and XLC Power the Market

SPY and QQQ recorded new highs this week to affirm their uptrends. Thus far, SPY is up 2% in September and QQQ is up 4%. Life is good for large-caps, the MAG7 and the Technology sector. Tech stocks account for 34.5% of the S&P 500 and 61% of the Nasdaq 100. SPY and QQQ can continue as long as the MAG7 and tech sector remain strong. Elsewhere, note that the S&P 500 EW ETF (RSP) is down 1% so far this month. The S&P MidCap 400 SPDR (MDY) and S&P SmallCap 600 SPDR (IJR) are also down month to date. There is a bull market in one part of the market and a correction elsewhere.

Corrections within the S&P 500 and Nasdaq 100

Individual stocks are correcting when we look under the surface. SPY is 2.2% above its 50-day SMA and QQQ is 3.2% above its 50-day SMA. On the chart below, we can also see that only 50% of S&P 500 stocks are above their 50-day SMAs. This is the lowest number since early August. Weakness within the Nasdaq 100 is more pronounced with only 41% of its components above their 50-day SMAs. These bearish divergences have yet to affect SPY and QQQ, but they “bear” watching.

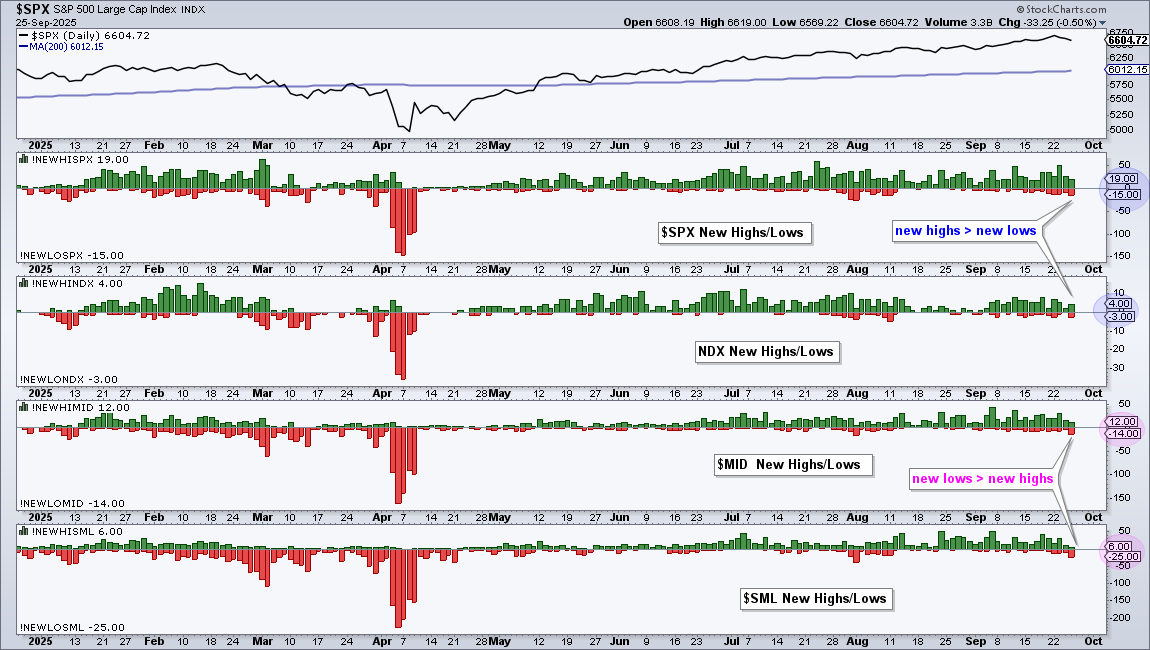

What a Drag it is Being a Small-Cap

The stock market sneezed on Wednesday-Thursday with the S&P 500 falling .78% in two days. Small-caps took it harder as the S&P SmallCap 600 fell 1.74%, more than twice as much as the S&P 500. Small-caps remain fragile as a group because the number of new lows (25) exceeded the number of new highs (6) on Thursday. Stocks hitting new lows are in strong downtrends and the S&P SmallCap 600 has the most of the major indexes.

Bull Market for a Broad Commodity ETF

The Continuous Commodity ETF (GCC) is a broad-based commodity ETF with a sprinkling of crypto. Yes, crypto accounts for 6.38%. For reference, the chart below shows the component weightings in the upper left. GCC is in a strong uptrend with price well above the rising 200-day SMA and new highs here in September. There is a message here: commodities are in a bull market and should be part of our portfolio. The lower window shows 2-year performance for Bitcoin and four commodity groups. Bitcoin is leaving the others in the dust, but the DB Precious Metals ETF (DBP) is up a highly respectable 82%. TrendInvestorPro is following the early September breakout in the Copper ETF (CPER).

Even the DB Commodity ETF Shows Promise

The DB Commodity ETF (DBC) is a different beast because it is heavily weighted towards energy-related commodities (oil, gasoline, natural gas). As the weighting on the chart shows, energy accounts for a whopping 55.72% of the ETF. The bottom window shows Light Sweet Crude ($WTIC) and Brent Crude ($BRENT) in downtrends since April 2024 (pink lines).

Despite downtrends in oil, I am seeing bullish price action on the DBC chart. Note that TrendInvestorPro covered oil and four energy-related ETFs in Thursday’s report/video. DBC surged from early April to mid June with a breakout in the 21.50 area. It then fell back to the breakout zone with a falling wedge that retraced 50% of the prior surge. This is normal price action for a correction after a breakout surge (50% retracement, wedge, return to breakout zone). DBC surged in September and broke out of the falling wedge. This signals a continuation of the April-June surge and argues for higher prices.

Recent Reports and Videos for Premium Members

- Setups in three Defensive ETFs and a Two Mag7 Stocks

- Bonds Break Out as Gold Forms Small Bullish Pattern

- Trend Signals and Momentum Scores for Dow 30 and Sector SPDRs

- Click here to take a trial and gain full access.