Breadth is holding up for Nasdaq 100 stocks, but deteriorating for S&P 500 stocks and I view this as a warning sign for the stock market. Breadth indicators measure the degree of participation. For example, the percentage of S&P 500 stocks above the 50-day SMA shows how many stocks made it above the 50-day SMA during a particular period. Chartists can compare S&P 500 price levels with breadth indicator levels to find out if breadth is keeping pace with price. Signs of potential trouble emerge when breadth lags price and participation significantly wanes.

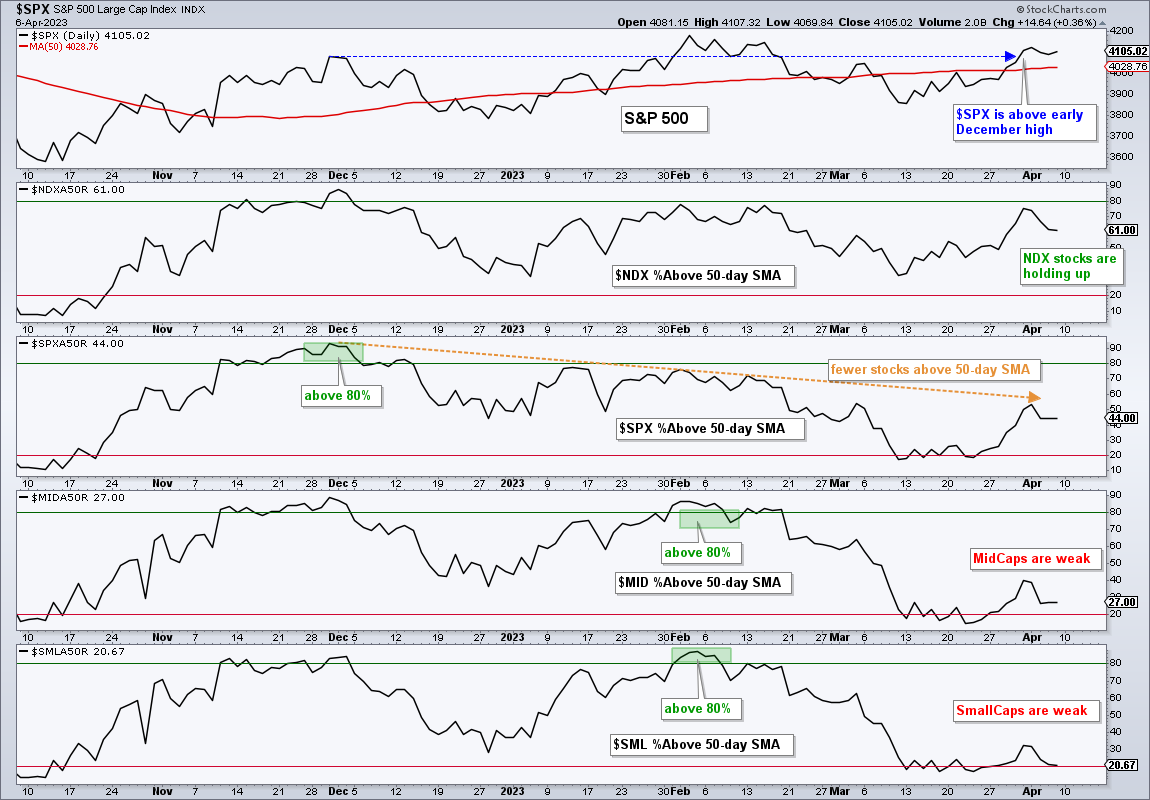

The chart below shows the percentage of stocks above the 50-day SMA for the Nasdaq 100, S&P 500, S&P MidCap 400 and S&P SmallCap 600. Let’s first look at the top half. Nasdaq 100 stocks are holding up well with some 61% of stocks above their 50-day SMA. Participation within the S&P 500, in contrast, peaked in early December and significantly narrowed over the last few months. Over 80% of S&P 500 stocks were above their 50-day SMAs in early December (green shading). The S&P 500 exceeded its December high in early February, but SPX %Above 50-day SMA did not make it back above 80%. Most recently, the S&P 500 advanced from mid March to early April and exceeded its December high (blue dashed line on price chart). The percentage of stocks above the 50-day SMA did not come close to its early February peak and barely exceeded 50%. As the dashed yellow arrow-line shows, fewer stocks are participating in the current advance and this could spell trouble.

Mid-caps and small-caps were leading the participation game in early February, but succumbed to broad selling pressure in March and did not really recover. Notice that the percentage of stocks above the 50-day SMA exceeded 80% in early February, for both mid-caps and small-caps (green shading). The indicator fell off a cliff from late February to mid March and moved below 20%. The percentage of stocks above the 50-day SMA recovered somewhat over the last few weeks, but remains at very low levels (27% for mid-caps and 20.67% for small-caps). This shows some serious weakness withing the mid-cap and small-cap space.

The Composite Breadth Model at TrendInvestorPro [1] is bullish right now, but this bullish signal looks fragile because of deteriorating breadth and could flip back to bearish. This model serves as the market timing filter for two quantified trading strategies: the Bull-Bear Strategy using the All Weather ETF List and a Trend-Momentum Strategy for 74 stock-based ETFs. We also have a Mean-Reversion Strategy for trading during all market conditions. Each strategy has a detailed article and signal tables are updated daily. Click here to learn more. [1]

The Trend Composite, Momentum Composite, ATR Trailing Stop and eight other indicators are part of the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Click here to learn more and take your analysis process to the next level. [2]