The S&P 500 and broad market indexes popped on Wednesday-Thursday. We also saw short-term breakouts in a number of ETFs. Are these breakouts enough to end the corrective period that began with the September decline? Or, is this just a short-term head fake that will fizzle? The short-term breakouts are holding until proven otherwise, but I am not convinced that the correction has run its course because the rebound in breadth was subdued.

Watch %Above SMAs for Breakout

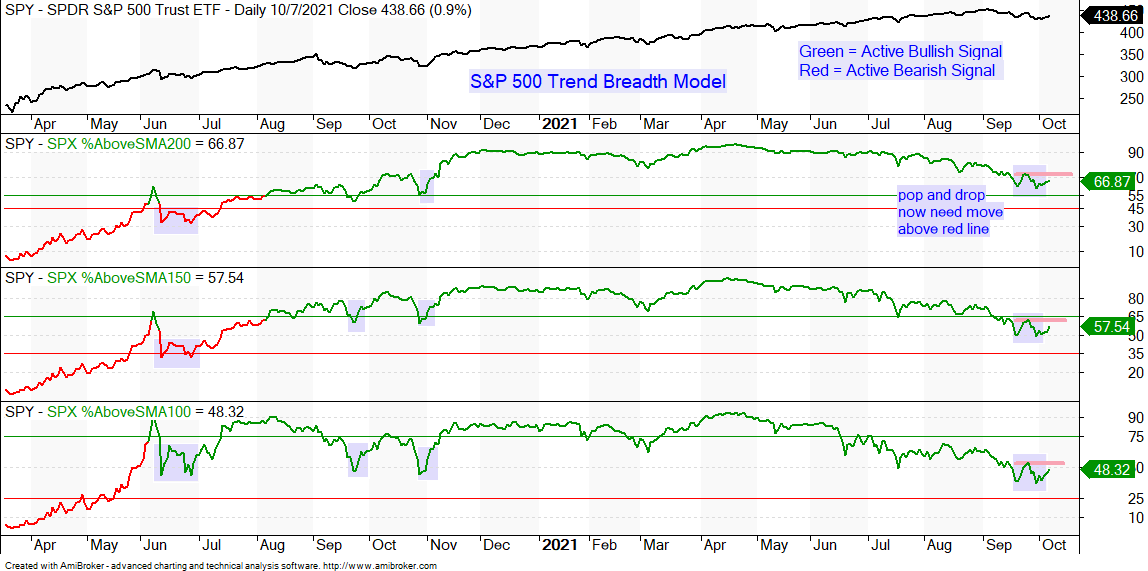

The chart below shows the percentage of S&P 500 stocks above the 200, 150 and 100 day SMAs. All three fell from April to mid September as participation narrowed during these months. All three ticked up with a pop in mid September and then fell back into late September (blue shading). They turned up over the past week, but we need to see a break above the red lines (prior highs) to show a true improvement in breadth. Such breakouts would show broadening participation and this would be bullish. Until then, the broader market could remain in corrective mode.

Wedge Breakout and Short-Term Breadth

The S&P 500 SPDR (SPY) broke out of a falling wedge on Thursday with a gap. This move also confirms the harami, which formed on Monday-Tuesday (long black candlestick and smaller white candlestick). The gap and breakout are treated as bullish as long as they hold. Short-term, SPY did not close strong on Thursday and there was no follow through after the gap. Even so, the gap and breakout are holding for now. A close below 435 would fill the gap and throw cold water on the breakout.

The first indicator window shows SPX Advance-Decline Percent ((advances – declines) / total issues)). The green bars show moves above +80% (broad upside participation) and the red bars show moves below -80% (broad downside participation). The green arrows/shading show strong upside days that reinforced the bullish continuation patterns in early March, late March and mid May. There were also +91% and +79% days in mid June and mid July. These occurred after sharp declines and marked a convincing rebound (bullish).

There were two -80% down days in September and we have yet to see breadth rebound in convincing fashion. Advance-Decline Percent did not exceed 55% over the last five days (yellow shading). This shows weak breadth behind the breakout and makes it a bit suspect. The bottom window shows the SPX Zweig Breadth Thrust and we have yet to see a thrust above .615.

Watch IJR and MDY

Breadth indicators often improve when mid-caps and small-caps break out because their respective ETFs are not driven by a few large-caps. The S&P SmallCap 600 SPDR (IJR), which I prefer over the Russell 2000 ETF (IWM), remains locked in a big trading range. This range narrowed over the last few months and a triangle is taking shape. Short-term, IJR bounced in late September, formed a small falling flag into early October and broke out of this flag on Thursday. A follow through move would trigger a triangle breakout and signal a continuation of the prior advance.

Other Notes

The Composite Breadth Model (CBM) remains bullish and has been bullish since May 2020 (see Market Regime page for charts covering the CBM, yield spreads and Fed balance sheet).

Investment grade and junk grade corporate bond spreads ticked up the last two weeks, but remain at low levels overall (since July) and there are no signs of stress in the credit markets.

The Fed balance sheet expanded by $16 billion to partially make up for last week’s $41 billion contraction. The overall trajectory remains up since July 2020.

The 20+ Yr Treasury Bond ETF (TLT) broke down in late September and the 10-yr Treasury Yield surged over the last four weeks.

The Gold SPDR (GLD) remains in a long-term downtrend.

The Dollar Bullish ETF (UUP) is trading above its breakout zone and remains in an uptrend.

Oil hit another 52-week high and remains one of the strongest commodities.

TLT Breaks Down after Retracement

The 20+ Yr Treasury Bond ETF (TLT) broke down in late September and this breakdown signals a continuation of the prior decline (August to March). Notice that the bounce from March to July retraced around half of this decline. This is one step up after two steps down. TLT stalled around 150 in the summer and then broke support with a sharp decline in late September. TLT is short-term oversold, but the breakdown argues for a move below the March low. The 10-yr Treasury Yield sports a mirror image and the breakout argues for a move above the March high (towards 2%). Banks are benefitting from rising rates.

Gold Pops within Downtrend

The Gold SPDR (GLD) got an oversold bounce in late September, but remains in a clear downtrend. Long-term, GLD has been working its way lower since August 2020 and hit a new low in March. Medium-term, GLD peaked in early June and the red lines define a falling channel. The green arrows show when the Momentum Composite dips to -3 or lower. GLD was oversold on 29-Sept and got a bounce. A small, very small, pennant formed the last few days and a breakout would argue for an extension of this bounce. This is very short-term stuff and still going against the bigger downtrend.

Dollar Holds above Breakout

The Dollar Bullish ETF (UUP) remains strong with a break above the spring highs in late September. Long-term, the pattern looks like a massive double bottom. Medium-term, the Dollar was already in an uptrend when it moved into the upper half of the range in late June. UUP consolidated in the summer and then broke out to resume its uptrend. There is no setup on the chart. Just an uptrend.

Oil Extends on Channel Breakout

Oil extended on its channel breakout and hit another new high this week. Spot crude is up over 20% since mid August and one of the strongest commodities out there. There is no setup on this chart, just a strong and leading uptrend. The lower window shows the DB Energy ETF (DBE), which is around 92.3% oil complex and 7.6% natural gas. The price charts are pretty similar with consolidation breakouts in April and August, and a new high this week.