Rotation Investor SPX500 – Strategy Details, Indicators, Universe, Signals, Tables

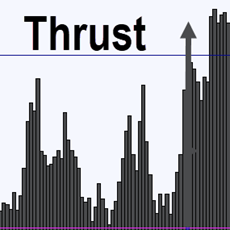

Rotation trading strategies capture the power of momentum by rotating into the strongest stocks and out of stocks that are losing upward momentum. This report explains rotation strategy that trades S&P 500 stocks (RO-Investor-SPX). We cover the trend filter, volatility