A Few Clear Uptrends

There are just a few clear uptrends, a handful of leaders and lots of counter-trend bounces. IBB and GDX hit new highs and are the leaders right now, while GLD, TLT and UUP are in clear uptrends. Then we get to the rest. Everything else is trading BELOW its prior highs, which were recorded in January or February. Everything else fell sharply when the market crashed and rebounded to varying degrees over the last four weeks.

I am measuring the rebound based on the retracement of this counter-trend bounce. That is, how much of the prior decline did the rebound retrace. Chartists can quantify this with the value of the Fast Stochastic (60,1). This indicator shows us the location of the current price relative to the high-low range over the last 60 days, which extends back to January 17th. The example below shows MDY retracing around 36% and the last close is just below the 38% retracement line.

The scatter plot below shows the percent above the 200-day SMA on the y-axis and the 60-day Fast Stochastic on the x-axis. The strongest ETFs are in the upper right (TLT, XBI, IBB, GLD, GDX). The weakest are in the lower left (KRE, KBE, XAR, XME, XHB, IJR).

Retracements are Relative

There are lots of rising wedges and rising patterns over the last four weeks. Rising wedges are typical for counter-trend bounces and the base retracement is around 50%. Some retrace more (61.8%) and some retrace less (38.2%). Those with bigger retracements show relative strength, while those with shallower retracements show relative weakness. QQQ and XLV show relative strength with big retracements, while XLE and KRE show relative weakness with small retracements.

SOXX Hits Moment of Truth

We have a case study for the Semiconductor ETF (SOXX) as it forms a bearish pattern and shows the first signs of a bearish reversal. First and foremost, the ETF broke down in February-March with a sharp decline and the long-term trend is down. Second, SOXX bounced with a rising wedge that retraced around 61.8% of the prior decline. This decline marks two steps down and the bounce is a step or so up. SOXX stalled over the last two weeks and could be poised to reverse the rising wedge. A break below 215 would be bearish.

The indicator windows show RSI(10) and StochRSI(10), which is the Stochastic Oscillator applied to RSI. RSI is momentum and StochRSI is the momentum of momentum (velocity). When the bigger trend is down, the 50-70 zone is a danger zone for RSI because this is the area where upside momentum typically stalls. RSI moved above 50 on April 6th and dipped below 50 on Tuesday, but rebounded with Wednesday’s bounce. StochRSI captured the dip in RSI with a move below .20 on Tuesday. This is a downside momentum thrust that could signal the start of a leg lower.

I am highlighting SOXX at the beginning for two reasons. First, this setup is quite prevalent right now. Lots of stocks and ETFs retraced 38.2% to 61.8% of their declines and formed rising wedges of sorts. RSI also moved above 50. Second, semiconductors are a key group in the Technology sector, the Nasdaq and the market. They are also a highly cyclical group. Thus, a breakdown in SOXX could have bearish ramifications for the broader market.

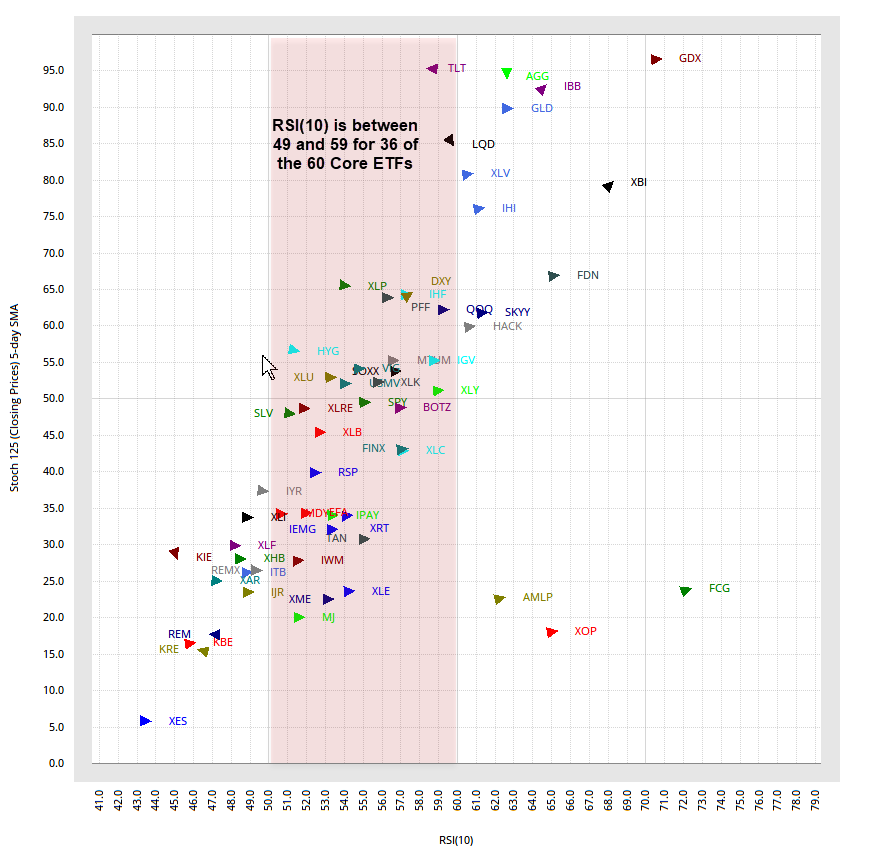

The scatter plot below shows the 5-day SMA of the 125-day Stochastic on the y-axis and RSI(10) on the x-axis. Note that RSI(10) is between 49 and 59 for 36 of the 200 core ETFs. With most of these ETFs in downtrends overall and RSI in the danger zone, this is a moment of truth for the broader market.

SPY Stalls in Danger Zone

SPY gets its own spot as well because it IS the market. There is no change from last week, except that SPY is down over the last three days (this week). SPY still looks vulnerable as it flirts with the 50% retracement and RSI(10) stalls in the danger zone. I view this as a danger zone because the Index and Sector Breadth Models are still bearish, SPY hit a new low in March and the ETF is below its falling 200-day SMA. Assuming the long-term trend is down, then the massive bounce back to the 285 area is considered a counter-trend bounce.

A counter-trend bounce is expected to fail because the bigger trend is the dominant force. In any case, the S&P 500 %Above 20-day EMA (!GT20SPX) became overbought above 80% two weeks ago and triggered bearish with a move lower the last two weeks. An RSI move below 50 would also act as a bearish trigger. StochRSI already triggered with a move below .20 on Tuesday.

Before getting too bearish, keep in mind that bears are fighting the Fed and the G-men, as well as the bulls. The Fed meets next week and Congress is set to vote on more stimulus. While I have my doubts that these efforts can lift the ceiling, they can certainly put a floor under the market.

Leaders with New Highs - Just Two

We will start with some monthly charts for the leaders. The Biotech ETF (IBB) is emerging out of a five year consolidation with a breakout and multi-year high this month. Note that I am using adjusted data because StockCharts does not adjust for splits and IBB split in November 2017. IBB surged some 600% from November 2003 until July 2010 and then embarked on a long consolidation. This biotech ETF then seriously lagged the S&P 500 for around five years as a massive triangle formed. This month’s surge pushed IBB out of the consolidation and forged a new high. Technically, this big breakout argues for much higher prices in the coming years.

Programming Note: I will post an article the pros and cons of dividend adjustments. In short, I prefer unadjusted data when analyzing price charts. However, I am gravitating towards dividend adjusted data for backtesting because dividends are a part of the return in trend-momentum strategies.

The next monthly chart shows the unadjusted Gold Miners ETF (_GDX) breaking out of a big falling wedge, forming a pseudo flag and breaking out to new highs this month. Oh, and there was a spike below 17.50 during the flag. Attributing the spike to market crash chaos and ignoring this dip, the chart sports a clear bullish configuration. GDX hit a new high, price is above the rising 12-month SMA and the PPO(3,12,0) is positive.

Just Three Clear Uptrends - GLD, TLT, UUP

The monthly chart for the Gold SPDR (GLD) looks extraordinarily bullish with new highs in the offing. GLD peaked in 2011, declined into 2015 and then became dead money as it consolidated for two years. The ETF broke out with a massive move in August 2019 and this ended a long drought for gold. GLD is up around 9% this month and above its rising 12-month SMA. The PPO(3,12,0) turned positive in January 2019 and remains firmly positive.

The 20+ Yr Treasury Bond ETF (TLT) will be the last monthly chart. TLT is trading near a multi-year high as the 30-year Treasury Yield hits historic lows. Moreover, the 30-yr Yield could fall even further because it is still well above zero. A move below 1% in the 30-yr yield would translate into new highs in TLT. TLT is extended by most metrics after a 24% gain in four months. However, strong buying pressure is required to become overbought or overextended.

Greater than 61.8% Retracements

QQQ, XLV, FDN, XBI, IHI, PFF, AGG, LQD

ETFs that exceeded their 61.8% retracements showed relative strength during the four week bounce, but they are still below prior highs. QQQ is one of these quasi leaders. It is above its rising 200-day SMA and could be classified in an uptrend. However, I have my doubts on this uptrend. This conundrum highlights the challenge with technical analysis: you can pretty much see anything you want to see on the chart.

In contrast to TLT, QQQ lacks momentum on this move. The ETF fell around 30% in route to a 52-week low in March and the counter trend bounce is over 20%. Note that QQQ is up 23.77% the last 21 days and up 15.72% the last 14 days. One would expect an overbought reading after such a move, but RSI(14) did not become overbought. Huh? Where’s the beef? The ability to become overbought is a sign of strength that stems from strong buying pressure and upside momentum. The inability to become overbought casts a shadow on this advance.

Yep, I had to sneak in an Optuma chart here. QQQ also sports a rising wedge with Tuesday’s low marking support. A break here would signal an end to this counter-trend bounce and a resumption of the bigger downtrend.

~61.8% Retracements

SPY, MTUM, USMV, XLK, XLY, XLP, XLU, SKYY, HACK, SOXX, IGV, IHF, VIG

The next group of ETFs show relative strength the last 21 days because they retraced around 61.8% of their prior declines. These bounces, while strong, are still considered normal for counter-trend bounces. At the very least, I would not be chasing a double-digit advance that started from a 52-week low and is currently near a 61.8% retracement level.

The first chart shows the Software ETF (IGV) moving above its 200-day SMA with a 25% advance. Also notice that RSI(10) did not become overbought during this double-digit run. That does not make sense to me. I drew some rising wedge trendlines, but these are subjective and a bit steep for my liking. Steepness, as the second chart shows, is also subjective. Just shorten the timeframe and your trendlines will miraculously become less steep. In any case, a break below 220 would reverse this four week upswing.

~50% Retracements

SPY, RSP, MDY, XLC, XLB, XLRE, FINX, BOTZ, HYG, SLV

This group of ETFs are performing in line with the broader market. I guess that is why SPY and RSP are in this group. They retraced around half of their previous declines. Thus, the bounces, while spectacular on their own, only recouped half of the prior loss. The chart below shows the Communication Services SPDR (XLC) with a rising wedge and 50% retracement.

~38.2% Retracements

IJR, IWM, XLF, XLI, IPAY, XRT, IYR, TAN, IEMG, EFA

Now we get to the weaker half of the market and there are still quite a few laggards. This is also why I do not think we are in a bull market environment. The Russell 2000 ETF (IWM), Finance SPDR (XLF), Industrials SPDR (XLI) and Retail SPDR (XRT) retraced around 38% of the prior decline and underperformed on the bounce.

The Russell 2000 ETF (IWM) highlights a short-term challenge. The ETF surged over 20% and then consolidated with a pennant, which is a bullish continuation pattern. A breakout at 121 would be short-term bullish, but not enough to change the bigger picture. In addition, I do not think it is time for playing breakouts and would prefer a mean-reversion setup in this choppy environment.

Looking at the bigger picture, IWM broke down and hit a 52-week low with a market-leading decline. The subsequent bounce is one of the weakest as it retraced just 38%. Another sloppy wedge is taking shape as RSI flirts with the 50-60 zone (momentum resistance). A break below 115 would be bearish here.

Relative weakness in Industrials and Finance is a concern going forward. The next chart shows XLI, XLF and XRT stalling the last eight days. Note that SPY hit a new high for the move on Friday, but these three did not and they are lagging short-term (and long-term). In the spirit of an open mind, I drew some small pennants on these charts. I am bearish, but upside breakouts in these three could spark another move higher.

Less than 38% Retracements

XLE, ITB, XHB, KBE, KRE, KIE, REM, XAR, MJ, FCG, XES, XOP, AMLP, XME, REMX

ETFs in this last group are lagging with the shallowest retracements. While I expect to find the energy-related ETFs in this group, note that the Home Construction ETF (ITB), Regional Bank ETF (KRE) and Aerospace & Defense ETF (XAR) are also in this group. These three peaked on April 9th and fell the last eight days. They barely bounced last Friday and underperformed on Wednesday’s bounce. SPY was up 2.22% on Wednesday and KRE was down .42%.