Friday Chart Fix – 2024 vs 2025 – Commodities with Crypto – Key Moment for IWM – The Tesla Squeeze

- Arthur Hill, CMT

Welcome to your Friday Chart Fix. Today we start with the difference between the 2024 bull market and the 2025 bull run. The S&P Total Market Index ETF hit new highs in July, but 2025 breadth is not what it was in 2024. Small-caps are weighing on the broader market as the Russell 2000 ETF battles its 200-day SMA. Even though QQQ is leading the major index ETFs with a double-digit gain year-to-date, Bitcoin and Gold are up twice as much as QQQ. Oddly enough, strength in Bitcoin may be helping the Continuous Commodity ETF (GCC). And finally, we close with Tesla and a Bollinger Bands squeeze.

Recent Reports and Videos for Premium Members

- Setups in three Defensive ETFs and a Two Mag7 Stocks

- Bonds Break Out as Gold Forms Small Bullish Pattern

- Trend Signals and Momentum Scores for Dow 30 and Sector SPDRs

- Click here to take a trial and gain full access.

Majority of S&P 1500 Stocks in Downtrends

The S&P Total Market Index ETF (ITOT) hit a new high, but the 2025 bull run is not the same as the 2024 bull run. In 2024, S&P 1500 %Above 200-day SMA ($SUPA200R) ranged from 55 to 80 percent and S&P 1500 High-Low Percent regularly exceeded +10% (blue shading). In 2025, %Above 200-day has yet to exceed 60% and High-Low Percent has yet to exceed +10%. ITOT hit new highs in July, but the internals reflect a split market because 48% of S&P 1500 stocks are above their 200-day SMA. This means 52% are below.

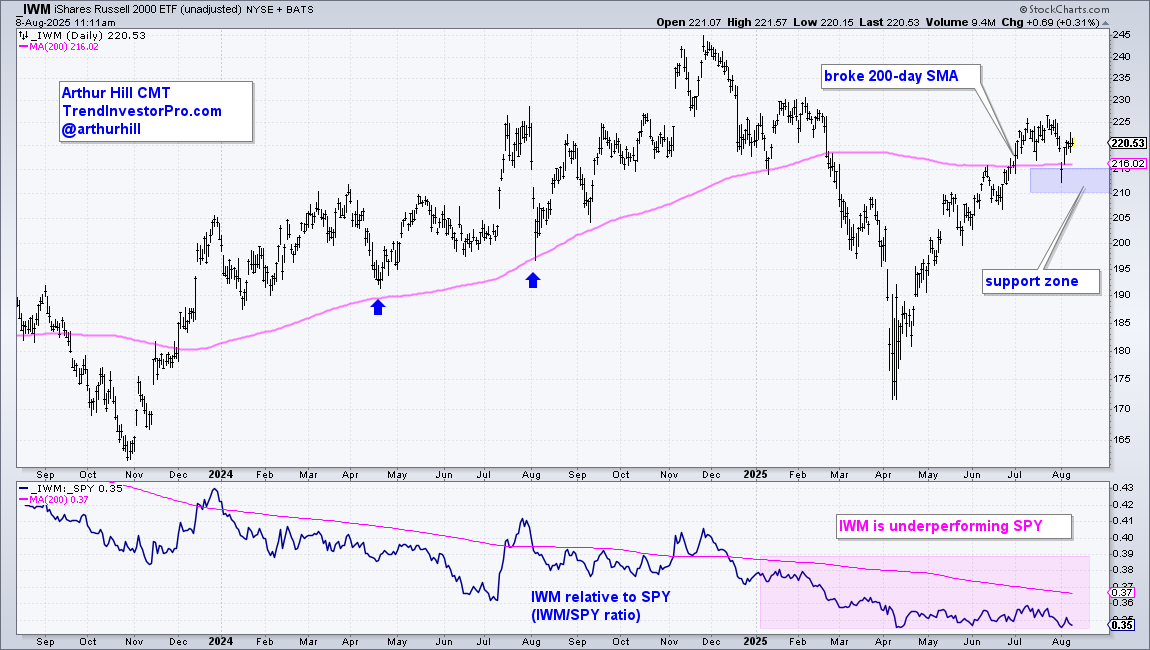

IWM Battles 200-day SMA

The Russell 2000 ETF (IWM) broke above its 200-day SMA on July 1st and is largely holding above this key moving average. Notice how the 200-day SMA acted as support in April and August 2024 as the ETF advanced last year (green arrows). IWM took a hit on August 1st with a close below the 200-day, but immediately bounced back. This establishes a support zone in the 210-215 area. A close below 210 would decisively break the 200-day and reverse the four month upswing.

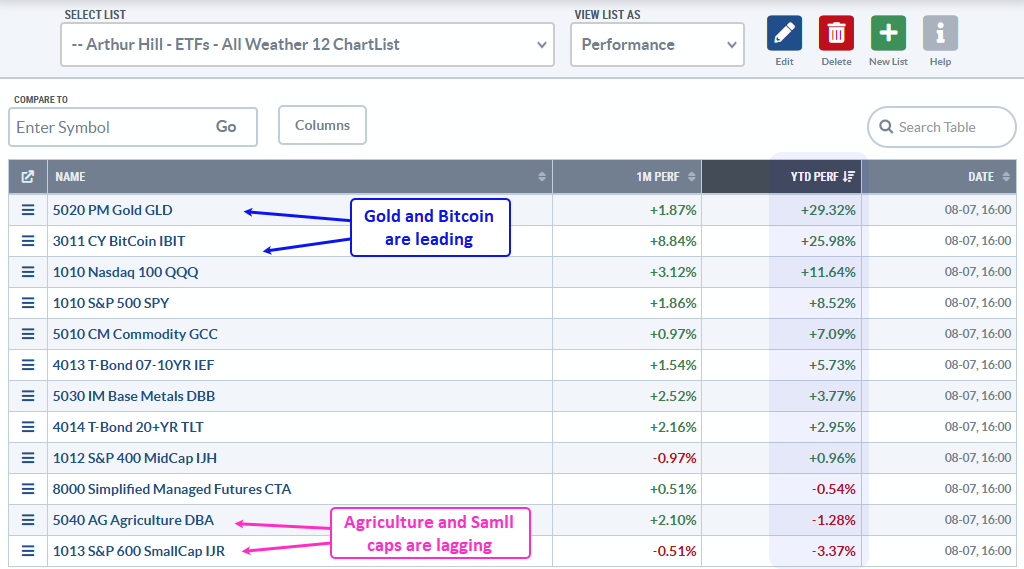

Gold and Bitcoin Lead as Small-caps Lag

The table below shows 1-month and year-to-date performance for 12 All Weather ETFs. It is sorted by year-to-date performance with the Gold SPDR (GLD) and Bitcoin ETF (IBIT) showing the biggest gains. Both are up more than twice QQQ. The Continuous Commodity ETF (GCC) and 7-10Yr TBond ETF (IEF) are having a pretty good year with gains greater than 5%. The S&P MidCap 400 ETF (IJH) is struggling, while the S&P SmallCap 600 SPDR (IJR) is the laggard with a 3.37% year-to-date loss.

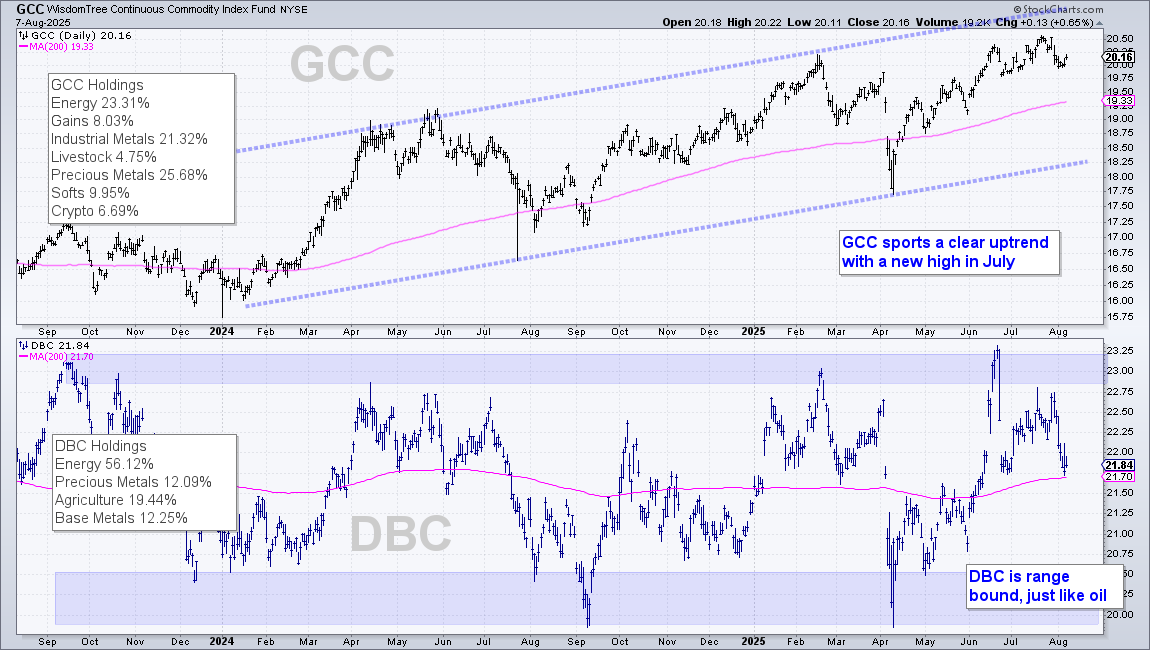

A Broad Commodity ETF with a Dash of Crypto

The DB Commodity ETF (DBC) is the most widely traded commodity ETF, but it is heavily weighted towards energy (56.12%). The Enhanced Commodity ETF (GCC) is more balanced with energy weighing less than a quarter (23.31%). GCC also includes some crypto (6.69%), which I did not know qualified as a commodity. Check out the WisdomTree website for more. Average volume is extremely low, but this ETF can be used as a broad commodity tracker because it is more balanced. The top window shows GCC in a clear uptrend with a new high in July. This means bull market for commodities. The lower window shows DBC in a trading range, just like oil.

A Bollinger Band Squeeze for Tesla

The chart below shows Tesla (TSLA) with Bollinger Bands (pink shading) and BandWidth (20,2). Notice how the Bands contracted the last few weeks and Bandwidth dipped below 1.2 for the first time since early February. This reflects a volatility contraction that could give way to a volatility expansion. The price chart shows a contracting range with a triangle forming. The direction of the break will dictate the next directional move.

Recent Reports and Videos for Premium Members

- Setups in three Defensive ETFs and a Two Mag7 Stocks

- Bonds Break Out as Gold Forms Small Bullish Pattern

- Trend Signals and Momentum Scores for Dow 30 and Sector SPDRs

- Click here to take a trial and gain full access.