Get Your Curated ETF Lists

All Weather List, Core List and Master List

Introducing two chart lists: a Master ETF list with over 200 ETFs and a focused All Weather list with 50 ETFs. Chartists looking for a wide array of industry group, commodity and international ETFs can turn to the Master list. Chartists looking for focus, diversification and long trading histories can use the All Weather list. Each list is organized in a top-down manner with numerical prefixes for sorting. Download links can be found at the bottom of this article.

There are also download links for csv files at the bottom of this article.

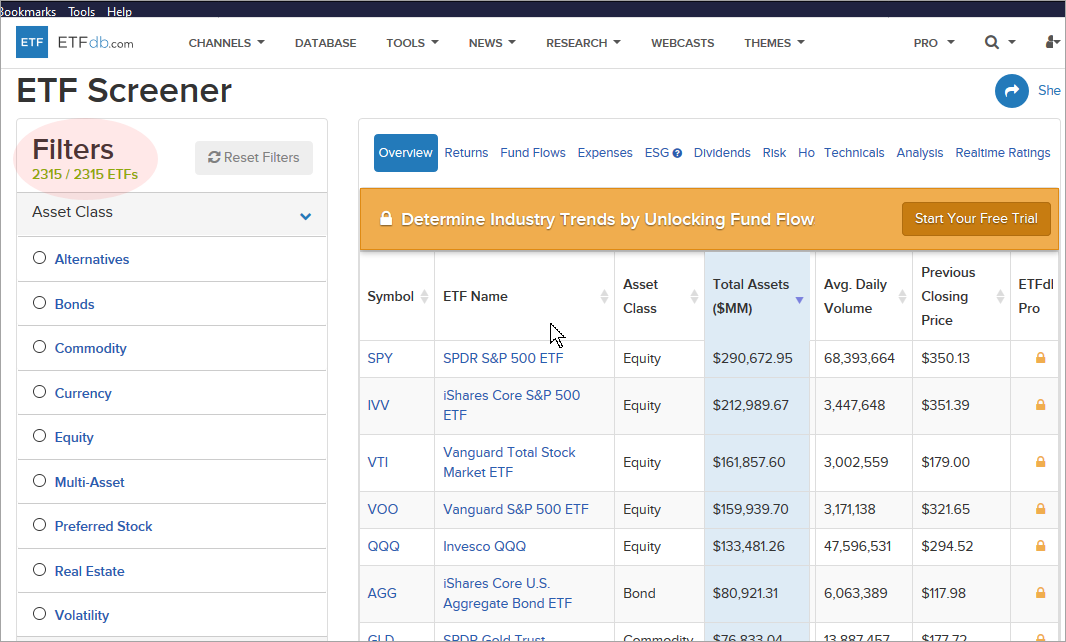

There are currently over 2300 ETFs in the US covering over $4 trillion in assets under management. This number is expected to exceed $50 trillion by 2030. There are dozens of categories covering active management, passive investing, factor investing, sectors, industry groups, commodities, bonds, foreign stocks, currencies and more. Tis enough to make one’s head spin. A little curation is required.

The All Weather ETF list includes ETFs with trading history back to 2007 and is designed to provide signals no matter what the market environment. This “all weather” concept takes a page from Ray Dalio of BridgeWater. See this post for more on the All Weather concept. This list has 36 equity-related ETFs and 14 alternative ETFs. I made a few adjustments by removing some duplicates and adding some ETFs to increase diversification. It is equity heavy because there is lots of choice in the equity market. The other 14 ETFs cover commodities, bonds and currencies.

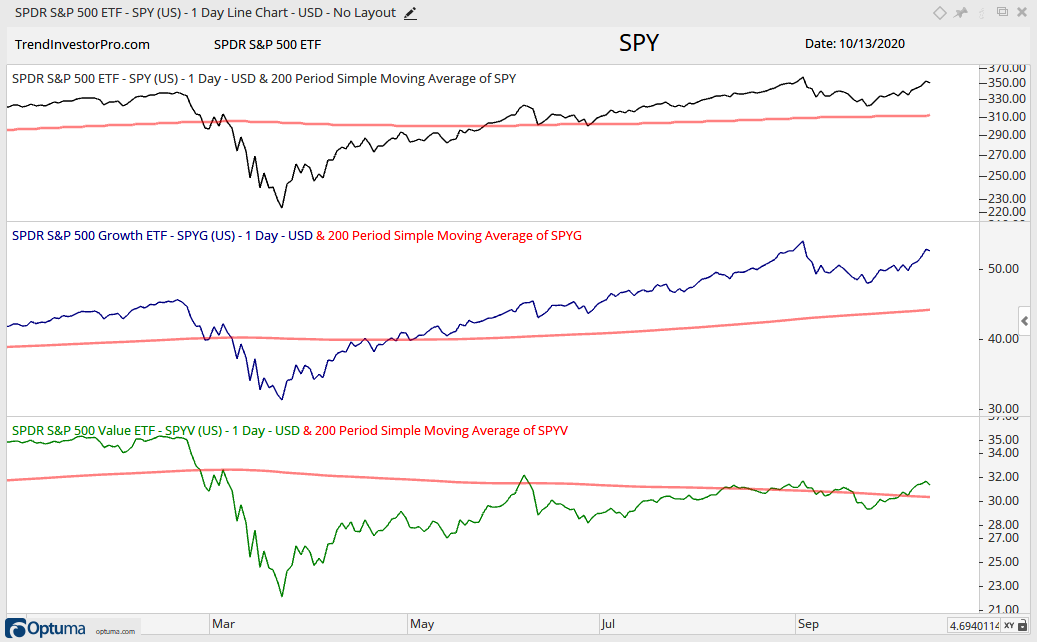

Let’s start with stock-related ETFs. Chartists should focus on a few major index ETFs, the sector SPDRs and a curated list of industry group ETFs. Forget ETFs that fall between the major index and sector level because they are just sector-industry mashups. These include factor ETFs and growth/value ETFs. They do not offer clear alternatives and are highly correlated to the broader market or their dominant sector.

Do you really know what you are getting? As of October 2020, tech (22%) and healthcare (16%) were the biggest sectors in the S&P 500 Minimum Volatility ETF (USMV). Healthcare, ok, but tech does not make much sense here. The S&P 500 Value ETF (SPYV) is also healthcare heavy at 19.36%. So healthcare is both value and growth. The S&P 500 Growth ETF (SPYG) makes sense because it is mostly technology (40%). Nevertheless, it tracks the tech-heavy S&P 500 SPDR step-for-step. Rather than trade factor mashups, we are better off jumping to the sector/industry group level.

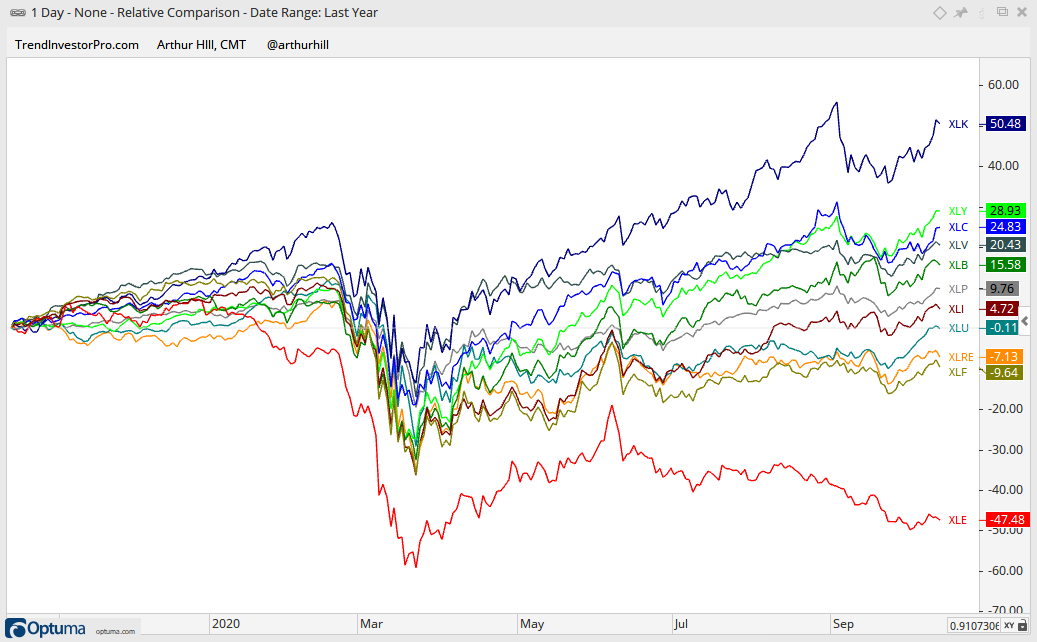

The sector SPDRs represent the 11 sectors within the S&P 500 and they are included in the list. I have not had much luck with sector rotation strategies, but I keep this group whole because they represent the sum of the parts for the S&P 500. The equal-weight and small-cap sector ETFs are worth a follow from an analytical standpoint, but they get low liquidity scores from ETFDB.com. I review these charts periodically because they reflect performance for the “average” stock in the sector. The sector SPDRs, in contrast, are weighted towards large-caps. The image below shows varying sector performance over a 1 year period.

Note that nine sector SPDRs have history back to 1999, but there were some serious realignments to consider when looking at historical data. The Communication Services SPDR (XLC) was extracted from the Technology SPDR (XLK) and Consumer Discretionary SPDR (XLY) in June 2018. The Real Estate SPDR (XLRE) was extracted from the Finance SPDR (XLF) in 2015. The XLY, XLK and XLF sectors you see today are not the same as they were prior to the realignments.

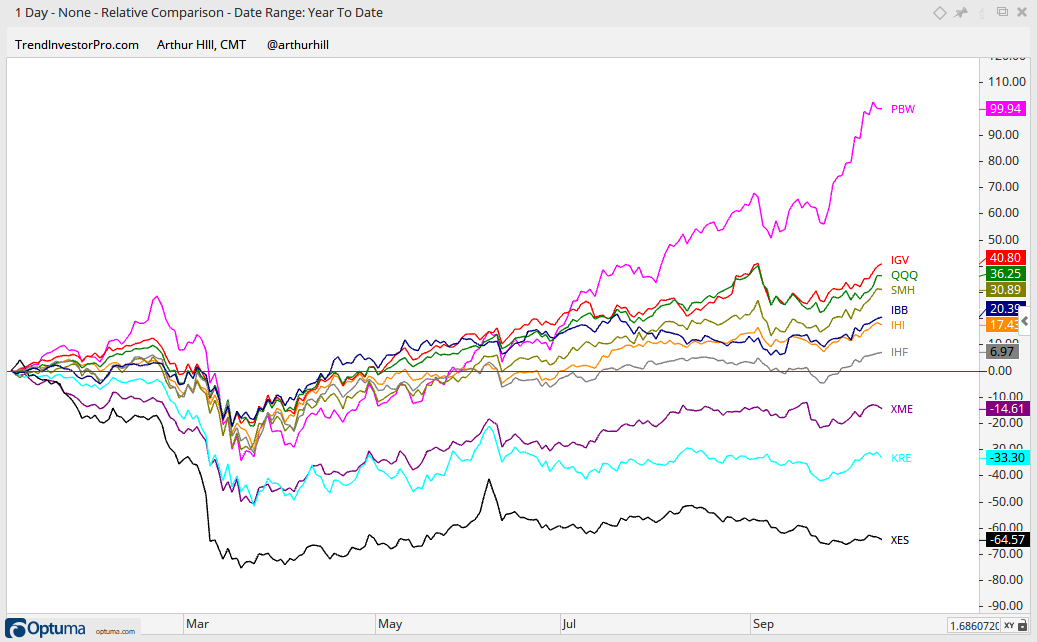

Industry group ETFs offer the most differentiation and outperformance opportunities (beta). These ETFs are more focused and homogeneous than the major index ETFs, sector SPDRs and factor ETFs. Key groups include software, semis, internet, housing, retail, banks, biotech, defense, oil and metals. The image below shows varying performance over a 1 year period.

All Weather 50 ETF List

Stock-related ETFs are the place to be during bull markets, but there are simply too many and most stock-related ETFs are highly correlated. In other words, you are not getting much diversification by having a universe of 1000+ stock-related ETFs to choose from.

The All Weather list cuts the duplicates and narrows the focus. ETFs in this list cover the broad stock market, sectors, industry groups, commodities, currencies and bonds. The goal of the All Weather list is to cover the major parts of the market with liquid ETFs that have relatively long trading histories (since at least 2007). This is important for backtesting purposes and studies. Furthermore, trend-following strategies need diversification for success over the long run. The idea is to create a truly diversified ETF list without much overlap. Personally, I am not a big fan of currency ETFs, but I must include them to get proper diversification. Stocks are the best game in town during bull markets, but we need alternatives when a bull market falters and a bear market takes over.

The All Weather list has 37 stock-related ETFs. There are 6 broad market ETFs (SPY, MDY, IJR, QQQ, RSP, IWC), 10 sector SPDRs, the REIT ETF (IYR), 19 industry group ETFs and one dividend ETF (DVY). The High-Yield Bond ETF (HYG) acts more like a stock-related ETF so it is grouped with the stock ETFs.

The Real Estate SPDR (XLRE) and Communication Services SPDR (XLC) started trading in 2015 and 2018, respectively. XLC is part of this list because I can hardly ignore a big sector that includes Alphabet and Facebook. I elected to use the REIT ETF (IYR) instead of XLRE because IYR has trading history back to 2000.

The 13 stock alternatives include six bond-related ETFs (AGG, IEI, IEF, TLT, LQD, HYG). There are five commodity-related ETFs (DBE, GLD, SLV, DBB, DBA) and three currency ETFs (UUP, FXE, FXY).

37 Stock ETFs:

SPY, RSP, MDY, IJR, IWC, QQQ, DVY, XLK, XLY, XLF, XLI, XLC, XLV, XLP, XLE, XLB, XLU, IYR, FDN, SOXX, IGV, ITB, XRT, KIE, KRE, ITA, PBW, IBB, IHF, IHI, XES, XOP, GDX, XME, PHO, PBJ, HYG

13 Alternatives:

AGG, IEI, IEF, TLT, LQD, GLD, SLV, DBE, DBB, DBA, FXE, FXY, UUP

Covering All Bases with the Master List

The master list has over 200 ETFs and represents around 10% of the ETFs on offer at ETFDB.com. There are lots of duplicate ETFs (3 Aerospace & Defense ETFs and 8 Clean Energy ETFs). I placed the clean energy ETFs as a subset of the Industrials sector, although they may also fit in Technology. Regardless, they are grouped. This list also includes over 50 international ETFs for those interested in other countries and such.

CSV Files for Download

Right click on button, choose “save link as”, save and then open in Excel.

Here is a link to a StockCharts article on creating ChartLists using a CSV file.

Here is a link to StockCharts article with a video midway down the page (Creating New ChartLists). The CSV instructions start around the 5 minute market and the narrator has a great voice.