New highs and a fast growing industry group make for a powerful combination. Today’s article will focus on two ETFs that capture two fast growing industries, video gaming and esports. We will show why these two ETFs are leading, why a consolidation within an uptrend is bullish and why a 50-day SMA is better suited for mean-reversion trading.

ETFs hitting new highs last week are leading and should be on our radar. First and foremost, SPY and QQQ have yet to record 52-week highs in November, though both are close. ETFs that already hit new highs are leading SPY and QQQ. Second, an ETF is in an undeniably strong uptrend when hitting a 52-week high.

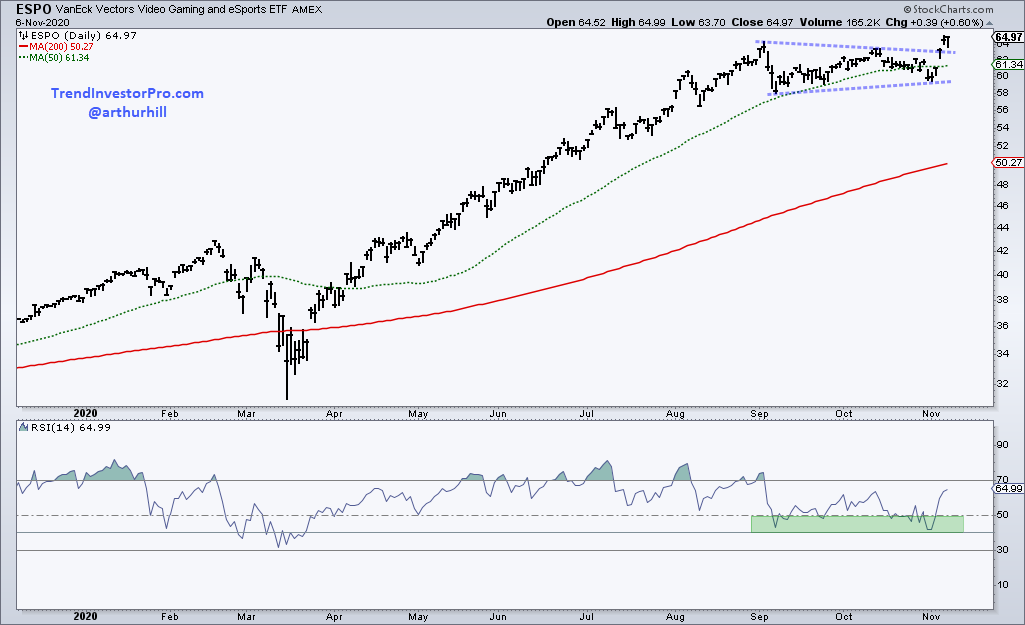

The charts below show two Video, Gaming & eSports ETFs, ESPO and HERO. Both hit new highs in early September, consolidated with triangles into early November and broke out last week. A consolidation within an uptrend is typically a bullish continuation pattern and the breakouts signal a continuation of the bigger uptrend. This is unequivocally bullish.

The charts also show the 50 and 200 day SMAs. Note that I do not view short to medium term moving averages as trend indicators. Instead, they are better suited for capturing mean-reversion setups, as is RSI. A dip below the 50-day SMA is not bearish when it occurs relatively close to a 52-week high and when price is above the 200-day. This dip signals a pullback within the bigger uptrend and this is more likely a tradable pullback, as opposed to a trend-changing event. Why? Because the path of least resistance is up when the long-term trend is up. We should expect price action to resolve in the direction of the bigger trend.

There were lots of bullish continuation patterns in September-October and lots of breakouts last week. These were covered in detail at trendinvestorpro.com. Subscribe today for immediate access to our detailed ETF Report, weekly Market Timing Report, weekend video and ETF ChartBook.

Click here to take your analysis process to the next level! [1]