Large-Cap Dominoes Fall – Finance Joins the Fray – Money Moves into Utes and Bonds

- Arthur Hill, CMT

Welcome to the Chart Fix!

The dominoes continue to fall within the large-cap tech universe as QQQ breaks a benchmark low. Weakness is spreading into the broader market as finance (XLF) plunges and SPY tests first support. Meanwhile, money is moving into safe-haven bonds and defensive utilities.

- Large-cap Dominated S&P 500 Struggles

- Dominoes Falling as MAGS, QQQ and XLK Break

- SPY Tests Benchmark Low as Finance SPDR Plunges

- Utilities and Bonds Pick Up the Slack

Recent Reports and Videos for Premium Members

- Trend Trio150 Signals for Dow 30 Stocks and SPDRs

- Bonds Tests Breakout Zone as Gold Triangulates

- Stock Setups in Healthcare and Defense

- Market Remains Defensive with Bearish Patterns in XLK/QQQ

- Click here to take a trial and gain full access. [1]

Large-cap Dominated S&P 500 Struggles

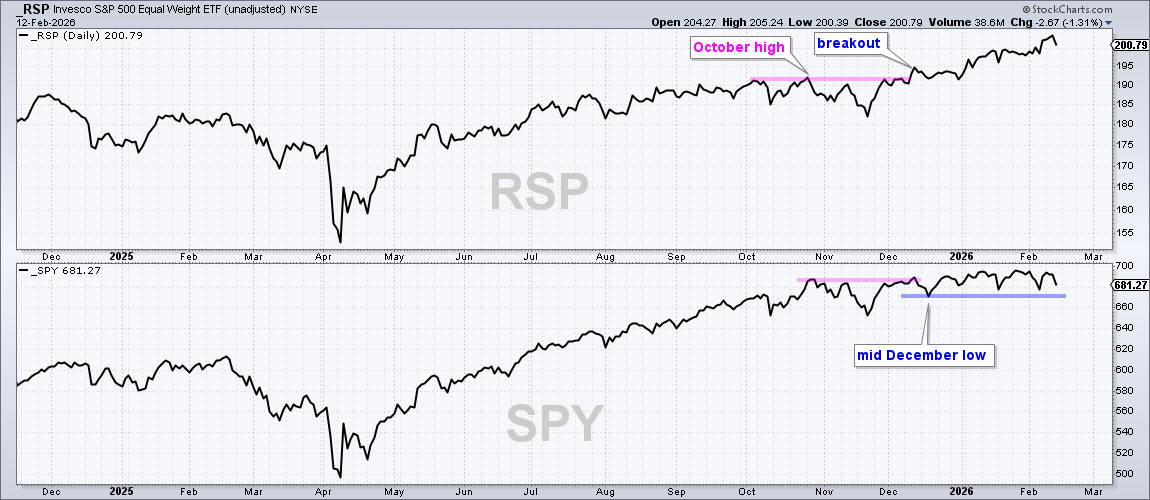

Chartists can use benchmark highs and lows to compare performance and identify trend signals. The chart below shows the S&P 500 EW ETF (RSP) in the top window and the S&P 500 SPDR (SPY) in the lower window. RSP represents the “average stock” in the S&P 500, while SPY represents large-caps.

The October high marks a benchmark high (pink line), which is a high we can use to compare charts. RSP broke this high and recorded a 52-week high in mid December. The ETF extended higher with new highs in January and February. RSP is clearly leading, which means the average S&P 500 stock is outperforming. This is part of the broadening trade, which TrendInvestorPro [1] has been following since the late November breakouts.

SPY also broke out and recorded a 52-week high in mid December. However, it struggled to extend on this breakout as it traded above/below the breakout level. The inability to follow through means large-caps are struggling. There was a dip into mid December and then a rebound towards 700. This mid December low now marks a benchmark low (blue line), which I can use to compare performance.

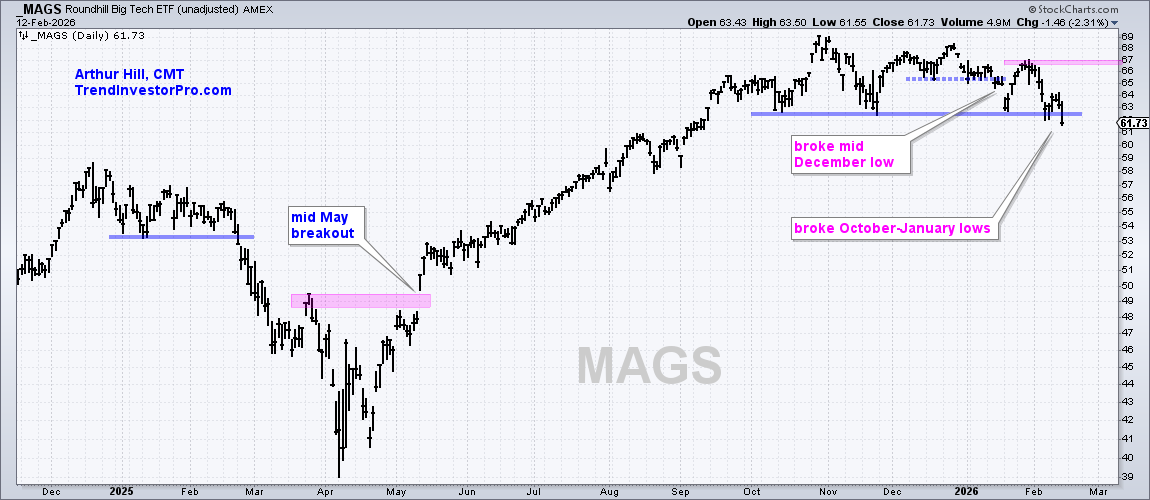

Dominoes Falling as MAGS, QQQ and XLK Break

The dominoes started falling when the Mag7 ETF (MAGS) broke the mid December low on January 14th. Working from left to right, we can see a breakdown in late February 2025 and a big bullish breakout in mid May. MAGS extended higher into October and then stuttered. First, it failed to break the October high and formed a lower high in December. Second, it broke the mid December low. This is the first domino to fall. MAGS went on to break the October-January lows on Wednesday. This break reverses the uptrend and signals the start of a new downtrend.

How long will this downtrend last? I take the Charles Dow approach to trend signals. The downtrend will remain in force until proven otherwise (reversed). Neither the length nor the duration can be forecast. The late January highs mark the first resistance at 67.

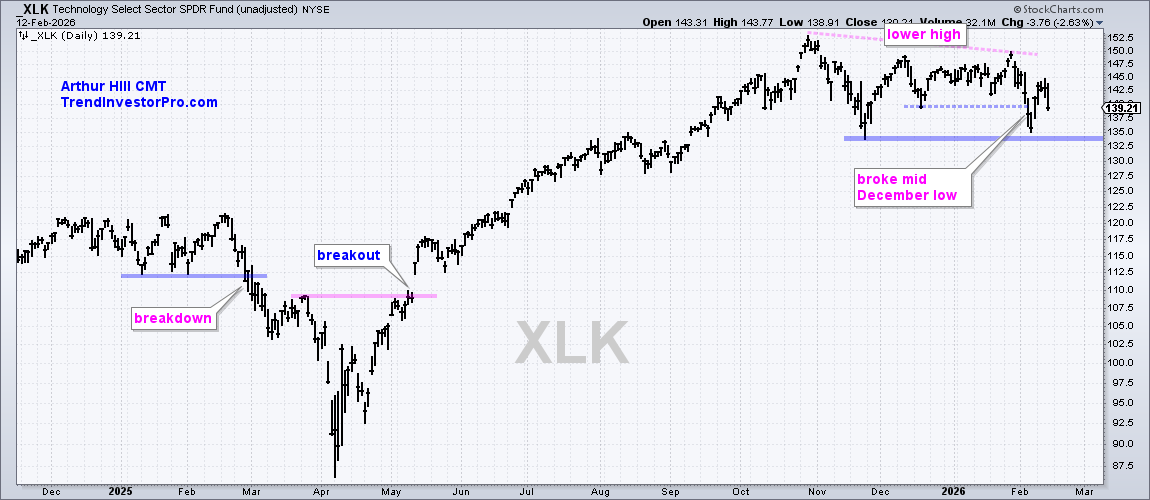

The next chart shows the Technology SPDR (XLK) forming a lower high from October to late January and breaking its mid December low in early February (second domino). XLK has yet to break the November low, which marks key support. A break would reverse the long-term uptrend because XLK would then have a lower high and a lower low.

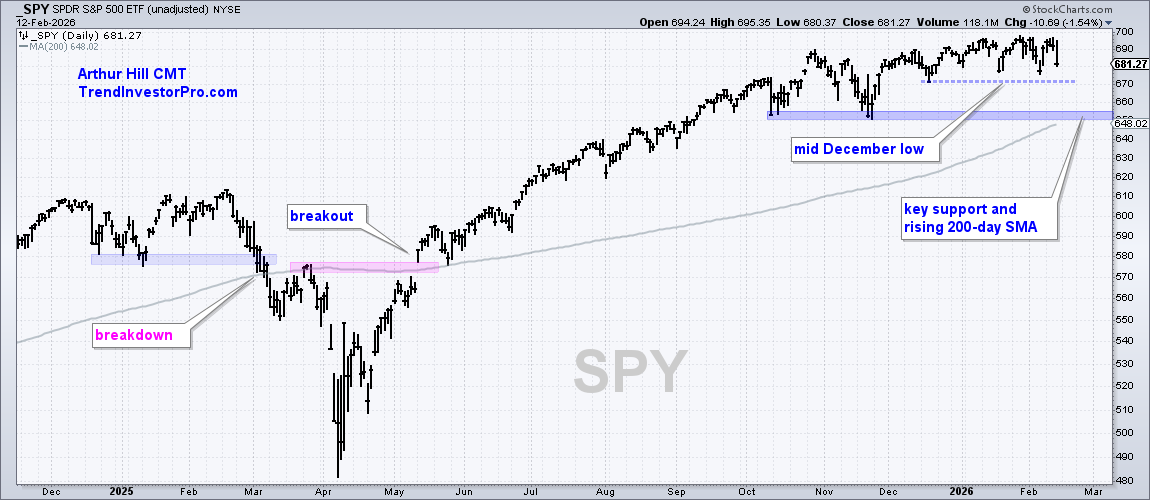

SPY Poised to Test Benchmark Low

The next chart shows SPY holding the mid December low at 670. So far, SPY has yet to join MAGS, XLK and QQQ with a break below this benchmark low. SPY bounced off the 670-680 area three times (mid December, mid January and early February). A close below 670 would break this benchmark low and SPY would become the fourth domino. The October-November lows and rising 200-day SMA mark long-term support at 650.

Finance SPDR Plunges with Outsized Decline

I featured the Finance SPDR (XLF) in late January because it became oversold within an uptrend. %B dipped below zero as XLF fell back to its rising 200-day SMA. This is a short-term bullish setup, but it ultimately failed as XLF fell 3.5% the last two days. Not all setups and signals work.

The 2-day 3.5 percent decline is the third sharpest two day decline in the last 12 months. 2-day ROC hit -4.33% on March 4 and -11.88% on April 4th. These are also outsized declines, which are above average declines that show a sharp increase in selling pressure. Not every outsized decline leads to a trend reversal, but the current outsized decline clearly fired a warning shot as XLF decisively broke the 200-day SMA. Note that finance is the second largest sector in the S&P 500 (12.7%). Technology is still the largest (33.4%).

Looking for indicators with an edge? Check out the TIP Indicator-Edge Plugin for StockCharts ACP. Click here to learn more. [3]

Utilities and Bonds Pick Up the Slack

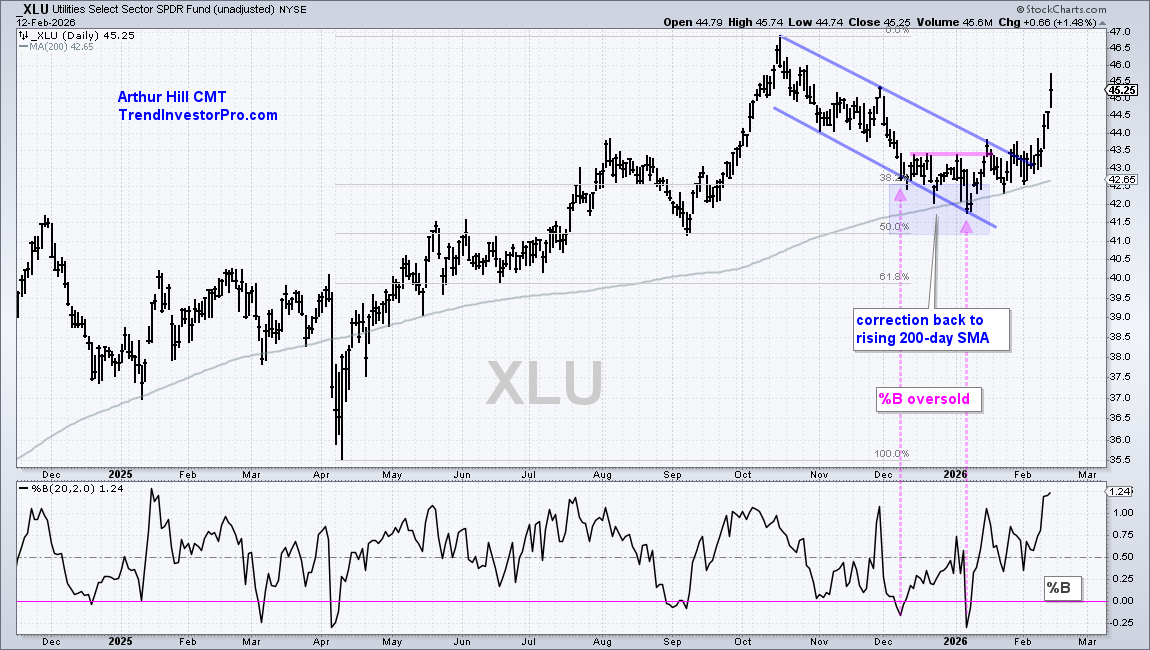

Utilities and Treasury bonds are benefitting as money moves out of the two biggest sectors in the market. The first chart shows the Utilities SPDR (XLU) with a classic setup, and one we have been featuring at TrendInvestorPro. XLU advanced to new highs in October and then corrected with a decline back to the rising 200-day SMA. This decline retraced 38-50 percent of prior advance and formed a falling channel. These are the hallmarks for a tradable correction: return to rising 200-day SMA, ~50% retracement and falling channel.

The bottom window shows %B becoming oversold in early December and early January. During this time, XLU firmed in the 42 area. The first breakout occurred in mid January with a move above the mid December highs. The second breakout occurred in early February with a break above the channel line.

The next chart shows the 7-10Yr TBond ETF (IEF) moving from breakdown to breakout this month. IEF broke the 200-day SMA at the beginning of the month, but came roaring back with a breakout surge this week. Overall, IEF formed a falling wedge that retraced around 50% of the May-October advance. After battling the 200-day SMA for a few weeks, the ETF made a decisive move this week with a break above the January highs. This reverses the fall and signals a continuation higher.

The bottom window shows the year-to-date change using ROC(29). IEF is up .70% year-to-date and outperforming SPY and QQQ. SPY is down 0.10% and QQQ is down 2.23%. Money prefers safe-haven bonds over large-cap stocks in 2026.

Recent Reports and Videos for Premium Members

- Trend Trio150 Signals for Dow 30 Stocks and SPDRs

- Bonds Tests Breakout Zone as Gold Triangulates

- Stock Setups in Healthcare and Defense

- Market Remains Defensive with Bearish Patterns in XLK/QQQ

- Click here to take a trial and gain full access. [1]