Today we will start with small-caps, industrials and banks, because these three could be turning the corner. The IWM:SPY ratio moved above its 40-week SMA for the first time in 2 years, XLI is above the 200-day and KRE rose from the ashes the last four weeks. GLD may be parting ways with TLT and hooking up with SPY again. The breadth models remain bullish and there were two new signals in the short-term breadth models. The sector breadth model also remains firmly bullish with the newest signals coming in XLF and XLU, which are the feature charts. In a perhaps related move, yield spreads narrowed the last four weeks and this could be wetting the risk appetite. The commentary concludes with the five breadth model charts.

Small-caps Make a Run for It

Last week we saw a broadening of strength with breadth thrusts in several sectors, small-caps and mid-caps. Breadth thrusts continued this week with the S&P 500 and S&P 100 joining the fray. The broadening of participation could bode well for sectors that lagged this year, such as finance and industrials.

First, let’s look at small-caps. The chart below shows the IWM:SPY ratio, which rises when small-caps outperform and falls when small-caps underperform. This ratio tanked from July 2018 to March 2020 as small-cap underperformance went to new lows, and large-cap outperformance to new highs.

There are signs that this ratio could be preparing for a bounce as it surged in April-May and flattened from July to October. Most recently we saw small-caps lead from 25-Sept to 12-Oct as IWM surged above its August-September high. SPY, on the other hand, has yet to clear its early September high. Turning back to the ratio, a break above the red line would show renewed outperformance from small-caps and this would be positive for IWM. Note that this ratio just broke the 40-week SMA this week.

The next chart shows the Industrials SPDR (XLI) consolidating above its 200-day (blue shading) and breaking out of this consolidation last week. The long-term trend is up and a consolidation breakout argues for a continuation of that trend. After a surge from 74 to 82, the ETF edged lower the last few days and a small bull flag formed. A breakout would argue for a continuation higher and a challenge to the February highs.

The bottom window shows the Regional Bank ETF (KRE) with a reversal near the 2/3 retracement line and break above the wedge line. I know that I have not been keen on banks because they are lagging on the six to nine month timeframes, but we need to keep an open mind (see XLF chart, Fed and yields spreads further down). KRE edged lower the last four days and a breakout at 40 could extend the move.

Don't Count SPY and QQQ Out Though

IWM may be poised to outperform, but SPY and QQQ are still leading year-to-date. These two recorded new highs in late August and early September. After falling wedge corrections that retraced almost 2/3 of the June-September advance, these two broke out and followed through on these breakouts. They have yet to exceed their early September highs, but the breakouts are bullish until proven otherwise. A move below 330 in SPY and 270 in QQQ would negate the breakouts and put the correction theme back on the table.

Stocks vs Bonds vs Gold

The Gold SPDR (GLD) may be divorcing itself from the 20+ Yr Treasury Bond ETF (TLT) and hooking up with the S&P 500 SPDR (SPY). GLD and TLT peaked in early August and fell with falling wedge patterns taking shape. TLT fell to its rising 200-day, but GLD held well above this moving average and turned up on 25-Sept (vertical line). This is also the day SPY bottomed and yield spreads began the narrow. It appears that GLD is making an attempt to break out of its falling wedge. TLT turned up the last six days, but remains short of a breakout. SPY also held well above its 200-day and broke out of a falling wedge on 25-Sept. Keep this date in mind because it returns later in this commentary.

The Future of ChartBooks

Chartbooks are great in theory, but challenging in practice. It is easy to publish a chartbook in Optuma because the charts are in one workbook and I simply click the publish button. Charts from StockCharts and Amibroker are a different story. They need to be saved as images, printed as PDF files and then compiled into a chartbook. This takes a lot of time, time that could be better spent on analysis, videos and such. Basically, I am spending too much time maintaining and publishing ChartBooks. Furthermore, fewer than 20% of subscribers access these ChartBooks. Thus, I am reconsidering ChartBooks going forward. The idea here is to continue with the ETF ChartBook and ETF Ranking Tables on Thursdays and Saturdays, but discontinue other ChartBooks. Feedback would be greatly appreciated (click here for the contact form [1]).

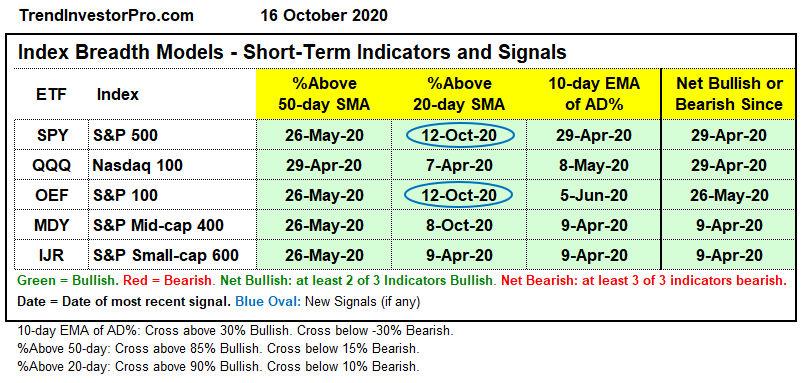

Short-term Models Improve with More Thrusts

The short-term breadth models improved this week as %Above 20-day SMA for the S&P 500 and S&P 100 surged above 90% to trigger bullish breadth thrusts. Yet more signs that participation is broad. These signals follow a bullish sign in MID %Above 20-day SMA last week. With three new signals in the last two weeks, all indicators on the short-term breadth model are bullish. Overall, four of the five indexes have been net bullish since April and the S&P 100 has been net bullish since May.

Long-term Models Still Favor Large-caps

Even though IWM could be poised for a relative breakout, large-caps are still stronger in the long-term breadth models. All five indexes are net bullish. The Nasdaq 100 kicked it off by turning bullish in May, the S&P 500 and S&P 100 followed in July, the S&P MidCap 400 in August and the S&P SmallCap 600 in September. The market rally was slow to broaden, but broaden it has: large-cap techs > large-caps > mid-caps > small-caps. Only two indicators remain bearish: %Above 100-day SMA for $MID and High-Low Percent for $SML.

The breadth models are shown further down. You can learn more about the breadth model and its historical performance in this article and video (here). [2]

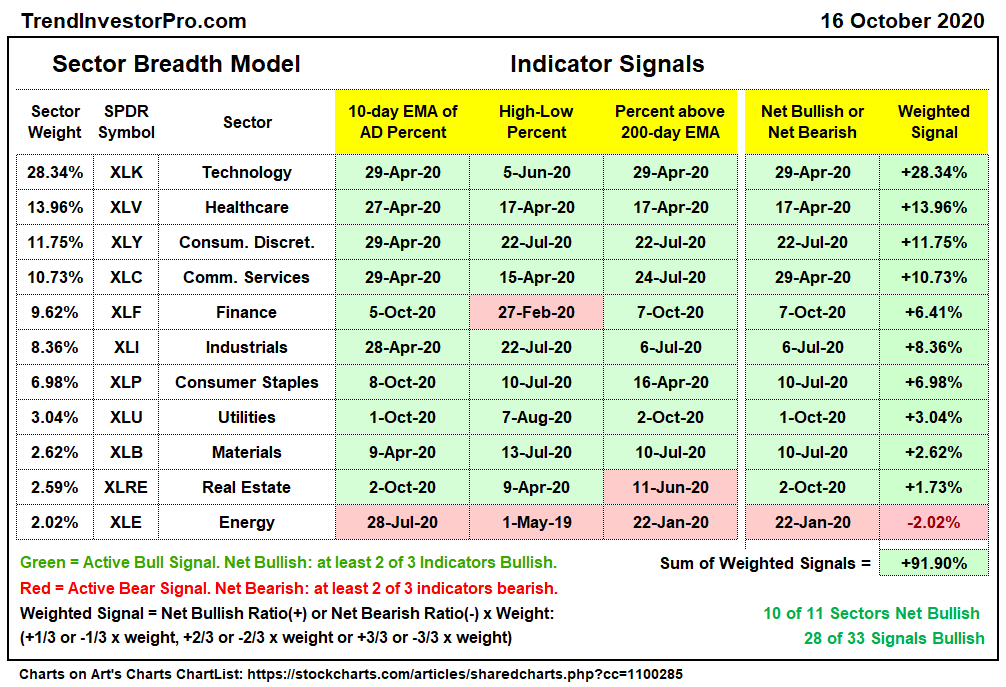

Sector Model Remains Firmly Bullish

There is no change in the Sector Breadth Model, which captures the sum of the parts for the S&P 500. The sum of the weighted signals is above +90% (out of 100%). 10 of 11 sectors are net bullish and 28 of 33 indicators are on active bullish signals. This shows broad strength within the S&P 500. Outside of Energy, the only pockets of weakness are XLF High-Low Percent and XLRE %Above 200-day EMA. REITs were once part of the Finance sector so perhaps there is some correlation here.

XLF and XLU Stall

The chart below shows the Finance SPDR (XLF) turning net bullish as the 10-day EMA of Advance-Decline Percent exceeded +30% and the %Above 200-day EMA exceeded 60% (green ovals). High-Low Percent remains with an active bearish signal from late February (red oval). A breakout on the price chart would likely lead to an expansion of new highs and High-Low Percent could then trigger with a move above +10%. XLF is still lagging on the six to nine month timeframes and has yet to exceed its summer highs. After a three week surge to the 200-day, XLF edged lower the last three days with a possible bull flag and a breakout could lead to a bigger triangle breakout.

The Utilities SPDR (XLU) turned net bullish on 2-Oct as the 10-day EMA of Advance-Decline Percent surged above +10% for a breadth thrust and %Above 200-day EMA exceeded 60%. Currently over 85% of utility stocks are above their 200-day EMA and High-Low Percent exceeded 10% this week. On the price chart, XLU broke out of a triangle pattern and exceeded its June high. The ETF stalled the last five days in what could be a short-term bull flag. A breakout would target a move towards 70.

Yield Spreads Narrow and Fed Balance Sheet Expands

Finance-related ETFs may be strengthening because yields spreads narrowed further and the Fed balance sheet continues to expand. The narrowing of yield spreads, which is especially prevalent in the BBB and junk bond spreads, shows more confidence in the debt markets. Investors are demanding less premium over Treasuries. This means investors are more confident that the debt will be repaid (or bought by the Fed!). Sorry, I could not resist that last jab.

The AAA and BBB yield spreads have been narrowing since 25-Sept (green circles). They were already below their pre-crisis highs and showing no signs of stress at the investment grade end of the debt market. With further narrowing, BBB spreads are their narrowest since 5-March.

We can also see a significant narrowing in the junk bond spreads. Junk bond spreads moved below 5 this week and the CCC spread moved below 11 (green ovals).

The Fed balance sheet also expanded this past week with the biggest increase since late May ($77 billion). Thus, the slow expansion since mid July continues and is perhaps accelerating a little. Overall, the balance sheet is now within $15 trillion of its mid June peak.

Large-caps Lead Moving Average Crossover Game

Below are the breadth model charts for each index. The 3-indicator short-term model is first, the 5-indicator long-term model is second and the percentage difference between the 5 and 200-day SMAs is third. As far as long-term trends, QQQ has been positive since 14-Apr, OEF since 21-May and SPY since 29-May. MDY and IJR dipped in September and this 5/200 cross turned positive again on 28-Sept and 2-Oct, respectively. Again we see the progression from large-cap techs to large-caps to mid-caps to small-caps. As the last to join in, small-caps and mid-caps remain the most fragile of the five groups.